Lahontan Gold Corp. (formerly, 1246765 B.C. Ltd.) (the "Company" or "Lahontan") is pleased to announce drill results from the first four core drill holes exploring the Slab pit area of the Company's 19 km2 Santa Fe Project in Nevada's Walker Lane. The four drill holes, totaling 891 metres, were completed in late 2021 and targeted down-dip extensions of oxidized gold and silver mineralization below the Slab open pit in an area where historic drilling outlined significant potential oxide resources. Highlights include

- 41.1 metres grading 0.54 gpt Au and 1.8 gpt Ag (0.56 gpt Au Eq) starting at only 52.4 metres down-hole, and a second vertically stacked zone of 19.5 metres grading 0.26 gpt Au and 5.6 gpt Ag (0.33 gpt Au Eq), all oxidized, in drill hole CAL21-002C.

- 26.7 metres grading 0.44 gpt Au and 3.1 gpt Ag (0.48 gpt Au Eq) starting at only 29.4 metres down-hole, and a second, deeper zone, grading 0.21 gpt Au and 1.5 gpt Ag (0.23 gpt Au Eq), all oxidized, in drill hole CAL21-005C.

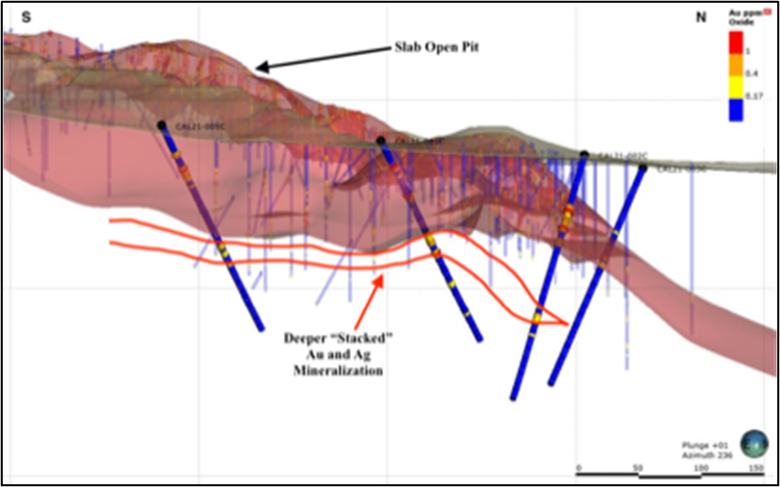

These four drill holes intercepted oxidized gold and silver mineralization throughout their entire lengths to a maximum down-hole depth of 246 metres (CAL21-002C, please see table below), confirming the presence of widespread oxide mineralization in the Slab pit area with only very minor amounts of transitional mineralization. Of critical importance, the drilling identified at least two vertically stacked zones of gold and silver mineralization; the deeper zone can help drive a deeper pit shell during resource estimation and optimization, which increases the volume of potential resources in the Slab pit area (please see long section below).

Drill hole CAL2-001C, 114.9 to 117.8m (377.0-386.5 feet); 2.9 metres grading 1.12 gpt Au, 17.3 apt Ag (1.35 gpt Au Eq). Gold and silver mineralization is hosted by brecciated, leached, and oxidized jasperoid and partly silicified limestone.

South-north (left to right, please see map below) long section through the Slab pit area, Santa Fe Project, Mineral County, Nevada. The grade shell outlining gold and silver mineralization (shown in pink above) is based upon modeling historic drilling, projected into the line of the long section, now confirmed and expanded by Lahontan drilling.

Kimberly Ann, CEO, President, Director, and Founder of Lahontan Gold Corp commented: "These drill results highlight the advantages of exploring a "Brownfield" project: Historic drill data allows us to vector into high probability target areas below previously mined oxidized gold and silver mineralization, rapidly outlining new potential precious metal resources. This is particularly evident in the Slab pit area. Previous mining exploited rock with an average grade of 0.7 gpt gold, similar to the grade range we see in our core drill holes. By targeting deeper unmined mineralization, below and north of the Slab pit, we are taking advantage of knowledge gained from our own geologic mapping and interpretation of historic drilling. During its productive period in the Nineties, the Slab pit had an ultimate strip ratio of only 0.7, leaving significant amounts of gold and silver mineralization potentially accessible via an additional pit layback. We look forward to continued drilling at the Slab pit as we head toward our maiden project-wide resource estimate later this year".

