February 12, 2023

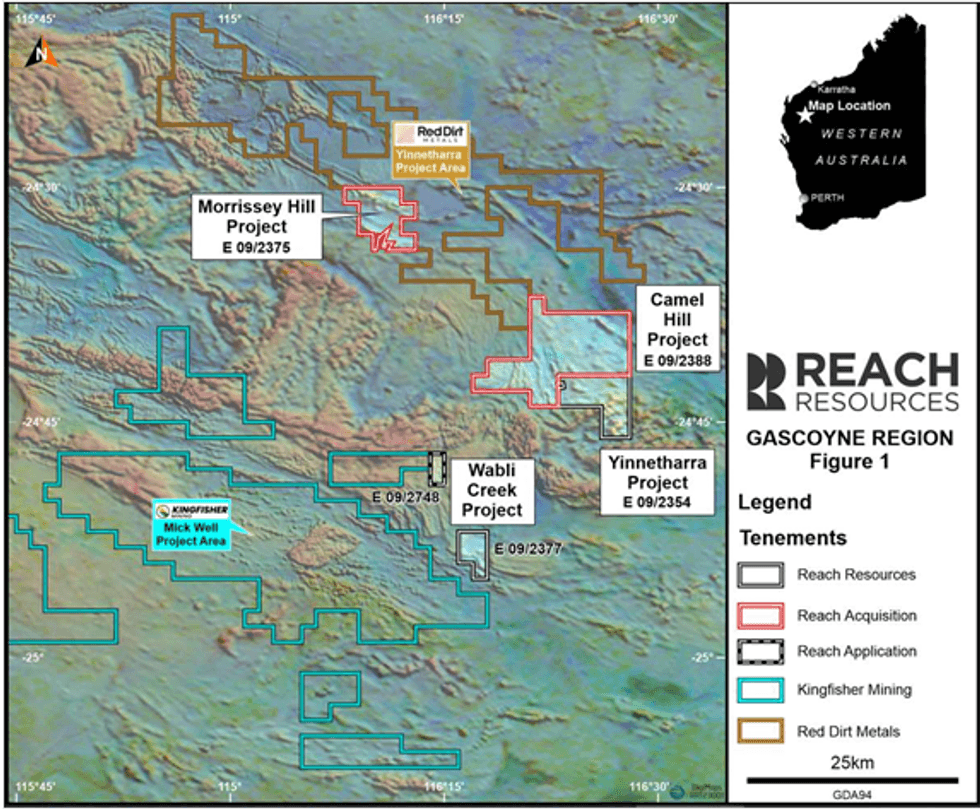

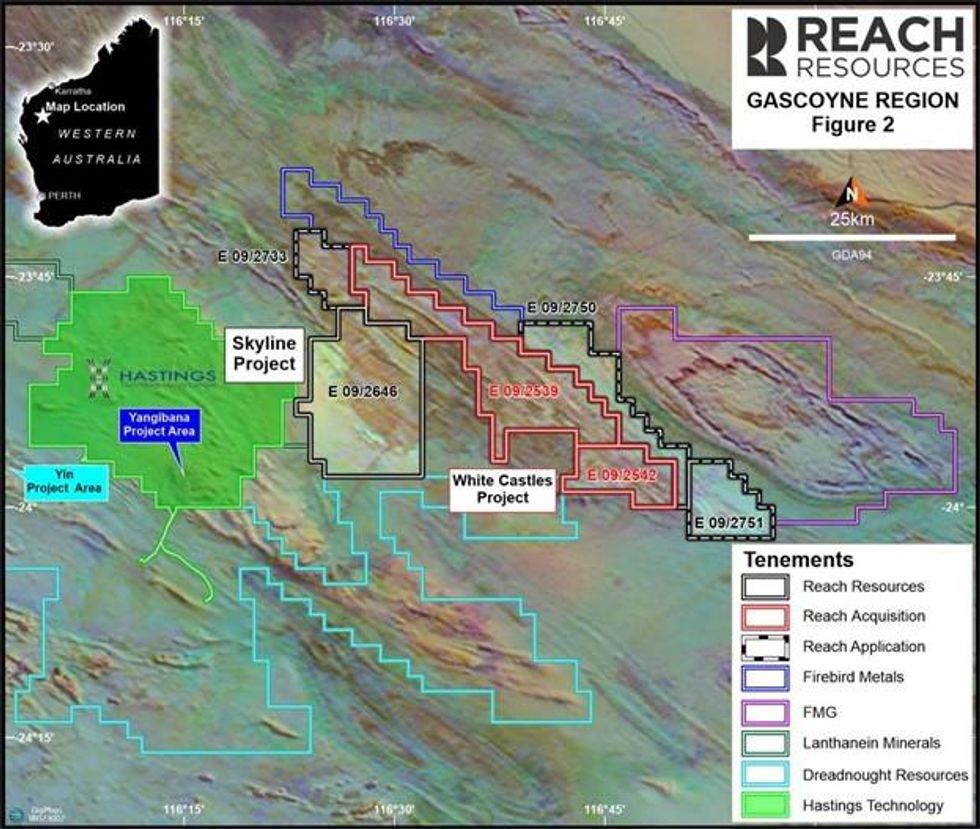

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that binding terms sheets have been signed with two separate and non-related parties for the acquisition of four tenements highly prospective for lithium, REE and/or manganese in the Gascoyne Mineral Field, WA (Figures 1 & 2). Three of the four tenements share a boundary with existing Reach tenure which significantly increases the Company’s ability to explore entire mineral strike lengths and provides greater contiguous area for potential future development.

