Gold Price Update: Q1 2022 in Review

What happened to gold in Q1 2022? Our gold price update outlines key market developments and explores what could happen moving forward.

Click here to read the latest gold price update.

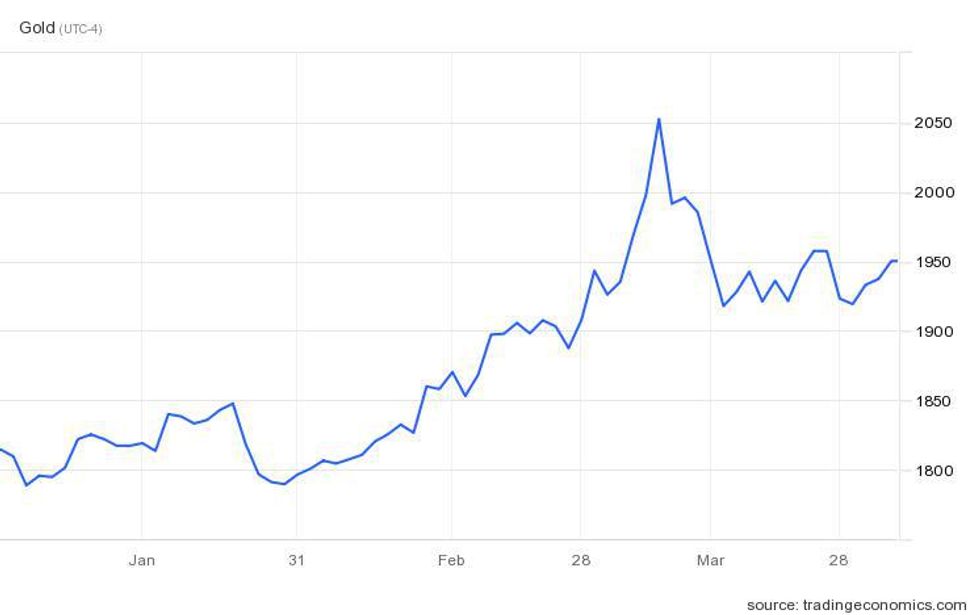

The first quarter of 2022 saw gold reverse its 2021 course with a gain of 8 percent.

Starting the three month period at US$1,814 per ounce, the yellow metal added as much as 13.15 percent to its value when it hit its quarterly high of US$2,053 on March 10.

Aided later in the quarter by historically high inflation around the globe, along with Russia’s invasion of Ukraine and growing uncertainty about economic recovery from COVID-19, investors sought out the safe-haven asset; this demand was reflected in the gold price and in gold-backed exchange traded funds (ETFs).

Even so, gold was rangebound around US$1,830 for much of January before news that the US Federal Reserve was on course to raise interest rates in March, which sent markets and the yellow metal lower.

By January 31, gold was at US$1,791.90, its lowest point in the quarter. In February it quickly regained ground and made its most pronounced increase for the quarter, rising from US$1,792 on February 1 to US$1,947 on March 1.

Gold's Q1 2022 performance.

Chart via Trading Economics.

“Gold rose for the second consecutive quarter in Q1,” said Juan Carlos Artigas, global head of research at the World Gold Council (WGC), noting it was the yellow metal's best quarterly performance since Q2 2020.

“(Gold) was among the best-performing assets amid significant weakness in both equity and bond markets," he added. "In a period marked by economic uncertainty and increased volatility, more persistent inflation — including record oil prices — and rising rates were the biggest influences on gold’s performance.”

Gold price update: Geopolitical strife drives investor interest

Russia’s late February invasion of Ukraine seemed to be a tipping point for the gold market, which at the time had yet to see sustained price growth from the rising market volatility.

Between February 25 and March 10, the gold price soared over 8 percent, from US$1,887 to US$2,053.

“The Russia/Ukraine war added an additional layer … as investors sought high-quality safe havens like gold, which proved to be a reliable source of diversification and wealth preservation,” Artigas said.

The broad positivity in the gold market also aided equities, with miners and explorers seeing share price growth.

“As an exploration and development mining company we watch the longer-term picture,” John Ryan, a seasoned mining executive and CEO of Gold Express Mines, told the Investing News Network (INN). “Gold and other metal prices are well above costs of production, including related sustaining costs.”

Ryan also explained that the sector has investment capital at its disposal for both exploration and project construction. However, if a global recession arrives, some of that broad sector optimism could dissipate.

“If world leaders drop the ball on carbon reduction, which might happen in the face of further global turmoil, then copper, lithium and other green metals might take a hit,” Ryan said. “However, gold will continue to benefit as a safe-haven asset. Rare earths and palladium/platinum would also respond strongly.”

