April 08, 2025

Grande Portage Resources Ltd. (TSXV:GPG)(OTCQB:GPTRF)(FSE:GPB) ("Grande Portage" or the "Company") is pleased to announce results from testwork of a sensor-based ore sorting system, utilizing a composite core sample from the New Amalga Mine Project located approximately 16 miles (25 km) northwest of the city of Juneau.

Summary of Results:

Unsorted Feed | Sorter Reject | Sorted Product | |

Mass (kg) | 64.8 kg | 37.2 kg | 27.6 kg |

% Mass Distribution | 100% | 57% | 43% |

Gold Grade (g/t) | 5.9 g/t | 0.6 g/t | 12.9 g/t |

% Gold Distribution | 100% | 6% | 94% |

Ian Klassen, President and CEO comments: "We are extremely pleased with the results of the testwork with the Steinert ore sorting equipment, which demonstrated excellent ability to identify and reject the unmineralized particles within the sample of New Amalga material, resulting in a 120% increase in gold grade and a 57% reduction in mass with very minimal gold loss."

Mr. Klassen continued: "These results are game changing for a host of reasons. Integrating ore sorting into the conceptual mine production plan significantly reduces the amount of mined rock requiring transportation and processing at a third-party facility, lowering per-ounce costs and also providing useful sorter-reject material for underground backfill, all without the use of chemical processing reagents. This further enhances the existing advantages of our proposed direct-ship mine configuration which utilizes offsite processing. As demonstrated by the test results, it may also create opportunities for inclusion of thinner veins into the mine plan - areas of the deposit which otherwise may not have been considered viable."

Background:

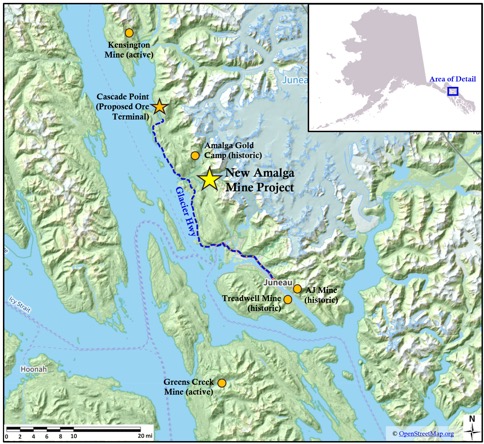

As previously announced, the Company's Conceptual Mining Plan envisions the future development of the New Amalga gold mine as a selective underground mining operation which would send ore off-site to be processed at a third-party facility, enabled by the project's location near tidewater and less than 4 miles (6.5km) from existing paved highway (Fig. 4). This results in a dramatically reduced mine site footprint due to the avoidance of chemical processing and tailings storage facilities.

The purpose of ore sorting is to quickly separate particles of waste dilution rock from the mined material, without the use of chemical reagents. The goal is to significantly reduce the volume of material that would be transported off-site to a third-party processing facility.

Grande Portage assembled a drill core composite which included both ore and waste material to reflect the dilution from wall rock (waste) which is inherent with underground blasting of narrow ore veins. The core composite was subjected to a sensor-based ore sorting test process at the facilities of Steinert US Inc, a leading global manufacturer of ore-sorting equipment.

Technical Description of Ore Sorting Test Process:

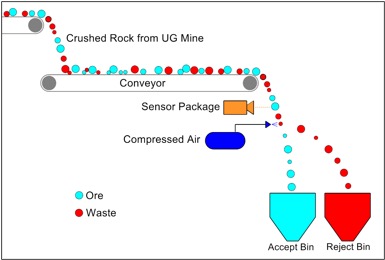

Sensor-based ore sorting can utilize a variety of measurements to determine whether a particle is ore or waste, including color, electromagnetic induction, laser, and x-ray analysis to assess elemental composition. The crushed rock is placed on a conveyor belt and then passed in front of the sensor, which rapidly analyzes the individual pieces of rock. When a piece of rock is identified as waste, a puff of compressed air redirects it to a "reject" bin. The remining pieces of rock are sent to the accepted "product" stockpile. (Fig. 2)

Fine particles too small to effectively sort are typically combined with the "product" stockpile, since higher-grade material tends to produce more fines during blasting and crushing due to the higher sulphide content and brittle nature of the quartz vein rock.

