July 11, 2024

Golden Deeps Ltd (ASX: GED) has entered into a binding Heads of Agreement (HOA) to earn an 80% interest in the holders of four granted and highly-prospective exploration licences in the world class Lachlan Fold Belt Copper-Gold Province of NSW (see Figures 1, 2 and 3).

- Under the HOA with Acros Minerals Pty Ltd (Acros) and Crown Gold Resources Pty Ltd (Crown), Golden Deeps will reimburse $179,263 previous exploration expenditure, and earn an 80% interest by spending $300,000 on exploration within three years (see Significant Terms, Appendix 1).

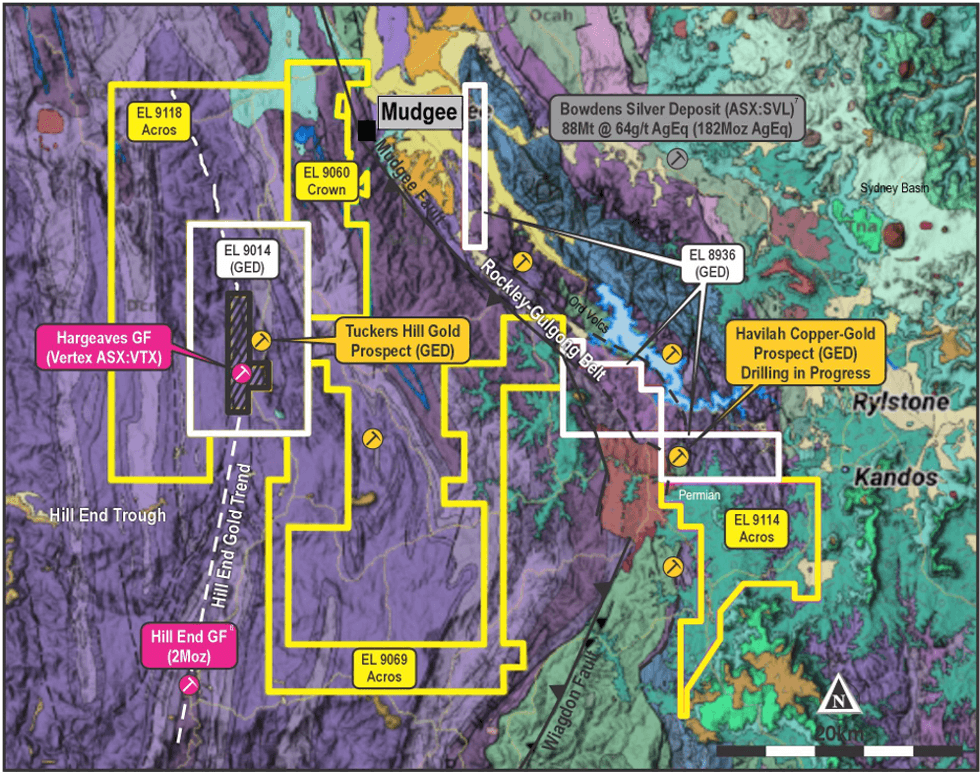

- The Acros and Crown tenements in the Lachlan Fold Belt straddle the boundary between the Siluro-Devonian Hill End Trough - which hosts the Hill End and Hargreaves goldfields (2Moz historic production1) - and the Rockley-Gulgong Volcanic Belt, which is highly prospective for porphyry copper-gold deposits (see Figure 1). Major deposits in the Lachlan Fold Belt include the world-class Cadia-Ridgeway deposit (456Mt @ 0.83 g/t Au, 0.24% Cu endowment2).

