November 29, 2023

Lightning Minerals (“L1M” or “the Company”) is pleased to report it has confirmed a lithium in-soil anomaly over a 2.6km by 1.0km area where assays have returned values more than 100ppm lithium. The infill soil sampling has returned assays up to 177ppm lithium, following the first pass soil sampling which returned assays up to 218ppm lithium1. All soil sampling is now complete on tenements E63/2000 and E63/1993 with plans now underway to begin drilling in early 2024.

HIGHLIGHTS

- Infill sampling has defined a ~2.6km x ~1km >100ppm lithium in-soil anomaly within E63/2000

- Results provide targets for exploration drill testing in early 2024 with heritage surveys now complete and approvals in place

- Exploration continues aggressively across the Company’s Dundas projects with multiple targets for follow up in 2024

Lightning Minerals Managing Director Alex Biggs said, “We are pleased to announce that follow-up geochemical sampling has confirmed the previously reported lithium in-soil anomalism identified in March 2023 within E63/2000. Importantly, the clustering of these results provides us with confidence to effectively drill-test priority areas in early 2024. With the heritage survey also now complete, we are finalising drill locations. We look forward to keeping the market up to date when drill targeting is complete”.

DUNDAS SOUTH LITHIUM SOIL RESULTS

During early 2023 Lightning Minerals completed a first pass reconnaissance (400m x 400m sample spacing) soil geochemistry program consisting of 1,391 soil samples at its Dundas South Project. Of these, 682 were collected within tenements E63/2000 and E63/1993, which defined a broad lithium in- soil anomaly over an approximate ~8km2 area, including a peak result of 218ppm lithium1. To progress these initial areas of interest to more clearly identifiable drill targets an infill sampling program to a greater resolution was required.

