July 10, 2022

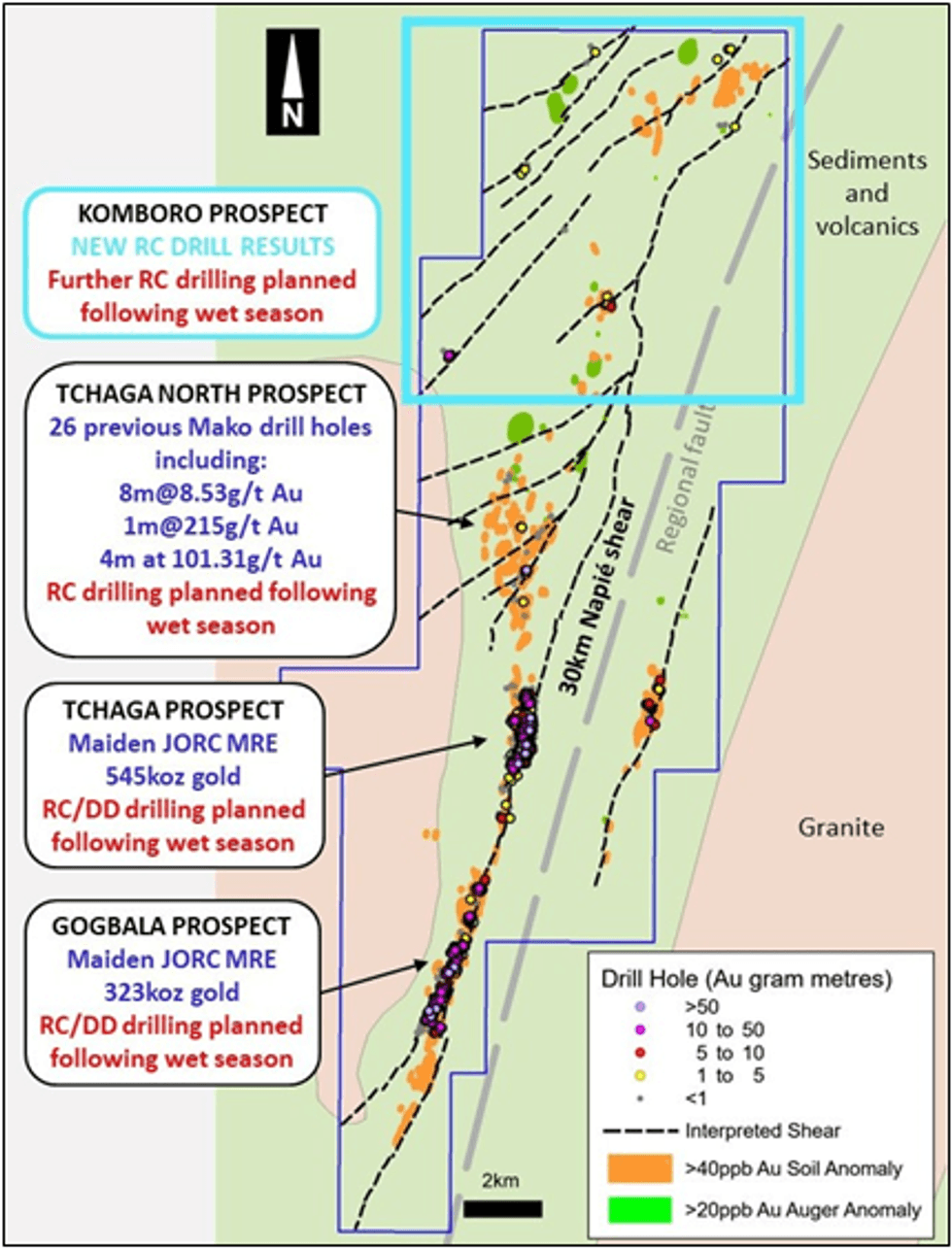

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) is pleased to advise that it has received positive assay results from the recent shallow Reverse Circulation (RC) drilling program from the Komboro Prospect, within the Company’s flagship Napié Project in Côte d’Ivoire. Komboro is located on a +23km soil anomaly and coincident 30km‐long Napié Fault and associated splays (Figure 1).

HIGHLIGHTS

- High‐grade gold discovery at Komboro is significant following release of maiden 868koz Au Inferred Mineral Resource Estimate (MRE) at Tchaga and Gogbala

- Validates Mako’s strategy to grow the Napié Gold Project to a multi‐million‐ounce system

- Reverse Circulation (RC) drilling program returned multiple shallow high‐grade intercepts, including 9m at 3.26g/t Au and 1m at 30.47g/t Au

- Significant results include:

- NARC741: 9m at 3.26g/t Au from 67m; including 3m at 7.29g/t Au from 67m; and

- 1m at 30.47g/t Au from 86m

- NARC743: 1m at 8.45g/t Au from 74m

- NARC753: 5m at 1.64g/t Au from 56m

- NARC741: 9m at 3.26g/t Au from 67m; including 3m at 7.29g/t Au from 67m; and

- 6 of 7 targets drilled returned significant gold values highlighting untapped potential of the northern part of the permit

