International Lithium Corp. (TSXV: ILC) (OTCQB: ILHMF) (FSE: IAH) (the "Company" or "ILC") is pleased to announce the start of Phase 3 of the 2022 diamond drilling campaign at the Raleigh Lake Lithium project near Ignace, Ontario, Canada.

Further to Company's news release dated September 20, 2022; ILC has completed 6,251 metres core drilling at the Raleigh Lake project in the first two phases of drilling in 2022. Phase 3 began on September 28, 2022 with approximately 2,500 metres of proposed drilling.

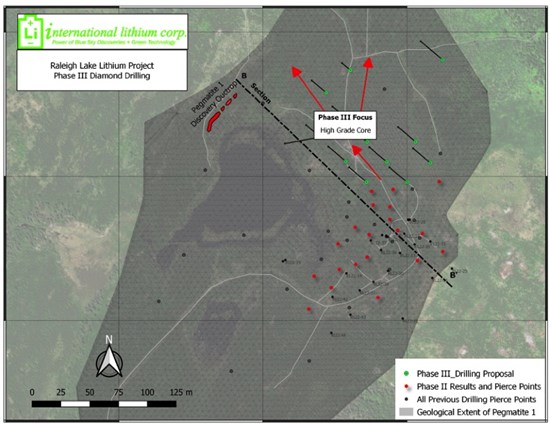

The previous phase of drilling showed Lithium Oxide concentrations up to 3.62% over 6.46 metres and Rubidium Oxide up to a grade of 1.38% over 5.9 metres. Phase 3 will include continued exploration and infill drilling of Pegmatite 1 at Zone 1 (Figure 1) and testing new exploration targets at Zone 5, Zone 3 and Zone 6, defined by lithogeochemical surveys in 2021. The drilling objective at Zone 1 will be to trace the high-grade core of Pegmatite 1 up-dip, closer to surface, and investigate the possibility of additional pegmatites occurring below Pegmatite 1.

Two holes have already been completed at the Zone 1 pegmatite occurrences with drill hole RL22-45 intersecting 14 metres of pegmatite (Pegmatite 1) starting at 84 metres downhole*. The intersection includes 4 metres of monomineralic microcline from 85.5 - 89.5m. The microcline associated with Pegmatite 1 is known to contain highly anomalous rubidium concentrations and occurs in a distinct zone within Pegmatite 1 that could warrant declaring the rubidium in the upcoming resource estimate as a standalone commodity.

The second hole, RL22-46 was drilled approximately 75 metres west of RL22-45 and intersected Pegmatite 1 over 10 metres from 89 metres downhole. Here Pegmatite 1 was encountered roughly 15 metres deeper than modelling would suggest. A second spodumene bearing pegmatite was intersected from 108 - 110.5 metres downhole which aligns well with a deeper pegmatite vein encountered in drill hole RL22-27 (Figure 2). This new discovery will be followed up immediately in the next few drill holes.

The drilling at Zone 1 continues to confirm the continuity of Pegmatite 1 and the near surface prospectivity for additional lithium and rubidium bearing mineralization. The narrow pegmatites intersected below Pegmatite 1 present an opportunity for the discovery of one or more pegmatites at depth which could be open to expansion in all directions.

* All intervals reported here are downhole core lengths. Accurate true widths are unknown at this time but are estimated to be within 70-100% of the reported intervals based on the geometry of the bodies and structural measurements on oriented core.

Figure 1: Approximate surface trace outline of Pegmatite 1 showing pierce points from drilling, and planned exploration holes for Phase 3. Pegmatite 1 appears to have an enriched core trending up dip toward the northwest.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3232/139538_1b27258ea4331b7e_003full.jpg

Figure 2: Cartoon cross section B-B' (Figure 1) illustrating the orientation of Pegmatite 1 and the up-dip projection to its surface outcrop. Drill hole RL22-46 intersected Pegmatite 1 deeper than anticipated giving it an almost horizontal orientation in this section. A second spodumene bearing pegmatite, that appears to line up with a pegmatite vein intersected in RL22-27, was encountered at a deeper depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3232/139538_1b27258ea4331b7e_004full.jpg

John Wisbey, Chairman and CEO of International Lithium Corp., commented:

We have already found some excellent grades of Lithium Oxide as high as 3.62% at Raleigh Lake and in the first two phases of drilling this year we have done enough drilling to be on track for producing a maiden resource estimate in 2022. As well as further exploration of the Raleigh Lake claims area, this drilling is designed to give additional input into the size of such resource, and to give us and our geological partners further confidence in the data, for example the size of a separate rubidium resource in the microcline. Analysis of exact grades for this phase of drilling is expected to be finished after the maiden resource estimate. Once again, we would stress that only 8% of the area of our claims has been explored so far, and also stress again the excellent access to road and energy infrastructure in this project.