Gold price update: ETFs see resurgence in demand

ETFs also saw increased interest in March — net inflows of 187 tonnes bolstered total Q1 inflows to 269 tonnes, approaching the previous record set in Q3 2020. Last year, gold ETFs saw net outflows of 174 tonnes.

“Gold is known to be a flight-to-safety asset for investors and a hedge against inflation,” Jon Maier, CIO at Global X ETFs, told INN. “So in Q1, when we saw weakness in equity and bond markets from supply chain disruptions, geopolitical conflicts and exceptionally high inflation, gold had another quarter of solid performance.”

Maier sees record inflation across North America and Europe as a sign that gold has room to grow.

“Because the Fed is behind the curve on fighting inflation, we could see further upside for gold. Unlike cash, which loses purchasing power during inflation, gold tends to maintain its position," he said. “We maintain exposure to gold in our model portfolios, which helped provide some positive alpha.”

Gold ETFs weren’t the only exchange-traded products that registered growth throughout Q1 2022. As Maier explained, many of Global X’s 93 ETFs saw gains during the first quarter.

“In March we saw good-sized flows into our covered call ETFs and commodity ETFs. For commodities, the strongest flows were into uranium, silver miners and copper miners,” he said. “Year-to-date our commodity suite of ETFs has had inflows around US$600 million. Most of which has gone into uranium.”

Elsewhere, physical gold investment grew over the first three months of year, with sales of American Eagle and Buffalo gold coins totaling US$427 million, or 220,000 ounces, in March alone.

“(March tallies) pushed Q1 total US gold coin sales to over US$1 billion (518,000oz), the second highest Q1 sales total in volume terms since 1999,” a March WGC report reads. “This performance clearly shows that the strong retail interest in physical gold investment products from last year has continued into 2022.”

This broad growth across the investment segment, along with global uncertainty, has prompted some to wonder why gold hasn't reached or surpassed its previous all-time high of US$2,070, set in August 2020.

“As in the past, market turmoil, war and inflation are gold boosters,” said Ryan, who also noted that market participants are not seeing the same sorts of gold and silver runs displayed in 1968 and 1979 to 1980.

“There seems to be a lot of speculation that bitcoin and other cryptos are sucking up what would have been 'gold bandwidth,'" he said. "However, the market has more options today, such as ETFs and other inflation hedges, which now compete with physical gold.”

Gold price update: Changing tides could hamper gold’s growth

In the months ahead, gold is likely to continue benefiting at a slower pace from inflation and investment demand. The war, its potential resolution and the disruption it is causing are also prevailing tailwinds for the gold price.

But what headwinds could the yellow metal see for the remainder of 2022?

“Tighter monetary policy, led by rising nominal interest rates, is likely to be the most significant headwind for gold,” Artigas commented to INN. “While our historical analysis shows that gold has typically performed well following the first rate hike in a tightening cycle, we believe gold may come under renewed pressure around the forthcoming Fed and (European Central Bank) meetings.”

The WGC's head of research also pointed to the geopolitical situation as an important factor that could both help and hinder gold’s movement.

“A prolonged conflict in Ukraine will likely result in sustained investment demand,” he explained. “However, a swift resolution, something which we all hope for, may see some tactical positions in gold unwind."

Artigas also suggested that a deceleration in consumer demand in markets like China could weigh on gold.

“However, we believe that stubbornly high inflation and an increase in overall geopolitical risk will likely continue to support gold demand as a hedge,” he said.

A decline in Chinese demand is something Global X’s Maier thinks investors should be especially cautious about.

“A slowdown in China would probably have a large impact on the resource sector,” Maier said. “We’ve even seen that with recent Chinese COVID-19 lockdowns helping reduce commodity prices, since they are such a fundamentally large base of commodity consumption."

A lengthened lockdown would create further complications within supply chains. That could have serious implications for economic growth, which also impacts broader global growth.

For Jeffrey Christian, managing partner of CPM Group, weakened economies in Europe and North America are expected to gain strength over the next nine months, an element that may push gold back to its previous consolidation range of US$1,780 to US$1,880.

“By the end of the second quarter there will either be some resolution … or there'll be some clear sign toward a resolution, so some of that war premium that's keeping the price basically above US$1,880 to US$1,900 right now may dissipate in the second half of this year,” Christian said during a gold market webcast.

This could be further compounded by rising interest rates and declining inflation, he added.

At 10:41 a.m. EDT on April 21, 2022, an ounce of gold was valued at US$1,944.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Gold Outlook 2022: Consolidation a Launching Pad for Price Rise ... ›

- A Guide to Physical Gold as an Investment | INN ›

- What Was the Highest Price for Gold? | INN ›

- What is the Gold Spot Price? | INN ›

- An Overview of Gold Investing and Prices | INN ›