- Komboro is a large‐scale regional prospect located on the +23km soil anomaly and coincident splays associated with the 30km‐long Napié Fault

- Results received from shortened Korhogo drilling program

Mako’s Managing Director, Peter Ledwidge commented:

“We are thrilled with the results of our new discovery at the Komboro Prospect as it has confirmed the presence of significant mineralisation at a 4th prospect on the Napié Project. The drill results validate the company’s growth strategy of identifying new areas for potential resource delineation following the recent delivery of the 868koz Inferred maiden MRE at Tchaga and Gogbala. We look forward to drilling more extensively along the 9km‐long intermittent artisanal mining sites at the end of the wet season”

Intervals above 0.5g/t Au cut‐off are reported in Appendix 1.

A map of the drill hole locations is shown in Appendix 2.

Results have also been received from the shortened maiden RC drill program on the Korhogo Project.

NEW MINERALISED ZONE DISCOVERED AT KOMBORO PROSPECT AT NAPIÉ

Results have been received from 23 shallow RC holes from a 2,824m drill program recently completed at Komboro Prospect.

The location of the Komboro Prospect is shown in Figure 1 relative to Tchaga and Gogbala, where the Company recently announced a maiden Inferred Mineral Resource of 22.5Mt at 1.20g/t Au for 868k contained ounces gold1.

Figure 1: Napié Project – Location of Komboro Prospect relative to Tchaga and Gogbala MRE at Napié with results and planned further drilling on all prospects

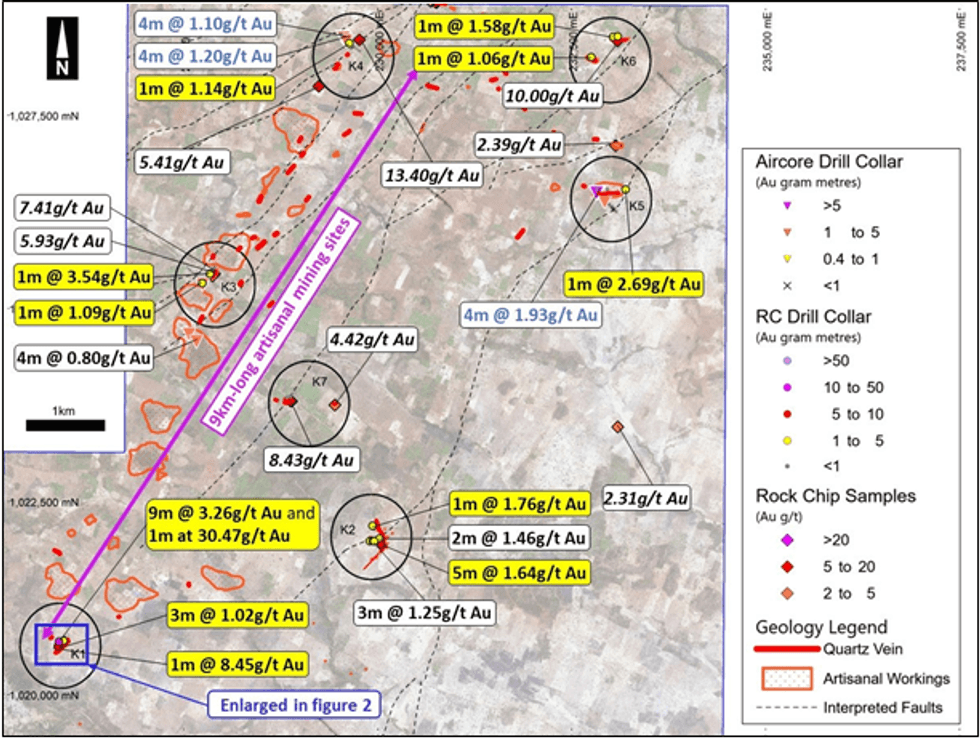

Seven targets were drilled with 6 of the 7 targets intersecting significant mineralisation (Figure 2).

Drill results include 9m at 3.26g/t Au, including 3m at 7.29g/t Au and, separately 1m at 30.47g/t Au in NARC741, as well as 1m at 8.41g/t Au in NARC 743 from the previously undrilled K1 Target (Figure 3).

Drilling at the K2 Target located on a separate structure 3km to the east, intersected 5m at 1.64g/t Au in NARC 753. (Figure 2).

Figure 2: Komboro Prospect: Drill targets K1 to K7 – Select new (yellow) and previous (white) RC results and previous AC results (blue) and rock chips (white italics)

Targets were identified from recent Air Core (AC) drilling which include 4m at 1.93g/t Au, 4m at 1.20g/t Au, and 4m at 1.10g/t Au, and from geological mapping and rock chip sampling. The majority of the holes were drilled on artisanal mining sites with large quartz veins which can be intermittently traced over 9km, as well as on other smaller artisanal sites, which were identified during recent geological mapping1.

Click here for the full ASX Release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

6h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

8h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

8h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

23h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00