January 15, 2025

King River Resources Ltd (ASX: KRR) (“KRR” or the “Company”) received the final batch of assay results from phase 1 drilling for gold targets at the Kurundi Prospect (Figure 1) within the Tennant East Project area (KRR ASX release 6 November 2024).

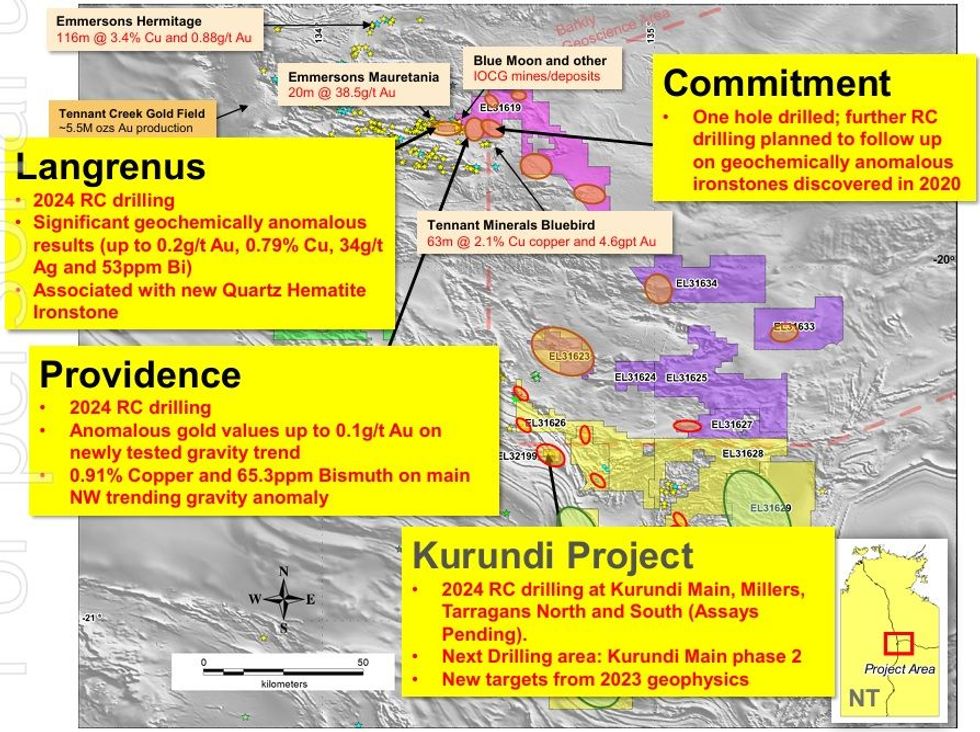

Northern Territory Tennant Creek Gold-Copper Projects

This drilling is the second part of the KRR’s larger $2million drill budget to follow up on targets generated from the 2023 geophysics programme targeting prospective IOCG and gold areas at Rover East, Tennant East, Barkly and Kurundi, including multiple targets along strike of geophysical and geological trends associated with other known significant deposits of high-grade Copper and Gold including Rover, Bluebird and Mauretania (KRR ASX releases 8 March 2023, 31 May 2023 and 11 October 2023).

Last year, KRR allocated a $2million drill budget to follow up on targets generated from its extensive 2023 geophysics programme including targets at the Tennant Creek East, Rover East, Kurundi and Barkly Projects which are along strike of geophysical and geological trends associated with known deposits of high-grade copper and gold including Rover, Bluebird and Mauretania.

Click here for the full ASX Release

This article includes content from King River Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

2h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

8h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

17h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00