November 07, 2023

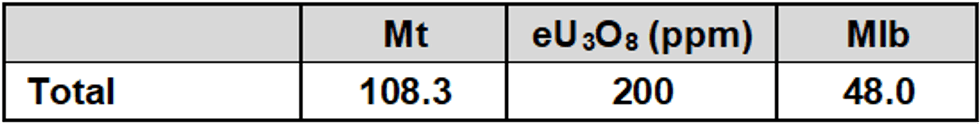

Elevate Uranium Limited (“Elevate Uranium”, or the “Company”) (ASX:EL8) (OTCQX:ELVUF) is pleased to announce an updated JORC Inferred Mineral Resource Estimate (“MRE”) of 48 Mlb eU3O8 for its Koppies Uranium Project in Namibia.

Key Highlights:

- Koppies JORC Mineral Resource Estimate (“MRE”) has been increased to 48.0 Mlb eU3O8.

- The MRE increase represents a 136% increase in the Koppies resources and a 42% increase in Elevate Uranium’s Namibian resources.

- Additional resource growth is targeted with 3 drill rigs currently progressing on resource drilling the mineralised zone south of Koppies 2 and at Koppies 4, to the south of the MRE envelope.

- Mineralisation remains open in multiple directions around the resource.

- Analysis of drilling results confirms the potential for additional mineralisation beneath earlier shallow drilling.

- Significant potential remains for resource expansion at Koppies and into the adjoining tenements.

Elevate Uranium’s Managing Director, Murray Hill, commented:

“Achieving the 48 Mlb eU3O8 resource is a milestone for the Koppies Uranium Project and the Company. The 136% increase in the resource substantially advances the status of the Koppies project, increasing our Namibian mineral resources by 42% to 94 Mlb eU3O8 and our global resources to 142 Mlb eU3O8.

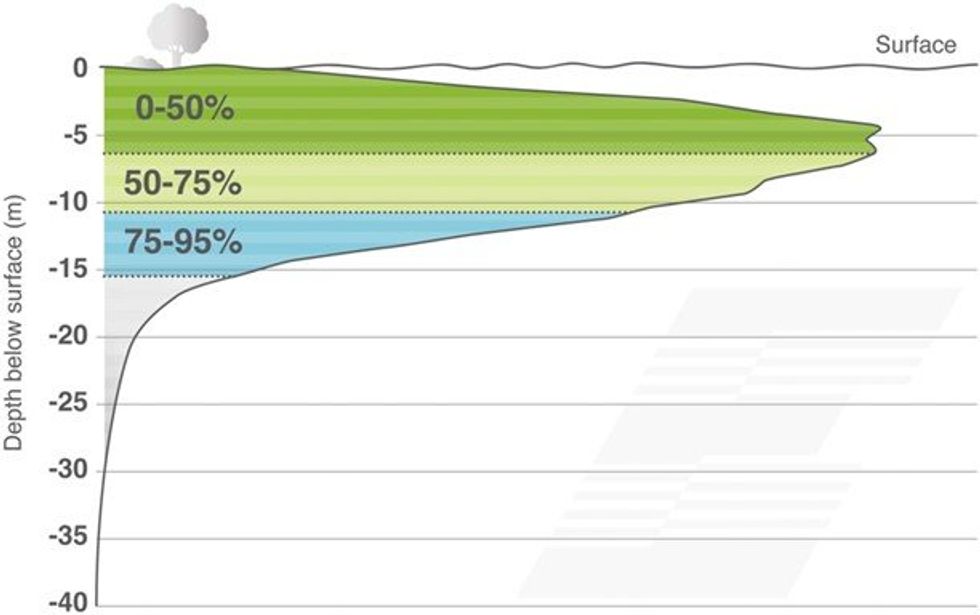

Koppies is one of the shallowest uranium resources globally, with 95% of the resource within approximately 15 metres of the surface and 50% of the resource within approximately 6 metres of the surface. These parameters are important for any potential low strip ratio, low-cost mining operation at Koppies.

Due to the large surface area of mineralisation at Koppies, drilling activities and resource updates are split into phases. The Company currently has three drill rigs operating to expand the resource reported here today. The next resource update will include the drilling currently in progress using three drill rigs to the south of Koppies 2 and into Koppies 4 and is expected to be completed during the March Quarter of 2024”.

This 48 Mlb eU3O8 MRE for the Koppies Uranium Project increases the Company’s total uranium resources to 142 Mlb, see Resource Table 3.

