Laramide Resources Ltd. ( "Laramide" or the "Company" ) (TSX: LAM; ASX: LAM; OTCQX: LMRXF), a uranium mine development and exploration company with globally significant assets in the United States and Australia is pleased to announce more assay results from the 2024 drilling activities at the Westmoreland Uranium Project in Queensland, Australia ( "Westmoreland" ).

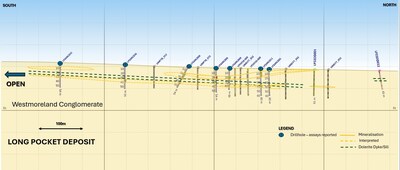

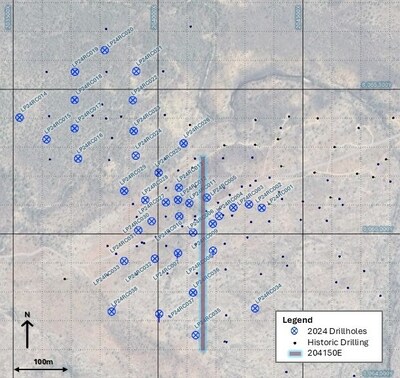

Assays have now been received from the remaining 32 RC drill holes at Long Pocket, with 29 of these holes mineralized. (Table 2) Long Pocket drilling has demonstrated that uranium mineralisation is laterally continuous with drillhole collar spacing now generally less than 50m which lends to a high level of confidence. Mineralisation remains open and untested in a southerly direction (Figure 2).

Zones of higher-grade uranium intercepted within the broader coherent mineralised envelope include:

-

- LP24RC008 – 16.00m @ 485.61 ppm U 3 O 8 from 16.00m depth, including 4.00 m @ 1,264 ppm U 3 O 8 from 21.00 m

- LP24RC009 – 8.00m @ 490.59 ppm U 3 O 8 from 16.00m , including 1.00 m @ 1,545 ppm U 3 O 8 from 20.00 m .

- LP24RC016 – 4.00m @ 2022.03 ppm U 3 O 8 from 8.00m , including 3.00 m @ 2,639 ppm U 3 O 8 from 9.00m .

Commenting on the results, Laramide's Vice-President of Exploration, Rhys Davies said:

"Results from infill drilling at Long Pocket demonstrate the quality of this satellite deposit with good uranium grade at very shallow depths and supports Laramide's focused attention on enhancing Westmoreland's resources towards improving the economics of a future mine plan. The deposit also remains open and untested to the south.

"We look forward to updating investors as we incorporate these results into a Maiden Resource Estimation of the deposit in Q1 2025."

Drilling across the broader Westmoreland Project is ongoing with the final few holes of the campaign due to be completed in the next two weeks. The 2024 drilling campaign has comprised over 100 holes across multiple targets, core processing is continuing, and assay results will be delivered with regularity throughout Q4 2024.

Long Pocket Uranium Deposit

Long Pocket is a satellite deposit located 7 km to the east of the Westmoreland Project. Thirty-eight infill RC drill holes, for a total of 2,139m , were recently completed in 2024.

Results from the 2024 drilling confirms shallow ( 50m depth), flat-lying, continuous mineralisation (Figure 1) with multiple zones intersecting a similar highly altered hematitic sandstone of medium to coarsely grained and poorly sorted texture, located peripheral to a dyke/sill margin.

The central part of this deposit is now well understood with hole spacing now less than 50m in places. Results from this drilling program will be incorporated into a Maiden Resource Estimation of the deposit in Q1 2025.

Qualified/Competent Person

The information in this announcement relating to Exploration Results is based on information compiled or reviewed by Mr. Rhys Davies , a contractor to the Company. Mr. Davies is a Member of The Australasian Institute of Geoscientists and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves', and is a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Davies consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

To learn more about Laramide, please visit the Company's website at www.laramide.com .

Follow us on Twitter @LaramideRes

About Laramide Resources Ltd.

Laramide is focused on exploring and developing high-quality uranium assets in Tier-1 uranium jurisdictions of Australia and United States . The company's portfolio comprises predominantly advanced uranium projects in districts with historical production or superior geological prospectivity. The assets have been carefully chosen for their size, production potential, and the two large projects are considered to be late-stage, low-technical risk projects.

