March 03, 2025

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to advise that today it will commence conducting a high-resolution ground magnetics and targeted pXRF assay program at the Company’s 100%-owned Kiabye Gold Project in Western Australia. The Company will aim to define potential gold bearing structures for conventional wet geochemical sampling.

HIGHLIGHTS

- Survey has launched today in the northern Kiabye area – an area which has previously reported anomalous gold-in-soil

- Kiabye Gold Project covers 23km2 of strike and remains underexplored – providing considerable upside potential for RMX

- The survey will target structures amenable to gold bearing fluids with target areas to be followed up with detailed pXRF assaying

- The program will take approximately 12 days, covering to 10km2 – results of the magnetic survey are anticipated in mid to late March

- Defined anomalous areas will be targeted for wet chemistry sampling with lab results expected in late March.

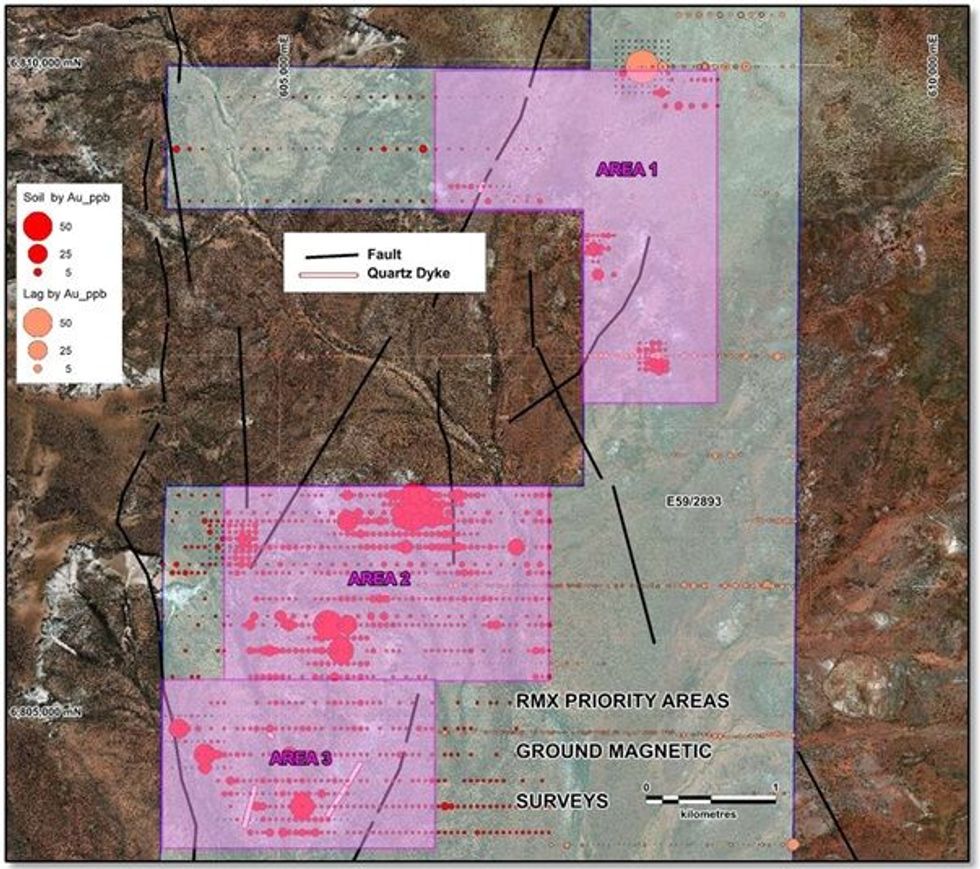

The program is focused on the most northern section of the Kiabye licence (E59/2893), which is one of the four exploration licenses that make up the project area. This straddles the Kiabye Greenstone Belt in the Yilgarn‘s Murchison Domain, southeast of Mount Magnet. The survey will total 10km2 and will be split into three areas of focus, based on priority (see Figure 1).

The program is expected to take 12 days, with coverage to depend on the rate of surveying, across both magnetics and pXRF assay follow-up. This will assist the Company in defining the three target areas, based on sample results (see Figure 2). A summary of each area is as follows:

- Area 1 covers a number of anomalous gold in soil samples, hosts two NNE (North- North-East) striking faults and is located in an area of unverified alluvial and insitu gold.

- Area 2 contains numerous gold in soil samples with several samples of >20ppb to 47ppb Au. The block is also cut by two faults striking NNE and NS. The area also contains RMX rock sample KPR020 which assayed at 96ppbAu and 2.6ppm Ag.

- Area 3 contains two areas with samples of >20ppb Au. The west is cut by a major NNW to NS faults marking the boundary between the Kiabye Greenstone Belt and Granites to the west. The second fault strikes NNE and is believed to extend north into Area 2.

Significance of Gold-in soils

In consideration of the highly diluting soil profile in the area, any soil sample with ≥20ppB Au is considered anomalous therefore Area 2 and 3 contain several areas with anomalous gold-in-soils.

Ground Magnetic Survey

The Red Mountain Mining team and contractors will conduct the geophysical survey initially at 100m east - west line spacing and 20m reading intervals. The data will be processed and interpreted in the field and where structures of interest are identifying these areas will be infilled to 50m line spacing. The main targets for gold mineralisation include shear zones and faults interpreted in the data. The surveys will collect data from 110 to 213-line kilometers depending on the number of infill lines conducted.

Project background:

The Kiabye gold project is located in WA and covers a strike length of 23km² of the greenstone belt (Figure 3) with less than half covered by exploration samples from historical explorers and only around 7% having been covered by prior holders.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00