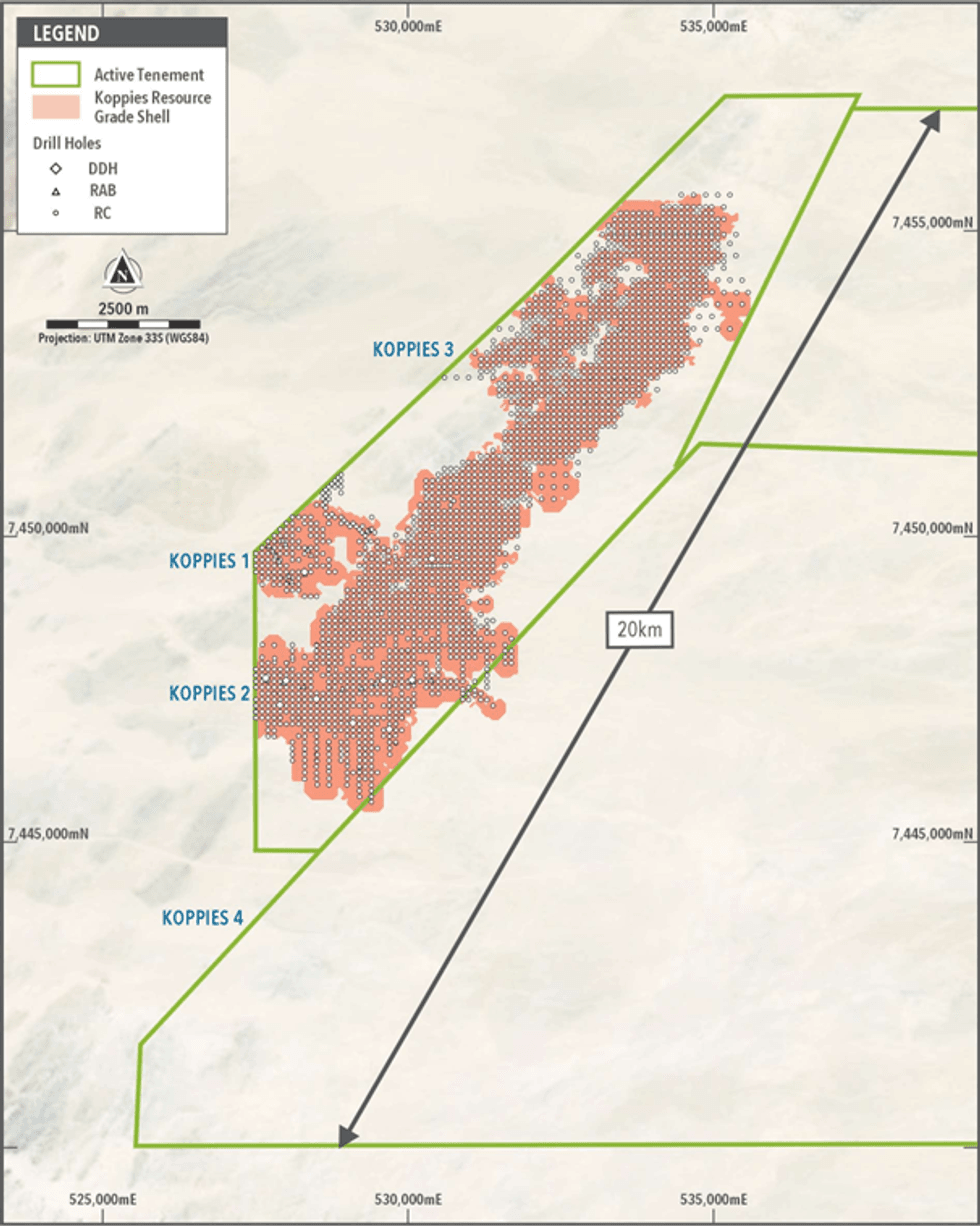

Figure 1 shows the surface extent of the mineral resource and the drilling completed for the resource upgrade.

Figure 2 indicates how the mineralisation is distributed by depth throughout the entire Koppies mineral resource. Koppies is one of the shallowest uranium resources globally and the diagram shows the near surface nature of the Koppies deposits, with 95% of the total mineral resource being within approximately 15 metres of the surface, and 50% of the resource within approximately 6 metres of the surface. These parameters are important for any potential low strip ratio, low-cost mining operation at Koppies.

Note – the scale on the left represents the cumulative depth, in metres, below surface. The diagram is not to scale.

Koppies Mineral Resource Estimate Summary

The Mineral Resource was estimated using Multi Indicator Kriging (“MIK”). The updated Inferred Mineral Resource Estimate (“MRE”) is reported at a number of cut-off grades from 50 ppm to 200 ppm eU3O8 and the MRE derived from these cut-off grades indicates that the mineralisation remains robust and consistent (see Table 2).

The MRE covers the Koppies deposit, between coordinates 527,500E, 7445500N to 535,600E, 7455600N, as shown on Figure 1. Mineral resources have been clipped to the Koppies tenement boundary to the west, where the deposit is contiguous with the Tumas 1E mineral resource (owned by Deep Yellow Ltd).

The maiden Koppies MRE was announced to the ASX on 4 May 2022 titled “22% Increase in Mineral Resources”. The results of drilling campaigns subsequent to the maiden MRE and included in this update were announced to the ASX on 30 October 2023, 31 July 2023, 27 April 2023, 22 November 2022, 28 September 2022 and 4 May 2022.

Click here for the full ASX Release

This article includes content from Elevate Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EL8:AU

The Conversation (0)

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00