Forward-looking Statements and Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expect, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "plans", "projects", "intends", "estimates", "envisages", "potential", "possible", "strategy", "goals", "objectives", or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Actual results or developments may differ materially from those in forward-looking statements. Laramide disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for uranium; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of resource estimates; health, safety and environmental risks; worldwide demand for uranium; uranium price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

| Table 1: Drill Collar Details | ||||||||||

| Prospect | Hole ID | GDA_Easting | GDA_Northing | RL (m) | Depth (m) | Grid Azi | Dip | Hole type | Drilling started | Drilling completed |

| AMPHITHEATRE | AMD008 | 209879 | 8074908 | 93 | 241.6 | 90 | -60 | DD | 01/07/2024 | 09/07/2024 |

| AMPHITHEATRE | AMD009 | 209928 | 8074816 | 90 | 202.9 | 270 | -80 | DD | 10/07/2024 | 15/07/2024 |

| AMPHITHEATRE | AMD010 | 209954 | 8074725 | 90 | 203.4 | 90 | -60 | DD | 15/07/2024 | 26/07/2024 |

| AMPHITHEATRE | AMD011 | 209958 | 8074620 | 99 | 200.3 | 90 | -60 | DD | 26/07/2024 | 02/08/2024 |

| AMPHITHEATRE | AMD012 | 209928 | 8074820 | 90 | 84.5 | 90 | -55 | DD | 03/08/2024 | 05/08/2024 |

| LONGPOCKET | LP24RC001 | 204362 | 8065063 | 98 | 54 | 0 | -90 | RC | 01/08/2024 | 01/08/2024 |

| LONGPOCKET | LP24RC002 | 204312 | 8065113 | 98 | 54 | 0 | -90 | RC | 02/08/2024 | 08/08/2024 |

| LONGPOCKET | LP24RC003 | 204262 | 8065063 | 98 | 78 | 0 | -90 | RC | 03/08/2024 | 03/08/2024 |

| LONGPOCKET | LP24RC004 | 204212 | 8065063 | 97 | 60 | 0 | -90 | RC | 03/08/2024 | 03/08/2024 |

| LONGPOCKET | LP24RC005 | 204168 | 8065127 | 95 | 60 | 0 | -90 | RC | 03/08/2024 | 03/08/2024 |

| LONGPOCKET | LP24RC006 | 204122 | 8065007 | 97 | 54 | 0 | -90 | RC | 04/08/2024 | 04/08/2024 |

| LONGPOCKET | LP24RC007 | 204092 | 8064933 | 98 | 48 | 180 | -60 | RC | 04/08/2024 | 04/08/2024 |

| LONGPOCKET | LP24RC008 | 204192 | 8064940 | 100 | 54 | 180 | -60 | RC | 04/08/2024 | 04/08/2024 |

| LONGPOCKET | LP24RC009 | 204187 | 8065025 | 97 | 48 | 0 | -90 | RC | 04/08/2024 | 05/08/2024 |

| LONGPOCKET | LP24RC010 | 204079 | 8065059 | 96 | 60 | 0 | -90 | RC | 05/08/2024 | 05/08/2024 |

| LONGPOCKET | LP24RC011 | 204109 | 8065106 | 96 | 60 | 0 | -90 | RC | 05/08/2024 | 05/08/2024 |

| LONGPOCKET | LP24RC012 | 204072 | 8065117 | 95 | 60 | 0 | -90 | RC | 05/08/2024 | 06/08/2024 |

| LONGPOCKET | LP24RC013 | 204078 | 8065160 | 94 | 54 | 0 | -90 | RC | 06/08/2024 | 06/08/2024 |

| LONGPOCKET | LP24RC014 | 203524 | 8065406 | 91 | 54 | 0 | -90 | RC | 06/08/2024 | 06/08/2024 |

