April 14, 2025

Invion (ASX:IVX) is a clinical-stage Australian life sciences company pioneering the next generation of photodynamic therapy (PDT) for the treatment of cancer and infectious diseases. Invion is advancing a transformative approach to disease treatment and diagnosis with a platform grounded in preclinical promise and growing clinical validation.

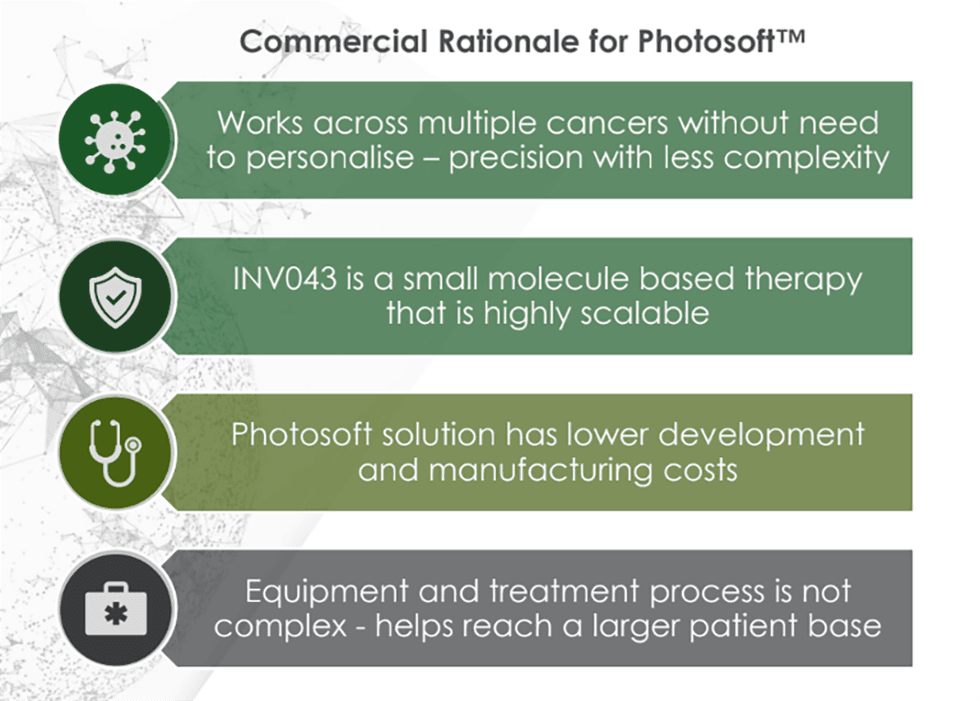

At the core of Invion’s platform is Photosoft, a proprietary suite of next-generation photosensitizers that selectively accumulate in diseased cells. Upon light activation, these compounds trigger a targeted oxidative stress response, leading to cell death with high precision. Unlike traditional PDT agents, Photosoft compounds are engineered to overcome the limitations of toxicity, off-target damage, and limited immune engagement. They are designed to deliver enhanced safety, selectivity, immune system activation, and theragnostic capabilities.

Invion is strategically expanding its clinical and commercial footprint through non-dilutive global partnerships that accelerate development while preserving shareholder value. In South Korea, Hanlim Pharm is fully funding the preclinical development of Photosoft for two high-need indications: glioblastoma multiforme (GBM) — one of the most aggressive and treatment-resistant brain cancers — and oesophageal cancer. Under the terms of the partnership, Hanlim covers all development costs, while Invion retains full ownership of the underlying intellectual property, positioning the company to benefit from future global opportunities.

Company Highlights

- Clinical-stage Pipeline in Multiple Indications: Successfully completed Phase II prostate cancer trial, ongoing Phase I/II skin cancer trial, and anogenital cancer trial initiating in 2025. Multiple cancer and infectious disease programs underway.

- Photosoft Platform Technology: Combines cancer selectivity, immune system activation, and minimal toxicity. Preclinical studies show INV043 can regress multiple cancers, deliver superior safety and efficacy and improve tumour control to 80 percent in combination therapy studies with blockbuster ICIs (vs 12 percent with ICIs alone).

