October 08, 2023

Impact Minerals Limited (ASX:IPT) is pleased to announce that the Company has adopted an Environmental, Social, and Governance (ESG) framework with 21 core metrics and disclosures created by the World Economic Forum (WEF).

Highlights

- Impact Minerals Limited has commenced disclosing Environmental, Social, and Governance (ESG) metrics

- Disclosures are made using the World Economic Forum Stakeholder Capitalism ESG framework

- Engagement of Socialsuite technology platform ESG Go for disclosing and monitoring progress

- Impact Minerals has set quarterly ESG actions and to release baseline ESG disclosure report

Managing Director, Dr Mike Jones said:

Impact Minerals is committed to building legitimate Environmental, Social, and Governance (ESG) credentials and we are now commencing ESG reporting as a tangible first step on our ESG journey. This is of increasing importance to us and to all of our stakeholders as we move along the path towards production from our Lake Hope High Purity alumina project here in Western Australia over the next few years.

We believe the Lake Hope project is already demonstrating strong ESG credentials, given the material is free- digging, and can be trucked off-site for processing at an established industrial site, leaving a very small environmental footprint compared to conventional mining. In addition, we have already received heritage clearance for the area to be mined from the Ngadju Peoples with whom we have an excellent relationship.

The ESG framework we have adopted, which will be applied throughout our entire project portfolio, will enable us to better identify material risks going forward, leading to better-informed decisions and business outcomes. Our commitment to ESG will also create a consistent and measurable approach that helps us contribute to the betterment of our communities both locally and globally.

We have adopted Socialsuite’s “ESG Go” as a best-in-class solution to start ESG reporting within a structured, standardised, and globally recognised solution that makes WEF framework accessible and operational. We look forward to sharing our ESG journey and reporting on our progress against the WEF framework.

ABOUT ESG REPORTING

The context in which the Company operates has been transformed by climate impact, nature loss, and social unrest around inclusion and working conditions. This new global environment is challenging the traditional expectations of corporations and redirecting investment capital. Global sustainable investment now tops $30 trillion, up 68% since 2014 and tenfold since 2004.

Impact Minerals Limited is charting a course to build resilience and enhance our social licence through a greater commitment to long-term, sustainable value creation that embraces the wider demands of people, planet and shared prosperity.

UNIVERSAL ESG METRICS

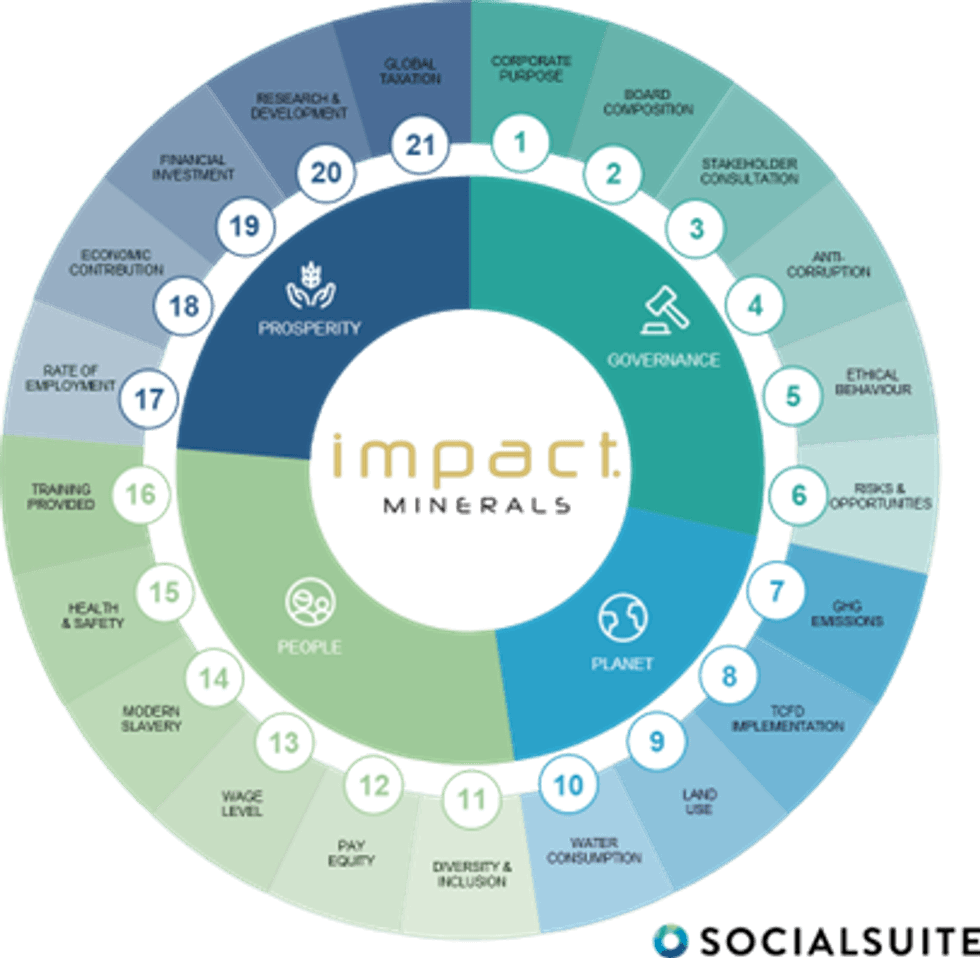

Impact Minerals Limited has commenced ESG reporting by making disclosures against the World Economic Forum Stakeholder Capitalism framework. The WEF framework is a set of common metrics for sustainable value creation captured in 21 core ESG disclosures (Figure 1). The Board of Impact Minerals Limited has resolved to use this universal ESG framework to align mainstream reporting on performance against ESG indicators.

Impact Minerals Limited sees the WEF Stakeholder Capitalism Metrics as the most appropriate ESG disclosure framework to start its ESG journey. The Stakeholder Capitalism framework leverages a variety of existing frameworks and is intentionally built to be a stepping stone to begin building capacity and capability in ESG reporting. It enables Impact Minerals Limited to report on core ESG matters of governance, anti-corruption practices, ethical behaviour, human rights, carbon emissions, land use, ecological sensitivity, water consumption, diversity and inclusion, pay equality and tax payments.

By including ESG metrics in mainstream reporting and integrating them into governance, business strategy, and performance management processes, Impact Minerals Limited sets out to demonstrate that it diligently considers all pertinent risks and opportunities in running its business. Impact Minerals Limited will demonstrate an ongoing commitment to ESG by sharing its progress toward ESG disclosures in regular updates.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

22h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00