| LONGPOCKET | LP24RC015 | 203615 | 8065322 | 91 | 48 | 0 | -90 | RC | 07/08/2024 | 07/08/2024 |

| LONGPOCKET | LP24RC016 | 203715 | 8065262 | 92 | 48 | 0 | -90 | RC | 07/08/2024 | 07/08/2024 |

| LONGPOCKET | LP24RC017 | 203715 | 8065362 | 91 | 48 | 0 | -90 | RC | 07/08/2024 | 07/08/2024 |

| LONGPOCKET | LP24RC018 | 203715 | 8065462 | 90 | 48 | 0 | -90 | RC | 08/08/2024 | 08/08/2024 |

| LONGPOCKET | LP24RC019 | 203724 | 8065561 | 90 | 54 | 0 | -90 | RC | 08/08/2024 | 08/08/2024 |

| LONGPOCKET | LP24RC020 | 203824 | 8065611 | 90 | 48 | 0 | -90 | RC | 08/08/2024 | 08/08/2024 |

| LONGPOCKET | LP24RC021 | 203924 | 8065561 | 90 | 48 | 0 | -90 | RC | 08/08/2024 | 08/08/2024 |

| LONGPOCKET | LP24RC022 | 203915 | 8065462 | 90 | 48 | 0 | -90 | RC | 09/08/2024 | 09/08/2024 |

| LONGPOCKET | LP24RC023 | 203915 | 8065362 | 91 | 48 | 0 | -90 | RC | 09/08/2024 | 09/08/2024 |

| LONGPOCKET | LP24RC024 | 203930 | 8065255 | 92 | 48 | 0 | -90 | RC | 09/08/2024 | 09/08/2024 |

| LONGPOCKET | LP24RC025 | 203999 | 8065213 | 93 | 98 | 0 | -90 | RC | 09/08/2024 | 10/08/2024 |

| LONGPOCKET | LP24RC026 | 204086 | 8065313 | 92 | 60 | 0 | -90 | RC | 10/08/2024 | 10/08/2024 |

| LONGPOCKET | LP24RC027 | 204027 | 8065110 | 95 | 60 | 0 | -90 | RC | 11/08/2024 | 11/08/2024 |

| LONGPOCKET | LP24RC028 | 203958 | 8065116 | 95 | 60 | 0 | -90 | RC | 11/08/2024 | 11/08/2024 |

| LONGPOCKET | LP24RC029 | 203881 | 8065146 | 94 | 60 | 0 | -90 | RC | 11/08/2024 | 11/08/2024 |

| LONGPOCKET | LP24RC030 | 203977 | 8065042 | 96 | 84 | 0 | -90 | RC | 11/08/2024 | 12/08/2024 |

| LONGPOCKET | LP24RC031 | 203933 | 8065019 | 96 | 48 | 0 | -90 | RC | 12/08/2024 | 12/08/2024 |

| LONGPOCKET | LP24RC032 | 203986 | 8064911 | 98 | 48 | 0 | -90 | RC | 12/08/2024 | 12/08/2024 |

| LONGPOCKET | LP24RC033 | 203889 | 8064909 | 97 | 48 | 0 | -90 | RC | 13/08/2024 | 13/08/2024 |

| LONGPOCKET | LP24RC034 | 204331 | 8064746 | 107 | 48 | 0 | -90 | RC | 13/08/2024 | 13/08/2024 |

| LONGPOCKET | LP24RC035 | 204134 | 8064653 | 108 | 54 | 0 | -90 | RC | 15/08/2024 | 15/08/2024 |

| LONGPOCKET | LP24RC036 | 204121 | 8064795 | 105 | 55 | 0 | -90 | RC | 15/08/2024 | 15/08/2024 |

| LONGPOCKET | LP24RC037 | 204001 | 8064732 | 101 | 66 | 0 | -60 | RC | 15/08/2024 | 16/08/2024 |

| LONGPOCKET | LP24RC038 | 203843 | 8064732 | 100 | 66 | 30 | -60 | RC | 16/08/2024 | 16/08/2024 |

| Table 2: Significant intercepts >100ppm U 3 O 8 | |||||

| Hole number | From | To | Length (m) | U 3 0 8 ppm | Au g/t |

| LP24RC007 | 19 | 20 | 1 | 160.96 | 0.01 |

| LP24RC007 | 33 | 35 | 2 | 157.42 | 0.06 |

| LP24RC007 | 40 | 41 | 1 | 153.30 | 0.01 |

| LP24RC008 | 16 | 32 | 16 | 485.61 | 0.011 |

| including | 21 | 25 | 4 | 1264.40 | 0.005 |

| LP24RC008 | 39 | 43 | 4 | 174.34 | 0.02 |

| LP24RC009 | 16 | 24 | 8 | 490.59 | 0.006 |

| including | 20 | 21 | 1 | 1544.75 | 0.005 |