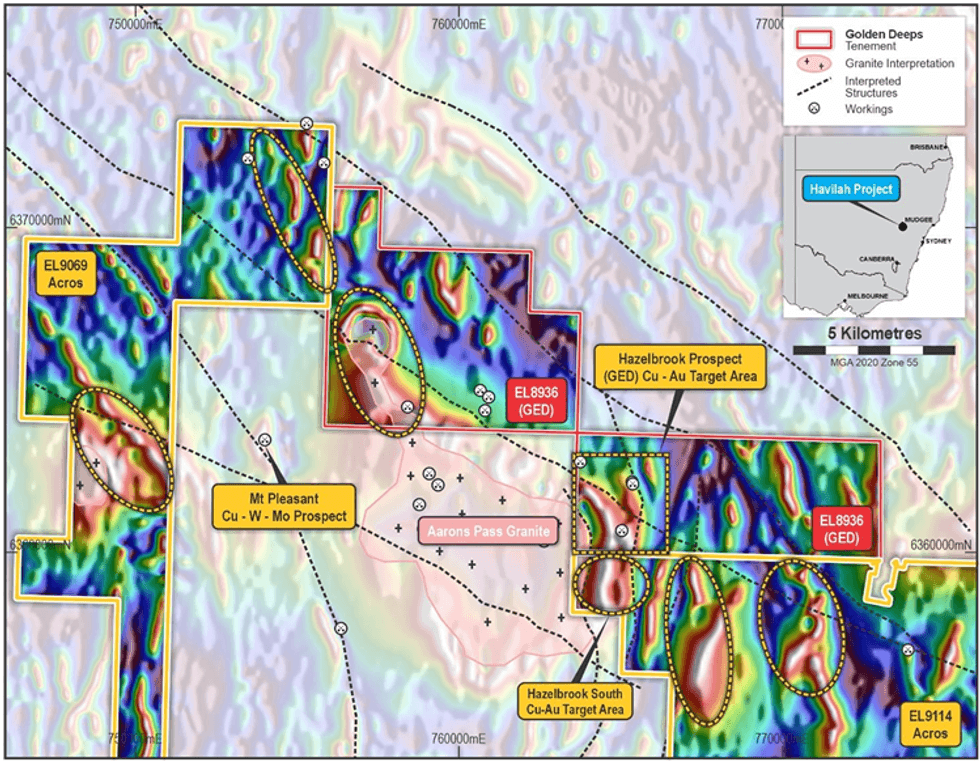

- Golden Deeps is currently drilling at the Havilah Copper-Gold Project (EL8936) within the Rockley-Gulgong Volcanic Belt to test a series of porphyry/volcanics hosted copper-gold targets at the Hazelbrook prospect3 (see location, Figure 1 and magnetics with key targets, Figure 2).

- Targets within the Acros (EL9114, EL9069 & EL9118) and Crown (EL9060) tenements include:

- Extensions of the Sofala Volcanics south of the Havilah Project. Magnetics indicate continuity of the highly-prospective volcanics and intrusives which project south under Permian cover into EL9114. No previous work has tested the underlying volcanics and/or the intrusive boundary (see Figures 1 and 2).

- Extensions of the Rockley-Gulgong belt along the Mudgee Fault (Figure 1), which includes the mineralised Sofala Volcanics and buried porphyry intrusion targets, into EL9069 and EL9060 north of the Havilah tenement (see Figures 1 and 2).

- Extensions of the Hargreaves and Tuckers Hill high-grade gold trends north into EL9118 (see Figure 1).

- The Company will build on previous work which has shown that the mineralised Sofala Volcanics and porphyry Cu-Au targets are present on EL9114 and EL9069. Planned work includes further geophysical surveys (detailed gravity, magnetics & Induced Polarisation), with a focus on extensions of the Rockley-Gulgong belt south and north of the Company’s projects (Figure 2).

- This work will aim to define drilling targets targeting major porphyry/volcanics hosted copper gold deposits in an area which has received limited exploration due to shallow cover.

Golden Deeps CEO Jon Dugdale commented:

“This HOA gives Golden Deeps access to extensions of mineralised volcanics and intrusives within the Rockley-Gulgong Volcanic Belt. This belt is highly prospective for major porphyry/volcanic hosted copper gold discoveries and is a similar setting to major deposits such as the world-class Cadia-Ridgeway mine.

“The Acros and Crown tenements also include extensions to the Hill End gold corridor which has produced over two million ounces of gold.

“We now look forward to immediately advancing geophysical programs to define drilling targets south and northwest of the Company’s Havilah Project, where drilling is currently testing copper-gold targets which continue under cover into the Acros and Crown ground.”

About the Acros and Crown Tenements

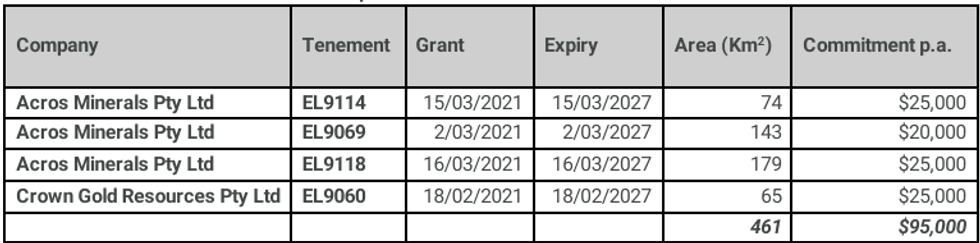

Acros holds three exploration licences (EL9114, EL9069 and EL9118) and Crown one exploration licence (EL9060) near Mudgee in the Eastern Lachlan Fold Belt region of NSW (see Figure 1 for locations). Details of the tenements are shown in Table 1 below:

Table 1: Acros and Crown Tenements expenditure and commitments:

The Acros and Crown tenements are located close to the eastern margin of the Lachlan Fold Belt and straddle the boundary between the Siluro-Devonian Hill End Trough - which contains the Hill End gold field (2Moz produced), and the Rockley-Gulgong Volcanic Belt which is highly prospective for porphyry related copper-gold deposits (see Figure 1).

In the eastern tenements (EL9114, EL9069 and EL9060), the Company is targeting porphyry/volcanic hosted copper-gold mineralisation in a belt of Ordovician age (Sofala) volcanic rocks in the Rockley Gulgong Volcanic Belt. This belt is part of the Macquarie Arc in the Lachlan Fold Belt - a major geological province known for world-class copper-gold deposits such as Cadia-Ridgeway2 and North Parkes4 (see Figure 3, below). These major deposits are hosted by Ordovician volcanic rocks and associated with “porphyry” intrusives and sit within parallel volcanic belts to the west of the Rockley-Gulgong Belt.

Click here for the full ASX Release

This article includes content from Golden Deeps, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00