August 13, 2024

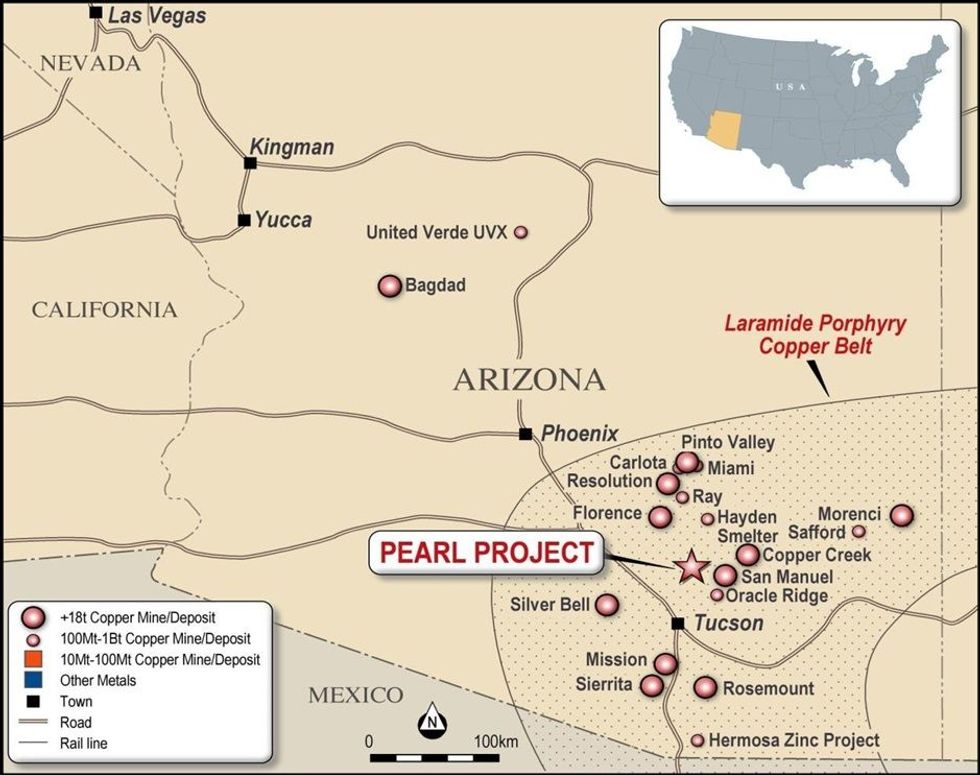

Golden Mile Resources Limited (“Golden Mile”; “the Company”; ASX: “G88”) is pleased to report the Company has completed successful due diligence and entered into a joint venture-acquisition agreement with Outcrop Silver & Gold Corporation (“Outcrop”) over the Pearl Copper Project located in Arizona, United States of America (“USA”).

HIGHLIGHTS

- Golden Mile has entered into a joint venture-acquisition agreement with Outcrop Silver & Gold Corporation (“Outcrop”) for the Pearl Copper Project located in Arizona, United States.

- Initial field reconnaissance has delineated multiple targets within the project area. This highlights the near-term drill, and company making potential, of the Odyssey and Ford Prospects.

- At Odyssey, which hosts the historic artisanal Pearl (Cu-Zn-Ag-Au) Mine, multiple vein targets up to five metres wide extend continuously for approximately 800m and are evident at the surface.

- At Ford, limited historic data indicates a shaft was developed to a depth of around 70 metres. Polymetallic Cu-Pb-Ag-Au-Zn vein type mineralisation, up to five metres wide, was mined before excess water halted operations in circa 1942.

- Due Diligence indicates the Pearl Copper Project not only hosts near-term vein targets but also shows widespread surface alteration, suggesting the presence of intrusive disseminated mineralisation, making it a significant Cu-porphyry target.

- Golden Mile and Outcrop have agreed on terms for Golden Mile to acquire up to a 100% ownership of the Pearl Copper Project through a staged, earn in and dilution, investment of up to $A 12 million over eight years along with up to a 2% net smelter royalty.

Overview

A recently completed field trip, undertaken as part of the due diligence, has confirmed the very high prospectivity of the project area for company-making copper resources.

This field examination, undertaken in late July, and while only preliminary in nature, has delineated the Odyssey and the Ford prospects within the Pearl project area as immediate highly prospective, exploration drill targets.

At Odyssey, a sub outcropping multiple vein copper target with surface mineralised widths up to five metres and a strike length of around 800 metres has been mapped. This prospect hosts the historic largely artisanal Pearl working’s where historical records indicate around 60,000 of ore containing copper oxide and sulphide, lead, silver, and gold was produced from 1915 to 1941 (Force, 1997).

Click here for the full ASX Release

This article includes content from Golden Mile Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

6h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

14h

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

15h

Precious Metals Price Update: Gold, Silver, PGMs Volatile on Oil Spike, Fed Rates

Precious metals prices are responding to the impact of the US-Iran war, as well as inflation data.The war has weighed on the precious metals market for much of this past week. An oil price surge past US$100 per barrel increased the threat of inflation and strengthened the US dollar, softening... Keep Reading...

22h

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

11 March

American Eagle Announces Exercise of Participation Rights by South32 and Teck, Updates Details of Recently Announced Financing

Highlights: South32 and Teck will maintain their equity ownership in American Eagle Gold.Including Eric Sprott's private placement, American Eagle Gold's cash balance will increase by $34 million to more than $55 million upon close of this financing.Eric Sprott, South32 and Teck are the sole... Keep Reading...

10 March

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00