| LP24RC009 | 35 | 36 | 1 | 139.15 | 0.03 |

| LP24RC010 | 28 | 33 | 5 | 297.04 | 0.006 |

| LP24RC010 | 36 | 41 | 5 | 239.14 | 0.074 |

| LP24RC011 | 7 | 17 | 10 | 152.95 | 0.006 |

| LP24RC011 | 32 | 33 | 1 | 340.79 | 0.005 |

| LP24RC011 | 36 | 41 | 5 | 362.65 | 0.022 |

| LP24RC012 | 0 | 3 | 3 | 434.34 | 0.005 |

| LP24RC012 | 13 | 16 | 3 | 138.63 | 0.007 |

| LP24RC012 | 32 | 33 | 1 | 202.23 | 0.005 |

| LP24RC012 | 37 | 41 | 4 | 185.67 | 0.013 |

| LP24RC013 | 5 | 10 | 5 | 507.06 | 0.005 |

| including | 5 | 6 | 1 | 1432.73 | 0.005 |

| LP24RC013 | 40 | 42 | 2 | 231.12 | 0.085 |

| LP24RC014 | 15 | 16 | 1 | 190.44 | 0.02 |

| LP24RC015 | 9 | 11 | 2 | 118.80 | 0.005 |

| LP24RC016 | 8 | 12 | 4 | 2022.03 | 0.005 |

| including | 9 | 12 | 3 | 2639.44 | 0.005 |

| LP24RC016 | 17 | 20 | 3 | 218.31 | 0.088 |

| LP24RC017 | 12 | 18 | 6 | 241.62 | 0.007 |

| LP24RC018 | 11 | 19 | 8 | 235.29 | 0.006 |

| LP24RC019 | No Significant intercepts | ||||

| LP24RC020 | No Significant intercepts | ||||

| LP24RC021 | 24 | 25 | 1 | 488.19 | 0.01 |

| LP24RC022 | 19 | 22 | 3 | 559.33 | 0.007 |

| including | 19 | 20 | 1 | 1089.58 | 0.005 |

| LP24RC023 | 19 | 23 | 4 | 437.31 | 0.031 |

| including | 20 | 21 | 1 | 1041.23 | 0.01 |

| LP24RC024 | 12 | 22 | 10 | 126.39 | 0.011 |

| LP24RC025 | 11 | 13 | 2 | 194.57 | 0.005 |

| LP24RC025 | 31 | 40 | 9 | 261.18 | 0.026 |

| LP24RC026 | 25 | 27 | 2 | 346.68 | 0.08 |

| LP24RC027 | 0 | 3 | 3 | 643.06 | 0.005 |

| including | 0 | 1 | 1 | 1160.33 | 0.005 |

| LP24RC027 | 9 | 10 | 1 | 165.68 | 0.005 |

| LP24RC027 | 36 | 40 | 4 | 298.63 | 0.025 |

| LP24RC028 | 34 | 42 | 8 | 238.94 | 0.018 |

| including | 35 | 36 | 1 | 1106.09 | 0.01 |

| LP24RC029 | 35 | 41 | 6 | 218.47 | 0.051 |

| LP24RC030 | 20 | 23 | 3 | 108.29 | 0.007 |

| LP24RC030 | 25 | 26 | 1 | 121.46 | 0.005 |

| LP24RC030 | 32 | 40 | 8 | 269.46 | 0.027 |

| LP24RC031 | 22 | 23 | 1 | 214.61 | 0.005 |

| LP24RC031 | 27 | 36 | 9 | 212.75 | 0.014 |

| LP24RC032 | 22 | 24 | 2 | 168.27 | 0.008 |

| LP24RC032 | 27 | 32 | 5 | 212.99 | 0.012 |

| LP24RC033 | 24 | 27 | 3 | 242.48 | 0.007 |

| LP24RC033 | 31 | 32 | 1 | 255.89 | 0.01 |

| LP24RC033 | 35 | 37 | 2 | 417.44 | 0.12 |

| LP24RC034 | No Significant intercepts | ||||

| LP24RC035 | 7 | 8 | 1 | 193.39 | 0.005 |

| LP24RC035 | 13 | 14 | 1 | 278.29 | 0.005 |

| LP24RC035 | 28 | 30 | 2 | 318.97 | 0.035 |

| LP24RC036 | 34 | 39 | 5 | 280.13 | 0.036 |

| LP24RC037 | 27 | 29 | 2 | 141.39 | 0.008 |

| LP24RC037 | 34 | 39 | 5 | 372.16 | 0.036 |

| LP24RC038 | 25 | 26 | 1 | 225.23 | 0.09 |

| LP24RC038 | 31 | 36 | 5 | 297.28 | 0.03 |

| * Included intercepts are above >1000 ppm U 3 O 8 | |||||

SOURCE Laramide Resources Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/22/c7116.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/22/c7116.html