October 29, 2024

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to report the completion of a detailed desktop review of historical exploration at Flicka Lake, part of the Company’s 100%-owned Fry Lake Gold Project in Canada. The review identified three gold bearing parallel quartz veins, validated by Troon Ventures Ltd using channel and grab samples taken from mineralised quartz zones exposed in trenches.

HIGHLIGHTS

- Recently completed desktop study has identified three parallel quartz veins, which have been targeted with grab rock samples at Flicka Lake Project in Canada

- Historical exploration identified gold bearing channel samples including 9.96 g/t Au and 12.96 g/t Au

- Previously reported grab samples included 17.88 g/t, 7.38 g/t and 20.07 g/t of Au

- Flicka Lake Gold Sampling Program Assay Results expected to be received shortly

While gold mineralisation has shown to be historically reported in the area, reportable validation sampling was completed in 2002 and 2006. Previous exploration targeted the Flicka Lake area based on the proximity to the Golden Patricia Mine located 25 km to the Northeast, where a shear hosted quartz vein averaging less than 40cm in width had been mined. The review identified the following results.

Grab sampling:

- At Vein #1, reported up to 17.88 g/t Au

- At Vein # 2, reported up to 7.38 g/t Au

- The best exposed zone, Vein #3 reported the highest assay result of 20.07 g/t Au

Channel samples:

- At Vein #2, reported up to 12.96 g/t Au

- At Vein #3, reported up to 9.96 g/t Au

The occurrence at Flicka Lake consists of 3 gold-bearing structures of limited extent hosted by gabbroic rocks that strike perpendicular to the main shear zones in the area and dip 55° to 65° to the east. The veins pinch and swell (up to 30 cm wide) and are hosted in discrete, highly strained, carbonate-actinolite-tourmaline arsenopyrite altered zones (~1.5 m wide). Refer to Figure 1 and Table 1.

RMX acquired the Flicka Lake claim, 855170, over the mineralised veins and has since undertaken due diligence with 11 rock and 11 soil samples collected within the claim boundary, Map 2.

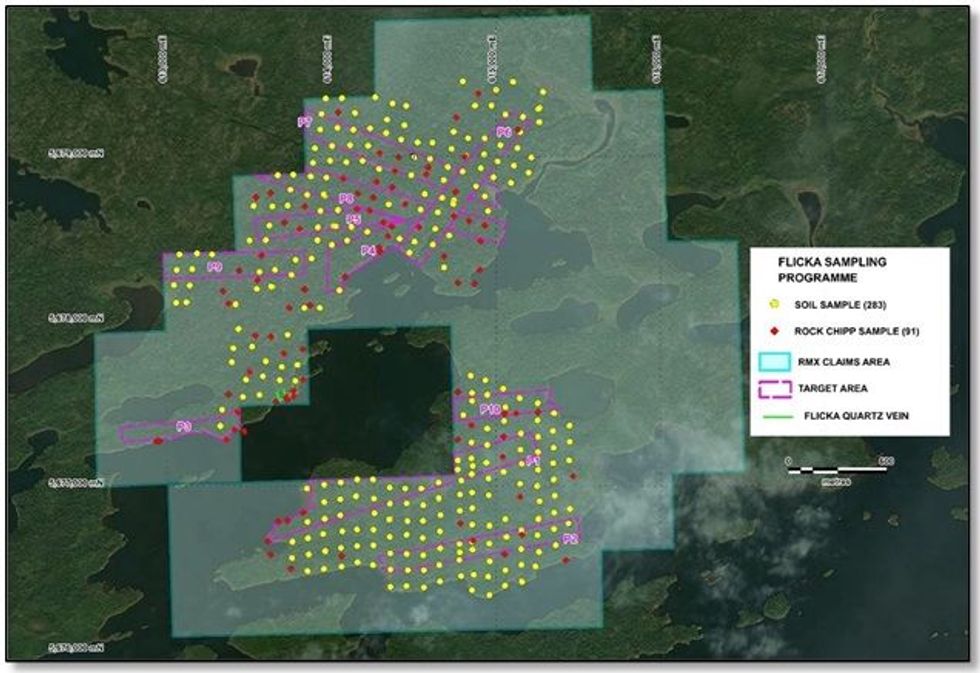

RMX has since completed its maiden sampling program at Flicka Lake, part of the Fry Lake Gold Project in Ontario, Canada. Results are expected shortly for 283 soil and 91 rock chip samples over its Flicka Lake claims which included due diligence sampling at the Flicka Lake gold bearing quartz veins as well comprehensive sampling over the claim area’s structural and geophysical targets (Figure 2 & Tables 2/3). The review has identified additional key target zones for anomalous copper towards the Northern portion of Flicka Lake. The Lab analysis, of which results are due to be received shortly, includes a gold and base metals suite also attempting to define areas for copper mineralisation.

Background

The Flicka Lake claims lie within the Meen-Dempster Greenstone Belt and is one of four recently acquired claim packages (Figure 3) considered prospective for gold. The four 100% RMX owned properties, named Flicka Lake, Fry Lake Stock, Fry-McVean Shear and Relyea Porphyry or collectively the Fry Lake Projects, hold potential to host gold lode mineralisation based on targeting and the known deposits in the broader area. The Fry Lake Projects are located in the Uchi region, a prolific mineral belt which has produced 32Moz Au to date1.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00