January 14, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that geophysical contractors have commenced a fixed loop electromagnetic (FLEM) survey at the Company’s 100%-owned Mount Vernon nickel, copper and platinum group element (Ni-Cu-PGE) Project, part of the Company’s district-scale Bangemall Project in the Gascoyne region of Western Australia.

- Fixed loop EM survey at Mount Vernon to refine targets for future drill testing

- Miramar has dominant land position in potential new Ni-Cu-PGE province

Miramar believes the Bangemall Project has significant potential for Ni-Cu-PGE mineralisation related to Kulkatharra Dolerite sills, which are part of the Warakurna Large Igneous Province and the same age as the large Nebo and Babel Ni-Cu deposits in the West Musgraves.

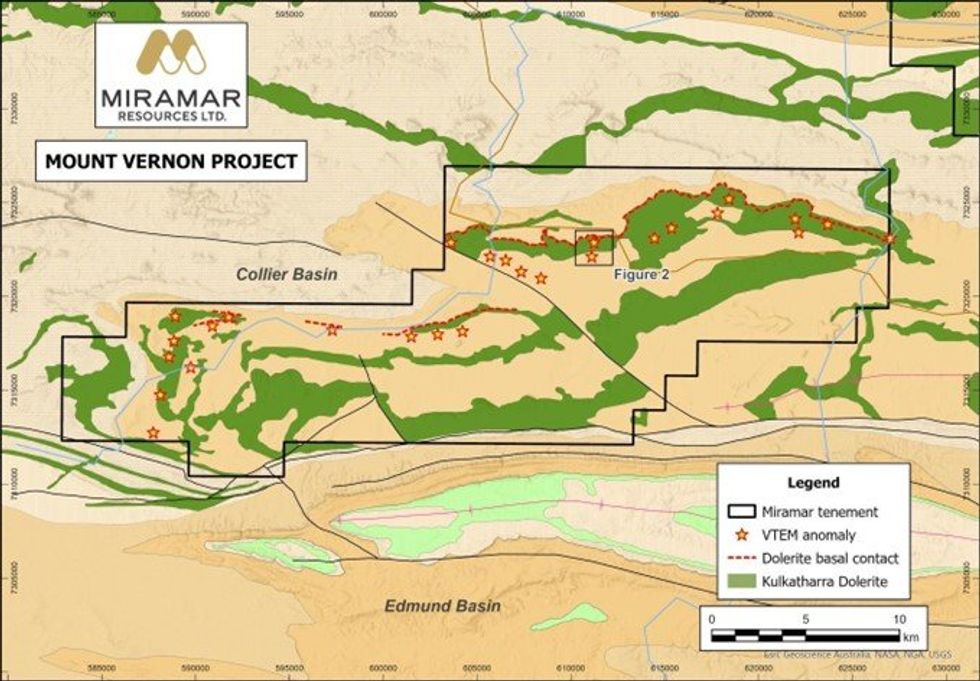

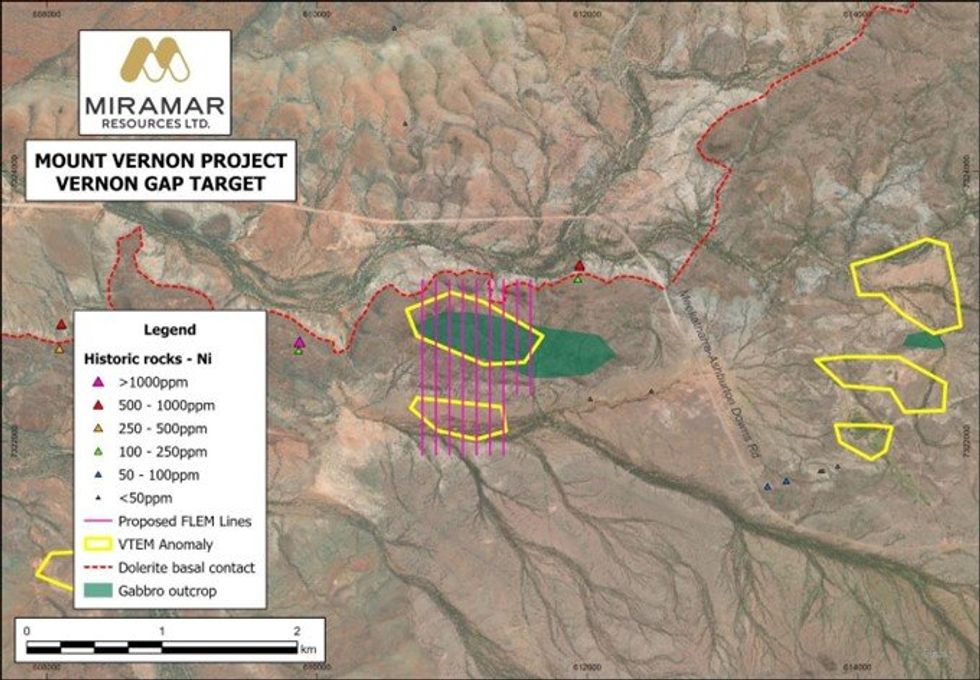

The Company previously flew a Versatile Time Domain Electromagnetic (VTEM) survey which identified multiple late-time EM anomalies where a dolerite sill intrudes into sulphidic sediments (Figure 1).

Subsequent reconnaissance rock chip sampling identified coarse-grained sulphides (pyrite) in outcropping fine grained chill margin of the dolerite and coarser-grained gabbro at several locations.

The FLEM survey will test several high priority VTEM anomalies to refine targets for future drill testing, including the “Vernon Gap” target where a strong late-time VTEM anomaly is seen beneath sulphides in outcropping gabbro and adjacent to significant Ni and Cu results in historic sampling (Figure 2).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Bangemall Project had the potential for a style of Ni-Cu-PGE mineralisation not previously seen in WA, and most like the giant Norilsk deposits in Siberia.

“We believe the Bangemall has the potential to be an entirely new nickel province in which we have built a commanding land position, and we look forward to continuing to uncover the potential of this very large project,” he said.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper stocksasx:m2rresource stocksasx stocksgold explorationgold stocksnickel stockscopper investingcopper explorationnickel exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

8h

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

13h

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00