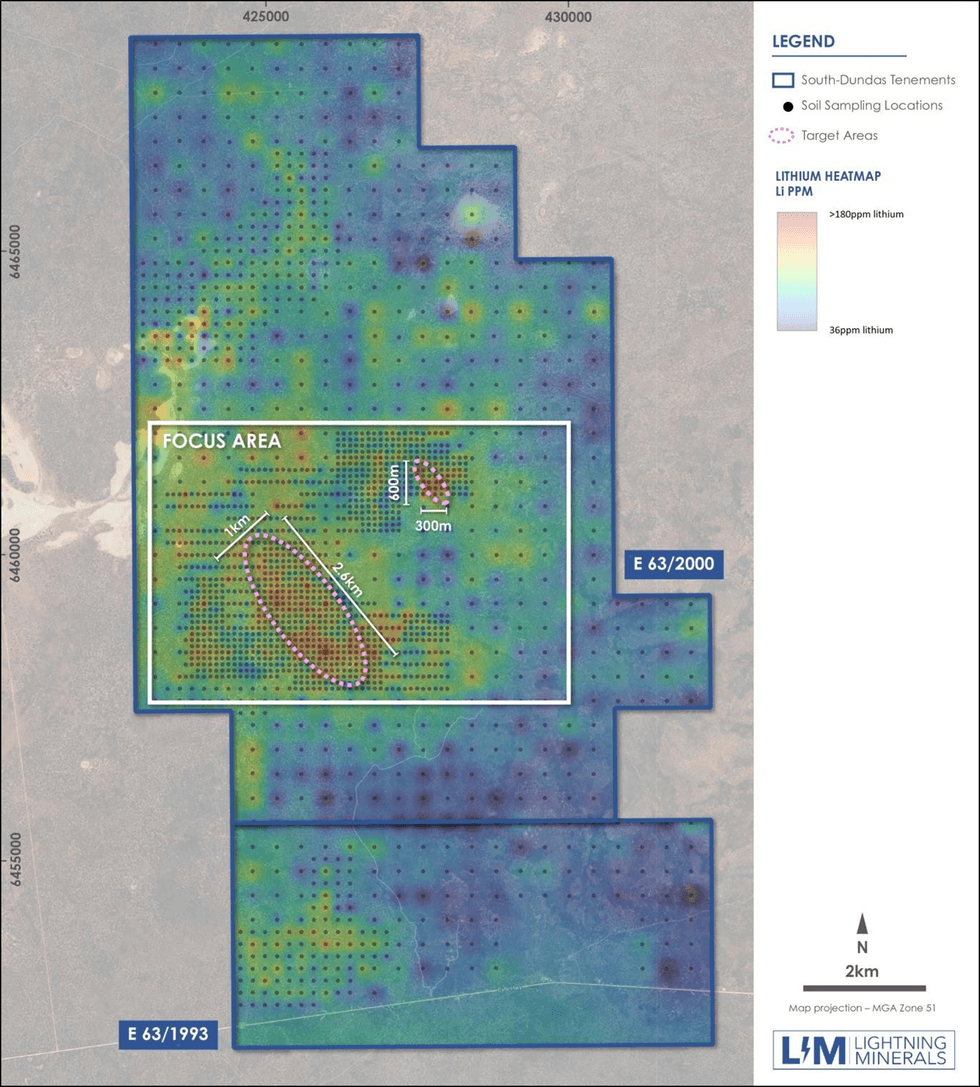

This follow up infill program has now been completed, the program has refined the anomalous lithium areas to better understand the location and potential orientation of the anomalism. The infill samples were collected on variably spaced East-West grids which included grids of 200m x 200m, 200m x 100m, and high-resolution grids of 100m x 100m across the priority areas. Samples were analysed at Labwest Laboratories utilising the Ultrafine + (UFF+) method with chemical analysis for a suite of 62 elements including lithium and associated pathfinders for lithium mineralisation. Sample locations and lithium assay values are shown in Figure 1 and 2. Results are available in tabulated format for samples >100ppm lithium in Appendix 2.

The results of the infill campaign are considered encouraging with peak assay values reported of up to 177ppm lithium, 69.8ppm caesium, and 296ppm rubidium. Two anomalous areas have been identified. The larger of these is elevated in lithium, caesium, and rubidium, within an area approximately 2.6km long and 1km wide (Figure 1).

A secondary zone of anomalism occurs ~2.7km North-East of the first anomaly. This area is approximately 600m long x 300m wide with a cluster of 16 samples returning values over 80ppm lithium. Peak assay values up to 166ppm lithium, 17.5ppm caesium and 171ppm rubidium have been recorded (Figures 2, 3 and 4).

GEOLOGICAL SIGNIFICANCE

The localised geology consists of complex felsic granitic plutons and rafts of ultramafic and mafic volcanics, as recorded by the Geological Survey of Western Australia 1:500,000 interpreted geological datasets. The granites located proximal (2-5km) to the anomalous zones exhibit multiple phases or ‘pulses’ of intrusive events which are visible within state geophysical datasets.

The timing of the granitic ‘pulses’, the structural setting, and the related geochemistry to these various pulses need to be correct and are considered critical to creating the right conditions to emplace late- stage felsic hydrothermal fluids for pegmatite hosted mineralisation. The potential for development of the target mineralisation style in the surrounding host rocks will require these factors to be supportive for lithium mineralisation.

Lithium, rubidium and caesium are considered valuable exploration pathfinder elements when exploring for lithium within highly weathered Archaean terranes. The results of the infill soil program are considered to be elevated once values report greater than 100ppm lithium, 150ppm rubidium and 9ppm caesium as shown in Figures 2, 3, and 4. The generally coincident spatial location of the anomalism for each element is shown in Figure 5. This coincident nature further increases confidence in the quality of the targets, supporting the upcoming drill testing.

Tabulated assay data for lithium, caesium, and rubidium is available in Appendix 2 for samples containing in excess of >100ppm lithium.

Click here for the full ASX Release

This article includes content from Lightning Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00