For the testwork, a series of reference samples were analyzed by the sorter machine, reflecting core material of various categories including "high grade ore", "mid grade ore", "low grade ore", and "waste". This allowed the sorter to learn the characteristics of each type of material in order to generate a sorting algorithm. Each of these reference samples were sourced from multiple drill holes at various locations within the deposit in order to capture any spatial variability in the rock characteristics.

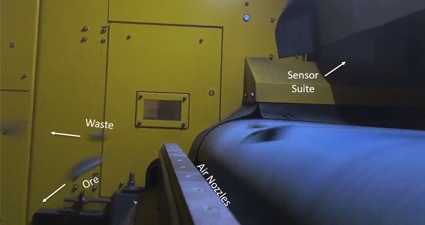

After the sorting algorithm was developed, the composite sample was fed into the sorter machine (Fig. 3). This composite was sourced from multiple drill holes in various areas of the deposit distinct from the reference samples. It included approximately 55% wall rock and 45% vein rock, reflecting potential waste dilution within run-of-mine material to simulate mining an area of vein narrower than the minimum mechanized mining width.

In addition to the "product" material, three splits of "reject" material were generated from sorting the sample at progressively increasing level of selectivity, reflecting operation of the machine at various degrees of sorting criteria. All material was then assayed at SGS-Lakefield.

All three "reject" splits returned assays below the level which would be considered viable to transport and process at a third-party facility, and were therefore classified as waste, indicating that the highest level of sorter selectivity is appropriate. In total the sorter rejected 57% of the feed material, indicating excellent alignment with the approximately 55% wall rock content of the composite sample.

Additionally, all material was screened before assay to collect unsortable fines (<1cm), which were assayed separately. This confirmed that the fines contained a high degree of gold mineralization and are appropriate to combine with the "product" sample. A full table of results is shown below (Fig. 1).

Fig. 1: Table of Assay Results

Reject #1 | Reject #2 | Reject #3 | Sorted Product | Unsortable Fines | |

Mass (kg) | 12.2 | 13.1 | 11.9 | 22.6 | 5.0 |

Au (g/t) | 0.48 | 1.09 | 0.30 | 12.9 | 13.1 |

Overall Waste Rejected | Overall Product | ||||

Mass (kg) | 37.2 | 27.6 | |||

Au (g/t) | 0.64 | 12.94 |

Fig. 2: Simplified Conceptual Diagram of an Ore Sorting System

Fig. 3: Image of Ore Sorting Testwork Being Conducted on New Amalga Samples

A short video of the testwork process is available on YouTube at https://youtu.be/K4XzoRbjCXA

Fig. 4: Location of New Amalga Mine Project

Kyle Mehalek, P.E.., is the QP within the meaning of NI 43-101 and has reviewed and approved the technical disclosure in this release. Mr. Mehalek is independent of Grande Portage within the meaning of NI 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly traded mineral exploration company focused on advancing the New Amalga Mine project, the outgrowth of the Herbert Gold discovery situated approximately 25 km north of Juneau, Alaska. The Company holds a 100% interest in the New Amalga property. The New Amalga gold system is open to length and depth and is host to at least six main composite vein-fault structures that contain ribbon structure quartz-sulfide veins. The project lies prominently within the 160km long Juneau Gold Belt, which has produced over eight million ounces of gold.

The Company's updated NI#43-101 Mineral Resource Estimate (MRE) reported at a base case mineral resources cut-off grade of 2.5 grams per tonne gold (g/t Au) and consists of: an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes). The MRE was prepared by Dr. David R. Webb, Ph.D., P.Geol., P.Eng. (DRW Geological Consultants Ltd.) with an effective date of July 17, 2024.

ON BEHALF OF THE BOARD

"Ian Klassen"

Ian M. Klassen

President & Chief Executive Officer

Tel: (604) 899-0106

Email: Ian@grandeportage.com

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Please note that under National Instrument 43-101, the Company is required to disclose that it has not based any production decision on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically production decisions made without such reports have increased uncertainty and higher technical and economic risks of failure. These risks include, among others, areas that are analyzed in more detail in a feasibility study or preliminary economic assessment, such as the application of economic analysis to mineral resources, more detailed metallurgical and other specialized studies in areas such as mining and recovery methods, market analysis, and environmental, social, and community impacts. Any decision to place the New Amalga Mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations would be largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

GPG:CC

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00