August 13, 2024

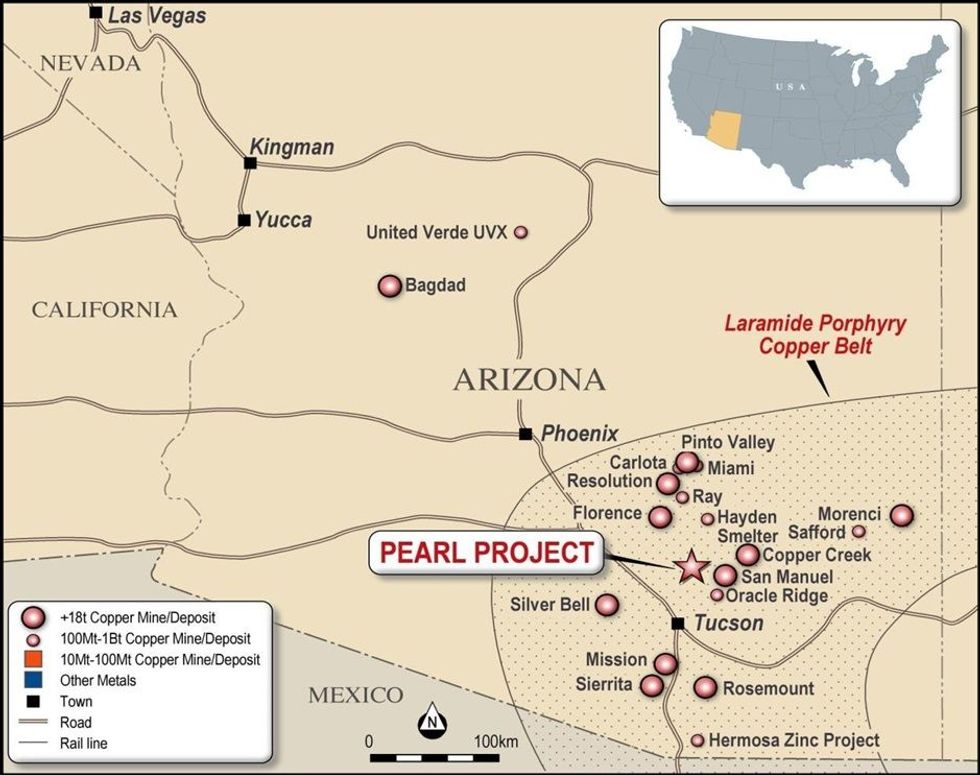

Golden Mile Resources Limited (“Golden Mile”; “the Company”; ASX: “G88”) is pleased to report the Company has completed successful due diligence and entered into a joint venture-acquisition agreement with Outcrop Silver & Gold Corporation (“Outcrop”) over the Pearl Copper Project located in Arizona, United States of America (“USA”).

HIGHLIGHTS

- Golden Mile has entered into a joint venture-acquisition agreement with Outcrop Silver & Gold Corporation (“Outcrop”) for the Pearl Copper Project located in Arizona, United States.

- Initial field reconnaissance has delineated multiple targets within the project area. This highlights the near-term drill, and company making potential, of the Odyssey and Ford Prospects.

- At Odyssey, which hosts the historic artisanal Pearl (Cu-Zn-Ag-Au) Mine, multiple vein targets up to five metres wide extend continuously for approximately 800m and are evident at the surface.

- At Ford, limited historic data indicates a shaft was developed to a depth of around 70 metres. Polymetallic Cu-Pb-Ag-Au-Zn vein type mineralisation, up to five metres wide, was mined before excess water halted operations in circa 1942.

- Due Diligence indicates the Pearl Copper Project not only hosts near-term vein targets but also shows widespread surface alteration, suggesting the presence of intrusive disseminated mineralisation, making it a significant Cu-porphyry target.

- Golden Mile and Outcrop have agreed on terms for Golden Mile to acquire up to a 100% ownership of the Pearl Copper Project through a staged, earn in and dilution, investment of up to $A 12 million over eight years along with up to a 2% net smelter royalty.

Overview

A recently completed field trip, undertaken as part of the due diligence, has confirmed the very high prospectivity of the project area for company-making copper resources.

This field examination, undertaken in late July, and while only preliminary in nature, has delineated the Odyssey and the Ford prospects within the Pearl project area as immediate highly prospective, exploration drill targets.

At Odyssey, a sub outcropping multiple vein copper target with surface mineralised widths up to five metres and a strike length of around 800 metres has been mapped. This prospect hosts the historic largely artisanal Pearl working’s where historical records indicate around 60,000 of ore containing copper oxide and sulphide, lead, silver, and gold was produced from 1915 to 1941 (Force, 1997).

Click here for the full ASX Release

This article includes content from Golden Mile Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

15h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

16h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

16h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

17h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00