Quality assurance/quality control procedures

The drill program is under the control of a Professional Geoscientist, registered with Engineers & Geoscientists British Columbia.

Patrick McLaughlin, P. Geo., a Qualified Person as defined by NI 43-101, has verified the disclosed technical information and has reviewed and approved the contents of this news release.

About International Lithium Corp.

International Lithium Corp. believes that the world faces a significant turning point in the energy market's dependence on oil and gas and in the governmental and public view of climate change. In addition, we have seen the clear and increasingly urgent wish by the USA and Canada to safeguard their supplies of critical battery metals and to become more self-sufficient. Our Canadian projects are strategic in that respect.

Our key mission in the next decade is to make money for our shareholders from lithium and rare metals while at the same time helping to create a greener, cleaner planet. This includes optimizing the value of our existing projects in Canada and Ireland as well as finding, exploring and developing projects that have the potential to become world class lithium and rare metal deposits.

A key goal has been to become a well-funded company to turn our aspirations into reality, and following the disposal of the Mariana project in Argentina in 2021 and the Mavis Lake project in Canada in January 2022, the Board of the Company considers that ILC is now well placed in that respect with a strong net cash position.

The Company's interests in various projects now consists of the following, and in addition the Company continues to seek other opportunities:

| Name | Location | Area (Hectares) | Current Ownership Percentage | Future Ownership percentage if options exercised or work carried out | Operator or JV Partner |

| Raleigh Lake | Ontario | 48,500 | 100% | 100% | ILC |

| Wolf Ridge | Ontario | 5,700 | 0% | 100% | ILC |

| Avalonia | Ireland | 29,200 | 45% | 21% | Ganfeng Lithium |

| Mavis Lake | Ontario | 2,600 | 0% | 0% (carries an extra earn-in payment of CAD $1.4M if resource targets met) | Critical Resources Ltd |

| Forgan Lake & Lucky Lake | Ontario | 0% | 1.5% Net Smelter Royalty | Ultra Lithium Inc. |

The Company's primary strategic focus at this point is on the Raleigh Lake lithium, rubidium and caesium project in Canada and on identifying additional properties.

The Raleigh Lake project consists of 48,500 hectares (485 square kilometres) of mineral claims in Ontario and is ILC's most significant project in Canada. The exploration results there so far, which are on only about 8% of ILC's current claims, have shown significant quantities of rubidium and caesium in the pegmatite as well as lithium. Raleigh Lake is 100% owned by ILC, is not subject to any encumbrances, and is royalty free.

With the increasing demand for high tech rechargeable batteries used in electric vehicles and electrical storage as well as portable electronics, lithium has been designated "the new oil", and is a key part of a "green tech" sustainable economy. By positioning itself with projects with significant resource potential and with solid strategic partners, ILC aims to be one of the lithium and rare metals resource developers of choice for investors and to continue to build value for its shareholders in the '20s, the decade of battery metals.

On behalf of the Company,

John Wisbey

Chairman and CEO

For further information concerning this news release please contact +1 604-449-6520

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release or other releases contain certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information or forward-looking statements in this or other news releases may include: the effect of results of anticipated production rates, the timing and/or anticipated results of drilling on the Raleigh Lake or Wolf Ridge or Avalonia projects, the expectation of resource estimates, preliminary economic assessments, feasibility studies, lithium or rubidium or caesium recoveries, modeling of capital and operating costs, results of studies utilizing various technologies at the company's projects, budgeted expenditures and planned exploration work on the Company's projects, increased value of shareholder investments, and assumptions about ethical behaviour by our joint venture partners or third party operators of projects. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled "Risks" and "Forward-Looking Statements" in the interim and annual Management's Discussion and Analysis which are available at www.sedar.com. While management believes that the assumptions made are reasonable, there can be no assurance that forward-looking statements will prove to be accurate. Should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Forward-looking information herein, and all subsequent written and oral forward-looking information are based on expectations, estimates and opinions of management on the dates they are made that, while considered reasonable by the Company as of the time of such statements, are subject to significant business, economic, legislative, and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management's estimates or opinions change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/139538