March 26, 2024

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide an update on its exploration program at its 100% owned Horden Lake project in Quebec, Canada.

Highlights

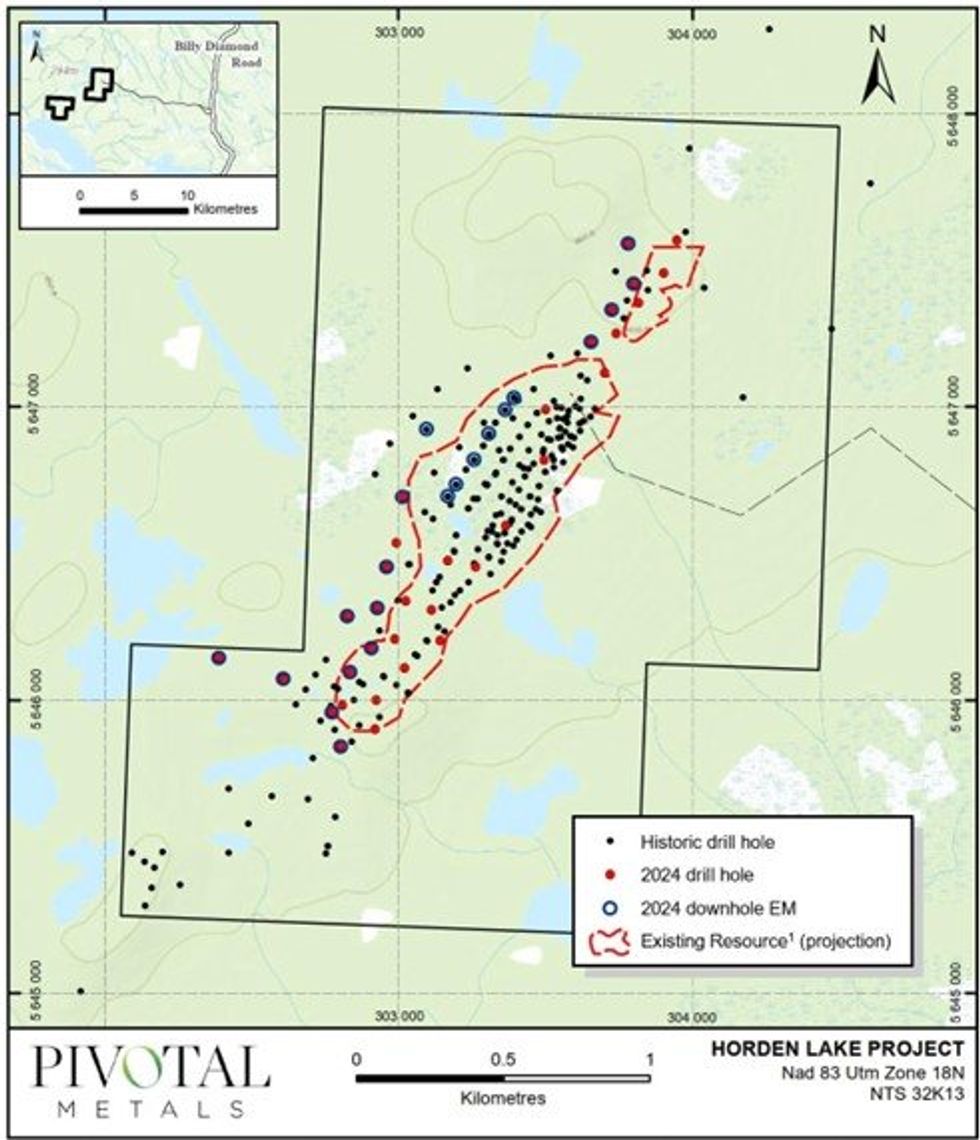

- 33 holes for 7,014 metres of diamond drilling completed at Horden Lake.

- Program targeted grade and tonnage opportunities within the 412 kt CuEq (27.8mt at 1.5% CuEq) Indicated and Inferred Resource1.

- Logging and assay in progress. First assay results are expected shortly, and will be released progressively during Q2 2024.

- Extensive 21 hole downhole EM geophysical survey in final stages of completion.

- Objective to show resource growth potential around the defined Resource, which was open along NE-SW strike and down-plunge directions.

Managing Director, Mr Fairhall said:

“We are proud to be wrapping up our successful drilling and downhole geophysics program on schedule at Horden Lake – the first since Pivotal’s acquisition of the property. Our strategy to target grade and tonnage increases on the project is firmly intact, and we look forward to sharing the results shortly.

This work program sets us up for a busy 2024 as we work towards a resource update, metallurgical testwork, and follow up drilling to continue to grow the already significant mineral endowment. I would like to thank our in-country team and contracting partners for a safe and well executed program”

Horden Lake Drill Program

The Company has completed 33 diamond drill holes at Horden Lake, for a combined program of 7,014 metres (Figure 1).

The program was designed to target improvements to both the quality and scale of the Horden Lake project and provide the foundation for advancing the asset from both a geological, and an engineering, perspective.

- Exploit the potential for increase in grade by collecting Au, Ag, Pt and Co by-product assay data for parts of the deposit that were not assayed for these metals in the past.

- Exploit the potential for increase in tonnage by drilling areas of limited density in or around the 27.8 mt Resource envelope. Downhole geophysics has been used to refine targets for further step-out drilling (see below).

- Collect significant sample for metallurgical testwork for flowsheet optimisation to support more detailed engineering studies.

Drill core is being progressively logged by the geological team in Val d’Or and sent for multielement assay with ALS Global. The first assays were sent on 19 February, and results are expected shortly.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00