November 20, 2023

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise of positive results from the recently completed airborne radiometric and magnetic survey completed at its 100% owned Green Mountain Project (Project) located in Wyoming’s prolific Crooks Gap/Green Mountain/Great Divide Basin uranium production district.

- Positive results from recent airborne Magnetic & Radiometric Survey

- 12 miles (19km) of anomalous uranium trends interpreted from airborne survey

- 6 prominent uranium anomalies were identified across the Project

- Anomalies correlate with historically identified drill holes, interpreted trends, areas of past mining and/or known mineralisation

- 28 additional claims staked, based on results of the geophysical surveys, bringing the total holdings to 697 mining claims comprising circa 14,000 acres

- Next steps: Planning & permitting for follow up drilling

GTI Executive Director Bruce Lane commented “The aerial geophysical survey has provided us with clear direction as to where to drill at Green Mountain. We have been able to utilise the historical drilling and geological information completed by Kerr McGee Corporation, Wold Nuclear and others during the 1970’s and 1980’s to help interpret and extrapolate significant additional anomalous uranium trends, particularly within the eastern part of the extensive Green Mountain land position. The land package is surrounded by significant uranium deposits and resources owned by Rio Tinto, Energy Fuels, Ur Energy & UEC, so we know we are in an area with real potential. Our next step is to progress work on refining drill targets and permitting”.

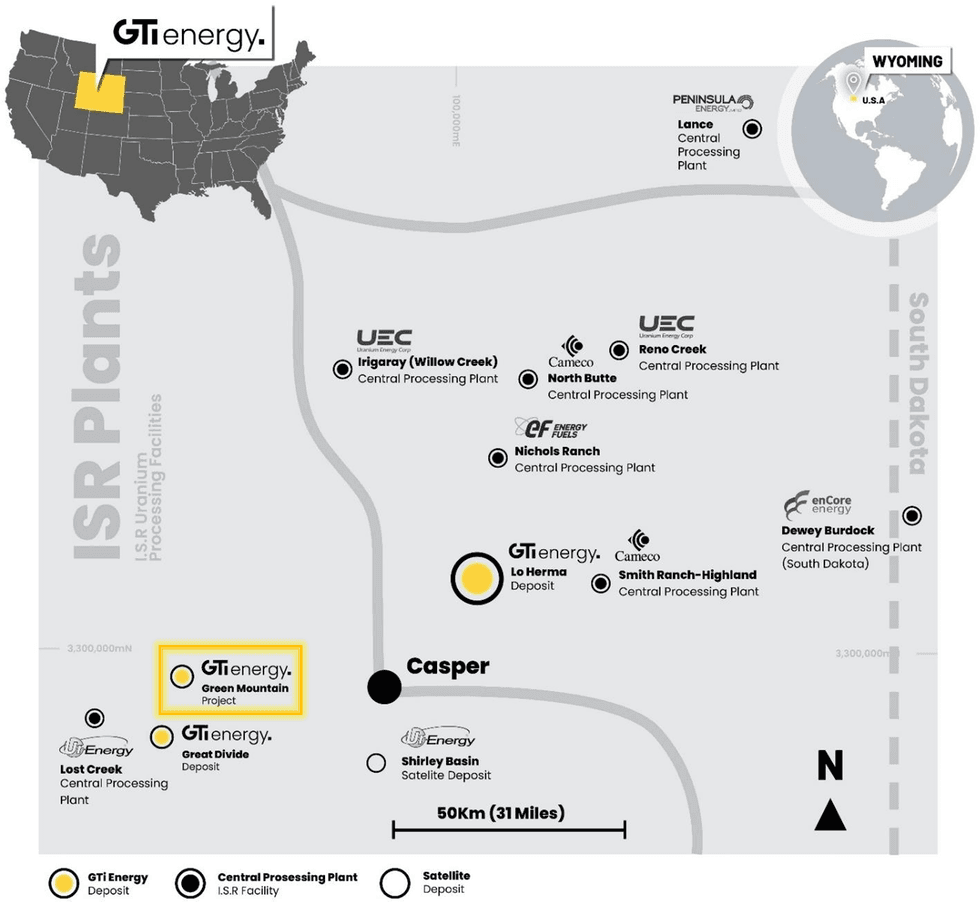

GTI’s 100% owned Green Mountain ISR Uranium Project (Green Mountain) is located in Sweetwater County, Great Divide Basin (GDB), Wyoming (WY) within a few miles of GTI’s Great Divide Basin projects and within 60 miles of GTI’s Lo Herma project in Wyoming’s Powder River Basin (Figure 1).

GTI’s Green Mountain Project covers ~14,000 acres (~5,665 hectares) of underexplored mineral lode claims (Claims) and benefits from historical Kerr McGee uranium drilling data and oil-well exploration drill logs which confirm the presence of roll fronts within the Battle Springs formation which hosts neighbouring major uranium deposits.

The Properties are located in the neighbourhood of Energy Fuel’s (EFR) 30Mlb Sheep Mountain deposit, Ur-Energy’s (URE) 14Mlb Lost Soldier ISR deposit, UEC’s (UEC) Antelope deposit & Rio Tinto’s (RIO) Big Eagle (past producing), Jackpot, Desert View, Phase II, & Willow Creek deposits (Figure 2). The Claims lie south of Green Mountain, ~5kms from GTI’s existing Odin claim group & within 15km of GTI’s Thor project where two successful drill programs were completed during 2022.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00