September 20, 2023

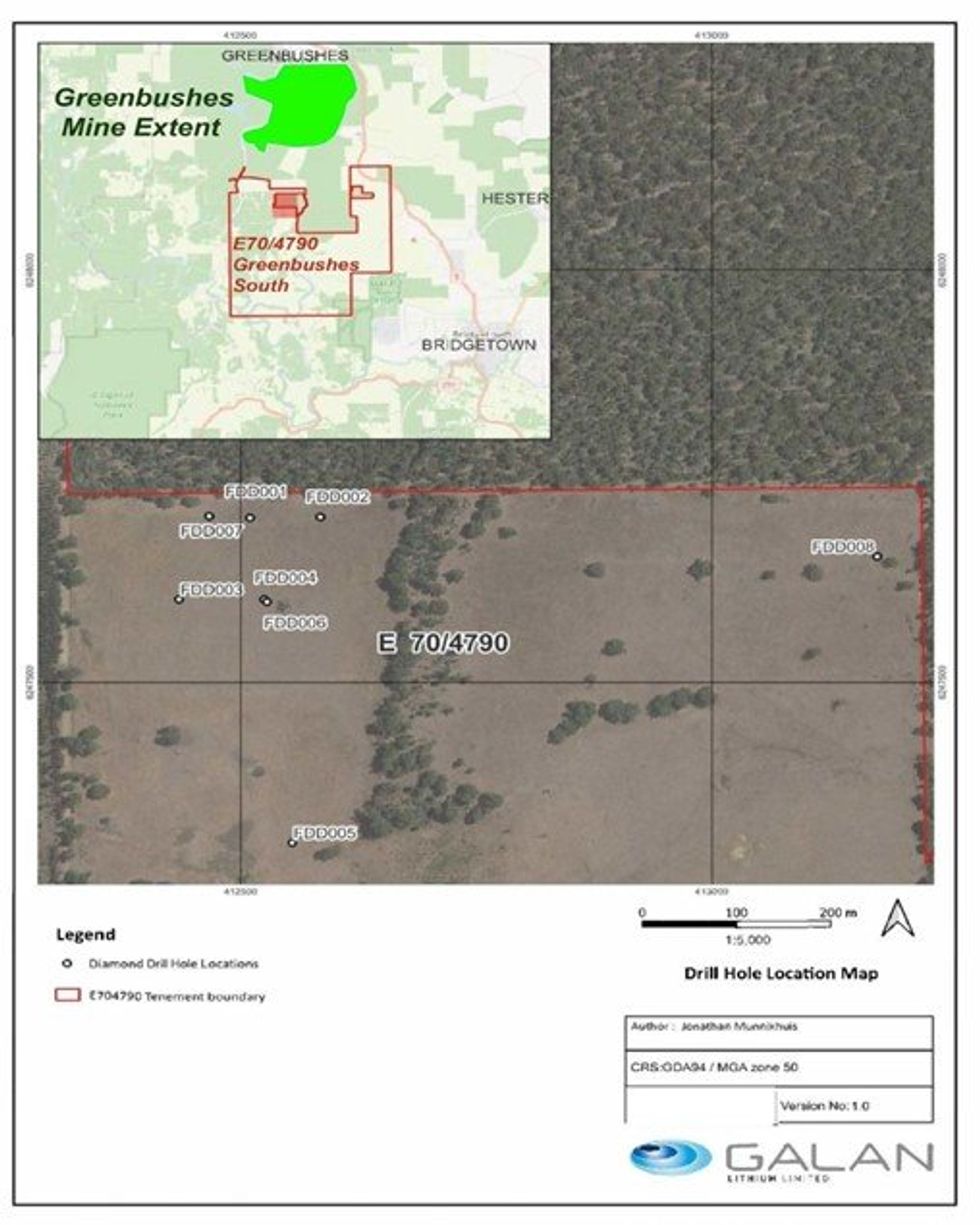

Galan Lithium Limited (ASX:GLN) (Galan or the Company) is pleased to provide an update on its extended maiden diamond drilling program at its 100% owned Greenbushes South project in Western Australia, with final assay results validating its exploration model for targets. The Company’s exploration model employed novel geophysical methods for identifying blind pegmatites at depth, and the rock types associated with spodumene mineralisation, and proved to be successful. Whilst drilling to date has not detected any significant lithium mineralisation, the results mean that Galan’s planning for further exploration will be more focused and cost-effective.

- Extended maiden drilling campaign completed at Greenbushes South

- Eight diamond drill holes completed for 3,885 metres

- Pegmatite exploration model validated

- Further drill planning underway

Fry’s Block

A ground-based geophysical campaign was conducted prior to drilling. The target area, "Fry’s Block”, was selected due to favourable land access, high lithium concentrations in soils, and outcropping pegmatite. Three ground-based geophysical methods were trialled within the Fry’s Block Prospect (see ASX Announcement 1 August 2022). Galan engaged NewGen Geo Pty Ltd to evaluate geophysics applications to detect Li-bearing pegmatites. A short trial program was designed over a known pegmatite occurrence at the Fry’s Block prospect (approximately 600 m x 300 m), which featured easy access to outcropping pegmatites of varying thicknesses (between 5 m and 40 m) and which disappeared under lateritic cover. Ground gravity and resistivity surveys were applied to determine pegmatite locations underneath this lateritic cover. Following the generation of these targets, the Company announced its 2,500-metre drilling campaign (ASX Announcement dated 6 March 2023).

Maiden drill programme extended

Galan completed its planned maiden diamond drilling campaign at Fry’s Block however drilling was extended into a second phase to validate the exploration model provided by the geophysical and drilling results, and furthermore to take advantage of the logistics, mobilisation and continued availability of the drilling team. Phase two drilling included three additional diamond drill holes and a further 1,385 metres of drilling for a total of eight (8) holes and 3,885 metres of drilling. The final assay data set for FDD008 pegmatite intersections have now been received and analysed by the Company.

Approximately 25% of the rock drill core recovered was classified as pegmatite. These pegmatites were characterised by their abundance of megacrystic k-feldspar, albite, tourmaline, and muscovite, all minerals associated with the spodumene-bearing pegmatites at Greenbushes (see Partington et al., 1991). Assay results from pegmatites intersected show a strong fractionation trend well into what would typically be considered a composition that would have the potential to produce Sn (tin) and W (tungsten) mineralisation in granite and, some circumstances, other rare metal mineralisation – this would not be inconsistent with a Lithium-Caesium-Tantalum (LCT) source magma (See Figure 2).

Validation of Galan’s pegmatite exploration model

In general, whilst the pegmatite intersected is not significantly enriched in lithium, caesium, and tantalum to an extent consistent with ‘mineralised’ LCT pegmatites or granite, it does show a trend towards some enrichment in these elements, which, along with some of the above observations, suggests the pegmatite cannot be disregarded as genetically unrelated to the Greenbushes pegmatite at this stage.

Planning for next drill campaign has commenced

After these results, Galan is developing additional targets for its next Greenbushes South drilling campaign. The Company has engaged with primary stakeholders to gain strategic land access in the region. It is pleased to have come to an agreement that will allow for exploration to continue closer to the Donnybrook-Bridgetown Shear Zone. Galan plans to engage with NewGen Geo Pty Ltd to develop another geophysical campaign and a new calibration of the previous drill core data. This will enable the Company to identify the density characteristics of potentially new host rocks and targets and provide further geophysical targeting.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00