- Renowned Partners & Global Pharma-funded Collaborations: Working with distinguished research institutions like Peter MacCallum Cancer Centre and Hudson Institute of Medical Research. Further, Hanlim Pharm (GBM, oesophageal cancer) and Dr.inB (HPV) are funding multiple programs without requiring Invion to contribute capital or give up IP.

- Theragnostic Capability: Photosoft compounds enable both treatment and imaging, allowing for highly precise cancer targeting and enhanced surgical decision-making.

- Strong Clinical and IP Foundation: GMP-grade INV043 manufactured and patented in Australia, with global IP protection extending to at least 2041.

- Compelling Upside: Following a share consolidation and reduced overhangs, IVX offers significant re-rating potential with multiple clinical readouts expected over the next six to 12 months.

This Invion profile is part of a paid investor education campaign.*

Click here to connect with Invion (ASX:IVX) to receive an Investor Presentation

IVX:AU

The Conversation (0)

22 December 2025

Hanlim & Korean Government Fund Pathway to Clinical Trial

Invion Limited (IVX:AU) has announced Hanlim & Korean Government Fund Pathway to Clinical TrialDownload the PDF here. Keep Reading...

02 December 2025

Invion Secures Expanded Photosoft Global Exclusive License

Invion Limited (IVX:AU) has announced Invion Secures Expanded Photosoft Global Exclusive LicenseDownload the PDF here. Keep Reading...

30 October 2025

Appendix 4C and Quarterly Activities Report - September 2025

Invion Limited (IVX:AU) has announced Appendix 4C and Quarterly Activities Report - September 2025Download the PDF here. Keep Reading...

20 October 2025

Funded Collaboration Agreement with Protect Animal Health

Invion Limited (IVX:AU) has announced Funded Collaboration Agreement with Protect Animal HealthDownload the PDF here. Keep Reading...

09 October 2025

Repayment of Lind Facility with Successful Capital Raise

Invion Limited (IVX:AU) has announced Repayment of Lind Facility with Successful Capital RaiseDownload the PDF here. Keep Reading...

06 March

InMed Provides Update on BayMedica Operations and Strengthens Focus on Pharmaceutical Development Pipeline

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical company focused on developing a pipeline of disease-modifying small molecule drug candidates that target CB1CB2 receptors, today announced an update regarding BayMedica LLC ("BayMedica"), a wholly owned... Keep Reading...

05 March

Moderna to Pay US$950 Million to Settle COVID-19 Vaccine Patent Dispute

Moderna (NASDAQ:MRNA) has agreed to pay US$950 million to resolve a long-running patent dispute tied to the technology used in its COVID-19 vaccine.The pharmaceuticals giant announced it has reached a global settlement with Arbutus Biopharma (NASDAQ:ABUS) and Genevant Sciences GmbH over claims... Keep Reading...

24 February

Gilead to Acquire Arcellx in US$7.8 Billion Bet on Cancer Therapy

Gilead Sciences (NASDAQ:GILD) announced plans to acquire cancer immunotherapy partner Arcellx (NASDAQ:ACLX) in a deal worth up to US$7.8 billion, moving to take full control of their jointly developed multiple myeloma therapy anito-cel as it seeks to expand its oncology pipeline.The agreement,... Keep Reading...

11 February

InMed Reports Second Quarter Fiscal 2026 Financial Results and Provides Business Update

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical drug development company focused on developing a pipeline of proprietary small-molecule drug candidates for diseases with high unmet medical needs, today reports financial results for its second quarter of... Keep Reading...

11 February

As GLP-1 Brands Go Prime Time, Regulators Flag Growing Illicit Market

At Super Bowl LX, companies behind blockbuster GLP-1 medications spent tens of millions of dollars to court a mass audience. But as brand-name makers and telehealth platforms race to normalize and expand access, regulators on both sides are warning of a parallel surge in counterfeit, compounded,... Keep Reading...

28 January

Expansion of SVN-015 into Depression Following Positive Preclinical Data

Demonstrates antidepressant-like activity benchmarked against fluoxetine (Prozac®), supporting potential in patients with inadequate SSRI response

Solvonis Therapeutics plc (LSE: SVNS), an emerging biopharmaceutical company developing novel medicines for high-burden central nervous system ("CNS") disorders, announces the expansion of its investigational compound SVN-015 into the treatment of depression, supported by preclinical data... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00