HIGHLIGHTS

- Four (4) tenements are being acquired for low cash consideration plus shares, and are highly prospective with known lithium, rare earth element (REE) and manganese mineralisation

- Lithium tenement (Morrissey Hill project) has widespread outcropping pegmatites, and is directly adjoining, and contains the same geology as, Red Dirt Metals’ (ASX: RDT) Yinnetharra Lithium Project (Figure 1)

- REE and Manganese tenements bordered by FMG Pilbara (ASX:FMG), Firebird Metals (ASX:FRB), and existing Reach tenure in the Gascoyne region (see Figure 2)

- Upon completion, Reach will command a significant land holding in the highly prospective Gascoyne region, providing scale, contiguity and excellent exposure

ACQUISITIONS:

➢Acquisition 1: Two tenements - Prospective for Lithium: Morrissey Hill (E09/2375) and Rare Earth Elements (REE): Camel Hill (E09/2388). Both in the Gascoyne Mineral Field, WA (Figure 1)

- Lithium tenement E09/2375 (Morrissey Hill) adjoins Red Dirt Metals’ Yinnetharra Lithium Project. RDT recently announced1 initial assay results from drill intersections including 55.6 m @ 1.12% Li2O incl. 15 m @ 1.52% Li2O from 95 m.

- Morrissey Hill historical high-grade lithium, tantalum, rubidium, cesium, niobium results from rock-chip samples include:

- 1.32% Li2O, 3.62% Ta2O5, 1,936 ppm Rb, 2,276 ppm Cs, and 1.55% Nb2O5

- Geology within E09/2375 is consistent with Red Dirt Metals’ “Goldilocks Zone” theory for occurrence of lithium-cesium-tantalum (LCT) pegmatites. Numerous outcropping pegmatites have already been mapped within E09/2375.

- In addition, results show a 5-km long lithium soil anomaly (>100 ppm Li) untested by drilling.

- REE tenement E09/2388 (Camel Hill) has historical rock-chip samples with total rare earth oxide (TREO) results of up to 1,357 ppm

- A ~3.5-km long REE soil anomaly (>500 ppm REE) untested by drilling.

- Recorded REE anomalies correspond with thorium radiometric highs.

➢Acquisition 2: Two tenements: White Castles (E09/2539 & E09/2542) prospective for manganese and REE in the Gascoyne Mineral Field, WA

- High-grade rock-chip results up to 18% MnO2.

- Multiple surface manganese outcrops over 50 km of continuous strike.

- Little to no exploration undertaken since 2010.

- Neighbours include FMG to the east, FRB to the north west and Dreadnought Resources (ASX:DRE) to the south west.

- The tenements lie within 5 km of recent anomalous REE results from Reach’s Skyline project (ASX Release 7 November 2022).

PLACEMENT:

➢The Company has received firm commitments for $2,000,000 in new equity to fund both acquisitions, pay off all debt (non-cash via share issue), conduct exploration activities and provide additional working capital

Firm commitments have been received from sophisticated and professional investors to raise $2M in cash, via a two tranche Placement to fund the acquisitions (low cash consideration plus share consideration – see section “Acquisition Summary and Terms” for full details), accelerate exploration on new and existing tenements with a focus on lithium, REE and manganese, and to provide additional working capital.

Commenting on the acquisitions, Reach CEO Jeremy Bower said:

“We have intentionally added lithium and manganese to our critical mineral portfolio due to the exponential demand for these minerals from the electrical revolution taking over the globe. When exploring for lithium, you want three key factors: the right geology to produce evolved LCT pegmatites, visible or known lithium mineralisation and the presence of pathfinder elements such as cesium, tantalum, rubidium – Morrissey Hill has all three.

Additionally, we have a direct comparison next door at Red Dirt’s Yinnetharra project. Yinnetharra has the same geology as Morrissey Hill and recent drill results by RDT have intersected good lithium grades. This gives us a great deal of confidence as we plan an aggressive exploration program at Morrissey Hill to begin in early March.”

Further, the acquisition of the White Castles Manganese project is a strategic play for Reach providing additional critical minerals diversification. There is no substitute for manganese in the steel making process, which provides a large demand for the metal itself. However, the importance of manganese is also growing exponentially within the battery sector for use in electric vehicles. Manganese is an important component in the cathodes of the two most commonly produced types of electric vehicle (EV) batteries available today, including Li-Ion.

There is a growing push from EV and battery cathode manufacturers to increase manganese content to improve battery and electric vehicle cost competitiveness, while maintaining energy density. Manganese is therefore a strategic commodity to add to the Reach asset portfolio.

It is an exciting time for the Company, and we can’t wait to update shareholders as our exploration across all tenements ramps up over the coming months.”

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

13 May 2025

Murchison South Increases to 67koz Gold Across Two Pits

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a... Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00