Drill Hole | Total Depth (m) | From (m) | To (m) | Interval (m) | Au (gpt) | Ag (gpt) | Au Eq (gpt) | Metallurgical Domain |

CAL21-001C | 207.3 | 52.1 | 64.0 | 11.9 | 0.53 | 5.4 | 0.60 | Oxide |

including: | 54.3 | 62.5 | 8.2 | 0.71 | 7.7 | 0.81 | Oxide | |

also: | 93.7 | 118.9 | 25.1 | 0.34 | 3.7 | 0.39 | Oxide | |

including: | 113.4 | 117.8 | 4.4 | 0.83 | 12.3 | 0.99 | Oxide | |

CAL21-002C | 245.7 | 52.4 | 93.6 | 41.1 | 0.54 | 1.8 | 0.56 | Oxide |

53.0 | 79.9 | 26.8 | 0.68 | 2.7 | 0.72 | Oxide | ||

also: | 156.7 | 176.2 | 19.5 | 0.26 | 5.6 | 0.33 | Oxide | |

CAL21-003C | 223.4 | 91.7 | 106.4 | 14.6 | 0.36 | 2.8 | 0.40 | Oxide |

CAL21-005C | 214.9 | 29.4 | 56.1 | 26.7 | 0.44 | 3.1 | 0.48 | Oxide |

including: | 29.4 | 32.5 | 3.1 | 1.03 | 8.8 | 1.15 | Oxide | |

also: | 126.5 | 147.8 | 21.3 | 0.21 | 1.5 | 0.23 | Oxide |

*Notes: Au Eq equals Au (gpt) + (Ag gpt/75). Metallurgical recovery has not been factored as insufficient test-work is available to determine potential Ag recoveries. True thickness of the intercepts shown above are estimated to be 75-85% of the drilled interval.

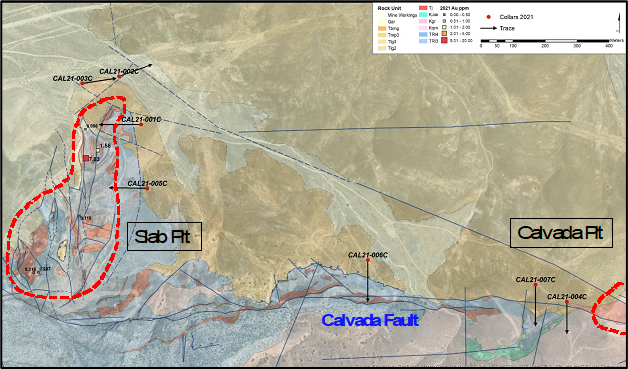

Drill hole location map, Slab pit area, Santa Fe Project, Mineral County, Nevada. Results for CAL21-004C, 006C, and 007C are pending.

QA/QC Protocols:

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM's were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM's and one blank CRM that were purchased from Shea Clark Smith Laboratories (MEG) of Reno, Nevada. Expected gold values are 0.188 gpt, 1.107 gpt, 10.188 gpt, and -0.005 gpt, respectively. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 gpt.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 - 30.48m) mark and labeled with a "D" suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (gpt).

About Lahontan Gold Corp:

Lahontan Gold Corp. is a Canadian mineral exploration company that holds, through its US subsidiaries, three top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 19 km2 Santa Fe Project, is a past producing gold and silver mine with excellent potential to host significant gold and silver resources (past production of 375,000 ounces of gold and 710,000 ounces of silver between 1988 and 1992; Nevada Bureau of Mines and Geology, 1996). Modeling of over 110,000 metres of historic drilling, geologic mapping, and geochemical sampling outline both shallow, oxidized gold and silver mineralization as well as deeper high grade potential resources. The Company plans an aggressive 25,000 metre drilling program with the goal of publishing a National Instrument 43-101 ("NI 43-101") compliant mineral resource estimate in 2022. For more information, please visit our website: www.lahontangoldcorp.com

All scientific and technical information in this press release has been reviewed and approved by Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., who is a qualified person under the definitions established by National Instrument 43-101.

On behalf of the Board of Directors

Kimberly Ann

Founder, Chief Executive Officer, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email:

Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

SOURCE: Lahontan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/702492/Lahontan-Drills-Shallow-Oxide-Gold-at-Santa-Fe-411m-Grading-054-gpt-Au-Starting-at-524m