October 18, 2024

IODM (ASX:IOD) is an Australian company well-positioned to leverage the increasing demand for accounts receivable automation, particularly in medium to large ERP companies. IODM's platform eamlessly integrates with ERP systems like Oracle, SAP, Microsoft Dynamics and Xero, reducing the need for manual invoicing and follow-ups.

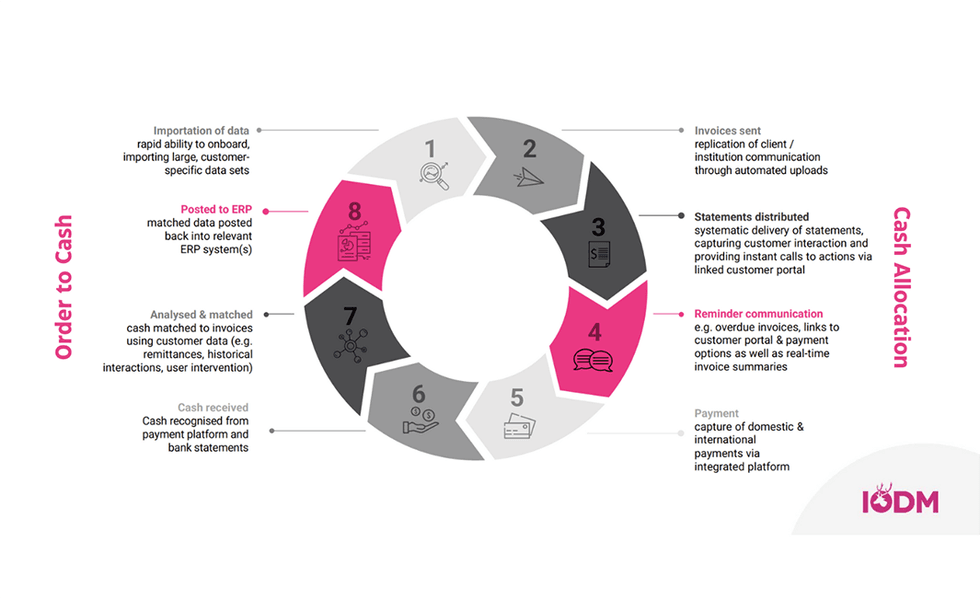

The company's flagship product, IODM Connect, is an intelligent accounts receivable platform that enables businesses to automate invoice reminders, payment collections, and cash allocation processes. The platform integrates seamlessly with major enterprise resource planning (ERP) systems such as Oracle, SAP, Microsoft Dynamics and Xero, allowing organizations to adopt the solution without significant disruption to their existing financial workflows.

IODM Connect illustration

IODM Connect illustrationIODM Connect automates time-consuming tasks involved in accounts receivable management and offers advanced cash allocation and reconciliation features. The platform is also highly scalable and customizable, making it suitable for businesses of all sizes and industries.

Company Highlights

- IODM is a cloud-based accounts receivable communications platform designed to automate and streamline cash collection processes within the terms of trade.

- The platform seamlessly integrates with ERP systems like Oracle, SAP, Microsoft Dynamics and Xero, reducing the need for manual invoicing and follow-ups.

- IODM targets medium to large companies and can handle seamlessly those with multiple divisions with multiple reporting functions

- IODM has been successful in universities and enterprises, with a focus on managing complex billing cycles and cross-border payments.

- The company is already used by ten UK universities, with plans to expand into North America, Asia and Greater Europe.

- IODM operates with a scalable revenue model, combining revenue share and license-based pricing to cater to different customer segments.

This IODM Ltd profile is part of a paid investor education campaign.*

Click here to connect with IODM Ltd (ASX:IOD) to receive an Investor Presentation

IOD:AU

Sign up to get your FREE

IODM Ltd Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 May 2025

IODM Ltd

Cloud-based cash flow optimisation solution for medium and large enterprises

Cloud-based cash flow optimisation solution for medium and large enterprises Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

IODM Ltd (IOD:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

26 January

Material revenue event from the Convera Commercial Agreement

IODM Ltd (IOD:AU) has announced Material revenue event from the Convera Commercial AgreementDownload the PDF here. Keep Reading...

27 October 2025

Quarterly Activities/Appendix 4C Cash Flow Report

IODM Ltd (IOD:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

07 October 2025

IODM UK Revenue Update

IODM Ltd (IOD:AU) has announced IODM UK Revenue UpdateDownload the PDF here. Keep Reading...

10 September 2025

UK Revenue Update

IODM Ltd (IOD:AU) has announced UK Revenue UpdateDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

IODM Ltd Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00