- WORLD EDITIONAustraliaNorth AmericaWorld

August 22, 2023

Lefroy Exploration Limited (ASX: LEX) (“Lefroy” or “the Company”) is pleased to advise that independent global consultancy, CSA Global, have completed a review of the Mineral Resource estimate (MRE) in accordance with the JORC Code (2012) for its Goodyear Nickel Deposit (Goodyear) in Western Australia.

HIGHLIGHTS

- Total Inferred Mineral Resource at the Goodyear Nickel Deposit confirmed at 392,000 t @ 3.78% Ni, reported and classified in accordance with JORC Code 2012

- Mineral Resource remains open down plunge with drilling planned to infill and extend the current limits of mineralisation

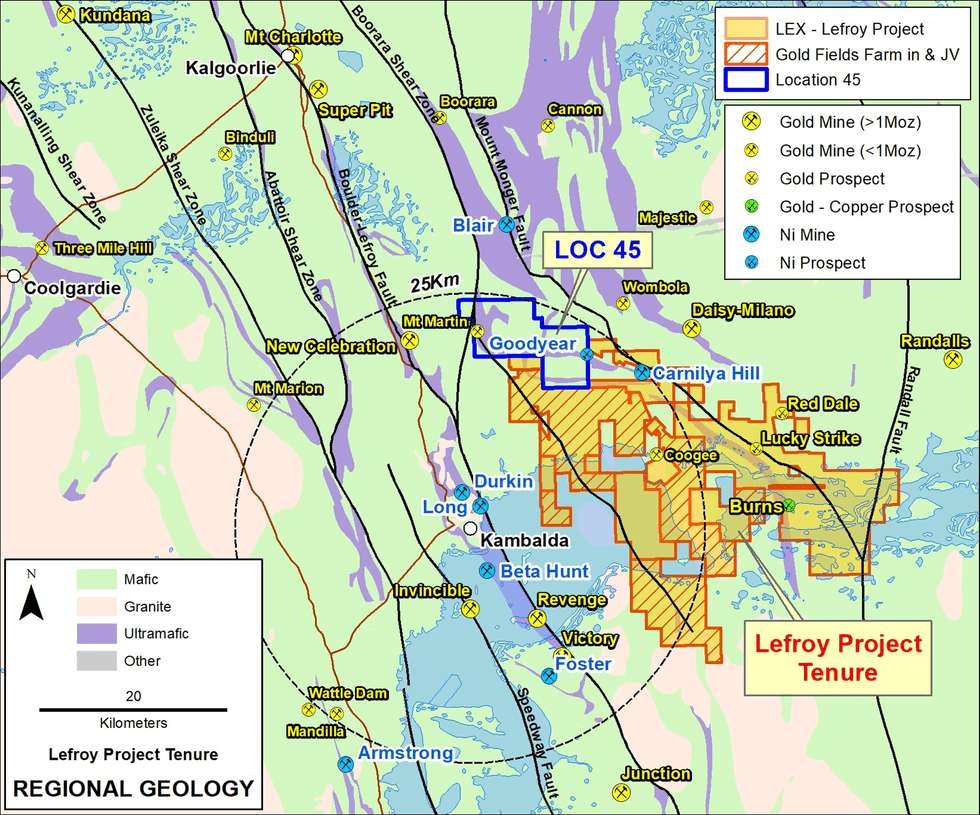

- Lefroy controls 30km of ultramafic basal contact within the Carnilya dome which is lightly explored and considered highly prospective for additional Ni sulphide discoveries

Goodyear now reports as 392,000 tonnes @ 3.78% Ni for 14,780t of contained nickel sulphide at a 1% nickel cut- off grade (Table 1). The review confirms the original Mineral Resource, reported in 2008 by Australian Mines Limited, in accordance with the JORC Code 2004 Edition.

LEFROY MANAGING DIRECTOR WADE JOHNSON COMMENTED:

“The seamless conversion of the Goodyear Nickel Deposit to JORC Code 2012 standards is an exciting development for Lefroy and our nickel-focused subsidiary, Hampton Metals Ltd.

The Goodyear Mineral Resource presents a unique opportunity, being on freehold title with a 15-year ownership history of gold majors and adjoining our commanding Lefroy Gold Project.

We now hold 30km of strike length of a key ultramafic unit, considered to be one of the most prospective geological settings for nickel sulphide discoveries, within what is one of the few unexplored parcels of land remaining in the Kalgoorlie-Kambalda region.

“With Hampton’s aim to be a key player in what is shaping up to be a new era of nickel exploration and production in the Kambalda district, we couldn’t be off to a better start.”

Goodyear lies the western boundary of Location 45 (Figure 1) which is a mineral freehold title situated within LEX’s 635km2 greater Lefroy Gold Project (LGP). The LGP is strategically positioned in the well-endowed Kalgoorlie Terrane, surrounded by the infrastructure of multiple other operating gold and nickel mines within the prolific Kalgoorlie-Kambalda mining district (Figure 1).

Goodyear is held by the Company’s wholly owned nickel focused subsidiary Hampton Metals Ltd (Hampton or HMT), led by Managing Director Graeme Gribbin. Graeme is a highly credentialed geologist with over 25 years’ experience in the resources sector with global expertise in nickel and base metals, including 8 years’ as General Exploration at Western Areas Limited (recently acquired by IGO Limited) and 6 years’ base metals experience at Vale as Exploration Manager. Graeme is supported by a proficient team of geologists and field staff with a proven track record for exploration success, including recently appointed, Jon Mcloughlin as Exploration Manager.

The Company acquired Goodyear in May 2023 through a Mineral Rights Agreement for Location 45 between title holder Franco Nevada Pty Ltd (Franco) and Lefroy’s wholly owned subsidiaries (refer to ASX release 23 May 2023). In this agreement HMT acquired all nickel, REE and lithium rights (including Goodyear) from Franco for an initial 21- year term in exchange for a minimum annual exploration expenditure of $100,000 and 4% royalty upon production.

Click here for the full ASX Release

This article includes content from Lefroy Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00