Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (FSE: 6MR1) (the "Company" or "Kuya Silver") is pleased to announce financial and operating results for the three and six months ended June 30, 2025. The second quarter was marked by continued progress at the Bethania Silver Project in Peru, highlighted by increased mining output, significant underground development, and encouraging exploration results.

Q2 2025 Highlights:

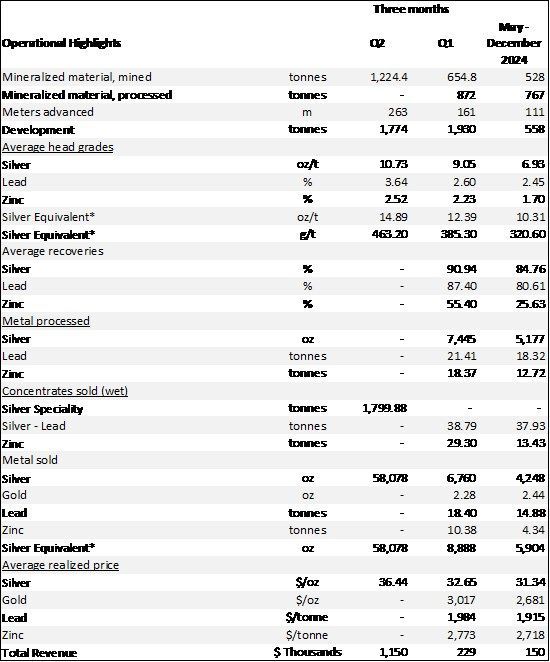

- Bethania mining ramp-up: 1,224 tonnes of mineralized material mined in Q2 2025, nearly doubling Q1 output, with average silver grades of 10.73 oz/t and silver equivalent* grades of 14.89 oz/t.

- Underground development advancing: Approximately 263 metres of development completed in Q2, expanding access to ten active working faces by quarter-end, compared to six in Q1.

- Infrastructure upgrades completed: Installation of trailing winches, a high-capacity compressor, and a new generator enhancing efficiency, safety, and reliability of underground operations.

- Exploration success: Sampling in historical artisanal mining zones resulted the discovery of three new silver-rich vein systems including 12 samples exceeding 1,000 g/t silver equivalent* and up to 2,668 g/t silver equivalent*. New targets were identified at Millococha Oeste, Millococha Norte, and Carmelitas Este, as well as extension to the Hilltop and Tito-PH zones expanding the mineralized strike length by 41% in the Bethania district.

- Silver Kings contribution: 1,800 wet tonnes of silver concentrate shipped in Q2, generating revenue of USD $1.15 million.

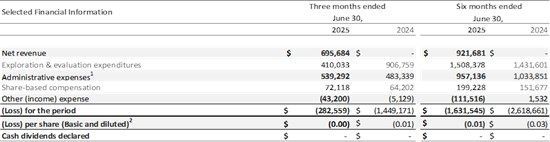

- Financial improvement: Net revenue of $0.70 million in Q2 2025, compared to nil in the prior-year quarter; net loss decreased to $0.28 million from $1.45 million in Q2 2024.

- Strengthened balance sheet: Raised over CAD $10.8 million through equity financings in H1 and subsequent to quarter-end, supporting Bethania accelerated development and regional exploration programs.

- Board and management enhanced: Added three independent directors with extensive capital markets and mining experience, as well, added Sheila Magallon as CFO to strengthen financial leadership.

David Stein, President & CEO, commented, "Q2 was a transformative quarter for Kuya Silver as we doubled output at Bethania and advanced mine development significantly. The progress we are making underground, combined with strong exploration results, demonstrates that, with further investment, Bethania has the potential to become a much larger and longer-lived operation. With milling resuming in July and a strengthened balance sheet following our recent financing, we are well positioned to accelerate development at Bethania while also advancing regional exploration opportunities to grow this district scale project. In addition, we are proud to have demonstrated the strategic importance of our 100%-owned Silver Kings project generating cash flow through the sale of a concentrate stockpile."

Operational Results

Bethania Silver Project (Peru)

At the Bethania silver project, Kuya Silver delivered notable operation progress in Q2 2025, achieving both higher output and steady advancement underground. The mine produced 1,224 tonnes of mineralized material, an 87% increase over the prior quarter, reflecting both improved efficiency and expanded access to mineralized material. Development work was equally strong, with metres advanced up 63%, providing the working faces needed to sustain higher mining rates and support the Company's ramp-up strategy. Although toll milling availability caused a temporary pause in processing, the Company accumulated a stockpile of mineralized material at the mine site. Milling operations resumed in July, keeping Bethania on course for consistent production in the second half of the year.

Grades also improved across the board, with silver averaging 10.73 oz/t and silver equivalent* grades rising to 14.89 oz/t, respectively. In parallel, Kuya Silver advanced key infrastructure upgrades including, new trailing winches, a high-capacity compressor, and a modern power generator. These investments have materially improved operational reliability and efficiency while preparing Bethania for higher throughput levels in the coming quarters. With development accelerating and systems in place to handle greater volumes, Bethania is positioned to reach its targeted 100 tonnes per day in Q3 2025.

Silver Kings Project (Canada)

At the Silver Kings Project, a total of 1,761 wet tonnes of silver concentrate were shipped in Q2 2025, generating provisional revenue of USD $1.18 million. The concentrate, which had been stockpiled and identified at site, was successfully marketed and sold during the quarter.

