- WORLD EDITIONAustraliaNorth AmericaWorld

April 18, 2023

High-Tech Metals Limited (ASX:HTM) focuses on its Canadian cobalt asset in the Kenora Mining District. The company’s Werner Lake project has received no previous modern exploration, creating blue-sky potential as High-Tech leverages new technologies and techniques. High-Tech Metals is a well-structured entity from a capital perspective, with a highly experienced team of experts leading the company towards its goals. Toby Hughes was recently appointed to lead the exploration team and improve the value of the Werner Lake project.

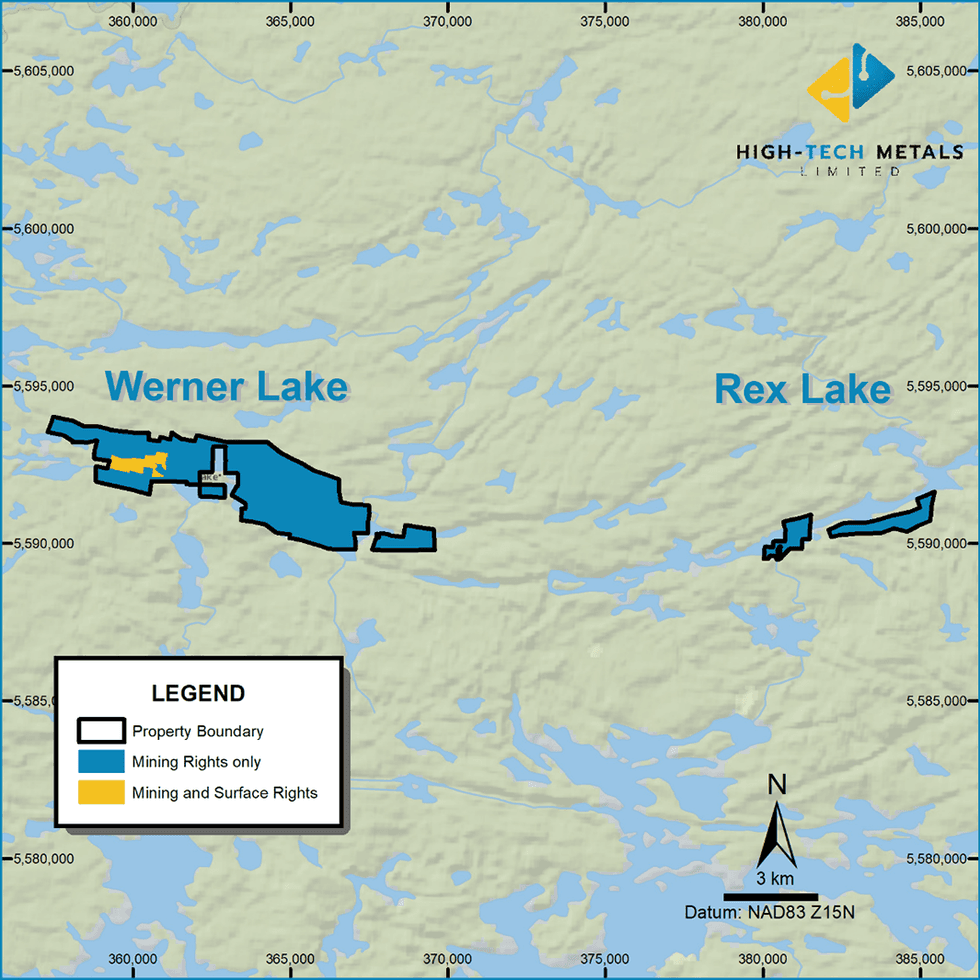

The Werner Lake project is near the Ontario-Manitoba border and is on the Werner Lake Geological Belt, known for hosting cobalt-copper and base metal deposits. The region has undergone continual exploration and production since cobalt was discovered in 1921.

The Werner Lake project is near the Ontario-Manitoba border and is on the Werner Lake Geological Belt, known for hosting cobalt-copper and base metal deposits. The region has undergone continual exploration and production since cobalt was discovered in 1921.

High-Tech’s project was explored in the 1930s and 1940s, then was taken into production in the 1990s. Results from historical exploration and production informed the project’s current JORC-compliant resource estimate of 720,000 pounds (lbs) at 0.52 percent cobalt. While encouraging, the team also believes there is a significant exploration of upside potential by leveraging modern tools and techniques.

Company Highlights

- High-Tech Metals Limited is an exploration and development mining company exploring its underexplored cobalt asset in Canada.

- The company is a well-structured entity from a capital perspective, with the right management team in place to realize the potential of its assets.

- The Werner Lake Cobalt Project has seen some historical exploration and production but has not been explored with modern exploration techniques and technologies, creating upside potential for additional discoveries.

- High-Tech Metals recently hired Toby Hughes, a renowned geologist, to lead the exploration team.

- Cobalt is currently used throughout a wide range of applications, and the growth of renewable technologies will continually drive up demand for the metal.

- The Werner Lake project is located on the Ontario-Manitoba border in a prolific mining district with an existing road network to facilitate future transportation.

- The company’s asset has a current JORC-compliant resource estimate of 720,000 lbs of ore at 0.52 percent cobalt.

- An experienced management team leads the company towards fully exploring its cobalt asset.

This High-Tech Metals profile is part of a paid investor education campaign.*

Click here to connect with High-Tech Metals Limited (ASX:HTM) to receive an Investor Presentation

HTM:AU

The Conversation (0)

08 November 2023

High-Tech Metals

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project Keep Reading...

12 January 2025

Appointment of Chief Executive Officer

High-Tech Metals (HTM:AU) has announced Appointment of Chief Executive OfficerDownload the PDF here. Keep Reading...

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00