Table 1: Operational Summary

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/263446_cd7634b5347bdacd_001full.jpg

*Silver Equivalency (AgEq) was calculated using silver ($37.77 USD/troy oz), gold ($3,328.60 USD/troy oz), copper ($9,581.63 USD/tonne), lead ($1,973.47 USD/tonne) and zinc ($2,695.92 USD/tonne) values, obtained on July, 15 2025, and do not consider metal recovery.

Exploration Overview

Bethania District (Peru)

During Q2 2025, Kuya Silver advanced its field exploration program at the Bethania Silver Project, successfully expanding the known extent of mineralized zones. The Company identified new high-grade vein zones at Millococha Oeste and Millococha Norte, where grab samples returned values up to 2,630 g/t Ag. Additional sampling at the Hilltop, Carmelitas Este, and Tito PH prospects contributed to a 40-41% increase in the combined mineralized strike length of silver-mineralized veins, now totaling close to 7 kilometers across the property.

These new discoveries demonstrate continuity of mineralization across a wider area than previously identified, and suggest the opportunity for multiple vein systems outside the current Bethania mine footprint. The latest surface sampling results reinforce the Company's strategy to define new targets and ultimately support future resource growth, positioning Bethania as a larger-scale silver district with potential beyond the current production zone.

Silver Kings Project (Ontario, Canada)

At the Silver Kings Project, final results from the Company's 2024-2025 drilling program intersected multiple mineralized ladder veins and identified a new vein cluster within a geophysical anomalous zone, directly comparable to the high-grade Angus-McNamara mineralized zone. These results have expanded the mineralized zone at depth. In addition, drilling at the Campbell-Crawford/Airgiod Prospect expanded the silver-cobalt mineralized footprint to 375 x 250 metres, which remains open. Further details were provided in the Company's April 24, 2025 press release.

Financial Highlights

Kuya Silver generated approximately $0.70 million in revenue during Q2 2025, primarily from l concentrate sales, compared to nil revenue in the prior-year quarter. The Company recorded a net loss of $282,559 or $(0.00) per share in Q2 2025, an improvement from a loss of $1,631,545 or $(0.01) per share in Q2 2024. Year-to-date, Kuya reported approximately $0.92 million in net revenue compared to nil in H1 2024.

Table 2: Financial Summary

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/263446_cd7634b5347bdacd_002full.jpg

- Administrative expenses exclude share-based compensation.

- In periods when the Company has a loss, diluted loss per share is the same as basic loss per share.

Corporate Overview

During and subsequent to the six months ended June 30, 2025, Kuya Silver strengthened its financial position and governance. The Company completed three tranches of a non-brokered private placement between March and April, issuing a total of 11.6 million common shares at CAD $0.25 per share for gross proceeds of approximately CAD $2.9 million. In August 2025, Kuya Silver closed an additional financing, issuing 18.1 million units for gross proceeds of CAD $9.1 million. These financings have bolstered Kuya Silver's balance sheet and will be directed toward accelerating mine development and exploration within the Bethania district.

At the Annual General and Special Meeting on June 26, 2025, Eugene (Gene) McBurney, Lisa Wilkinson, and Sandro Ferrarone were elected as independent directors. Mr. McBurney was also named Chair of the Audit Committee, further enhancing the Company's governance and oversight. On July 2, 2025, Kuya Silver appointed Sheila Magallon as Chief Financial Officer. Ms. Magallon brings more than 20 years of financial leadership experience in the mining sector, strengthening Kuya Silver's financial management team as the Company transitions into production.

Outlook

Kuya Silver's primary focus continues to be the advancement of the Bethania Silver Project in Peru. The Company is on track to achieve its initial production milestone of 100 tonnes per day by Q3 2025, supported by the development of additional mining faces and incremental infrastructure improvements. As the daily production ramps up, Kuya Silver expects unit costs to fall as revenue increases, setting the stage for significantly stronger operating cash flow potential from the mine. Longer-term, Kuya Silver remains committed to expanding Bethania toward its phase 1 target production rate of 350 tonnes per day, supported by ongoing development, exploration, and a strengthened balance sheet that enables the company to manage its near term production goals, while executing on the longer-term growth potential for the Bethania project over the next several years.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by Kevin J. O'Connell, P.E., Independent Technical Advisor to of Kuya Silver and a Qualified Person as defined by National Instrument 43-101 and David Lewis, M.Sc., P.Geo., Vice President Exploration with Kuya Silver Corp. and a Qualified Person as defined by National Instrument 43-101.

About Kuya Silver Corporation

Kuya Silver is a Canadian‐based, growth-oriented mining company with a focus on silver. Kuya Silver operates the Bethania silver mine in Peru, while developing district-scale silver projects in mining-friendly jurisdictions including Peru and Canada.

For more information, please contact:

David Stein, President and Chief Executive Officer

Telephone: (604) 398‐4493

info@kuyasilver.com

www.kuyasilver.com

Reader Advisory

This press release may contain statements which constitute "forward-looking information", including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers. The words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", "potential" and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities or performance and involve risks and uncertainties, and that the Company's future business activities may differ materially from those in the forward-looking statements as a result of various factors. Such risks, uncertainties and factors are described in the periodic filings with the Canadian securities regulatory authorities, including the Company's quarterly and annual Management's Discussion & Analysis, which may be viewed on SEDAR+ at www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results to not be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements other than as may be required by applicable law.

Neither the Canadian Securities Exchange nor the Canadian Investment Regulatory Organization accepts responsibility for the adequacy or accuracy of this press release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263446