- WORLD EDITIONAustraliaNorth AmericaWorld

March 16, 2023

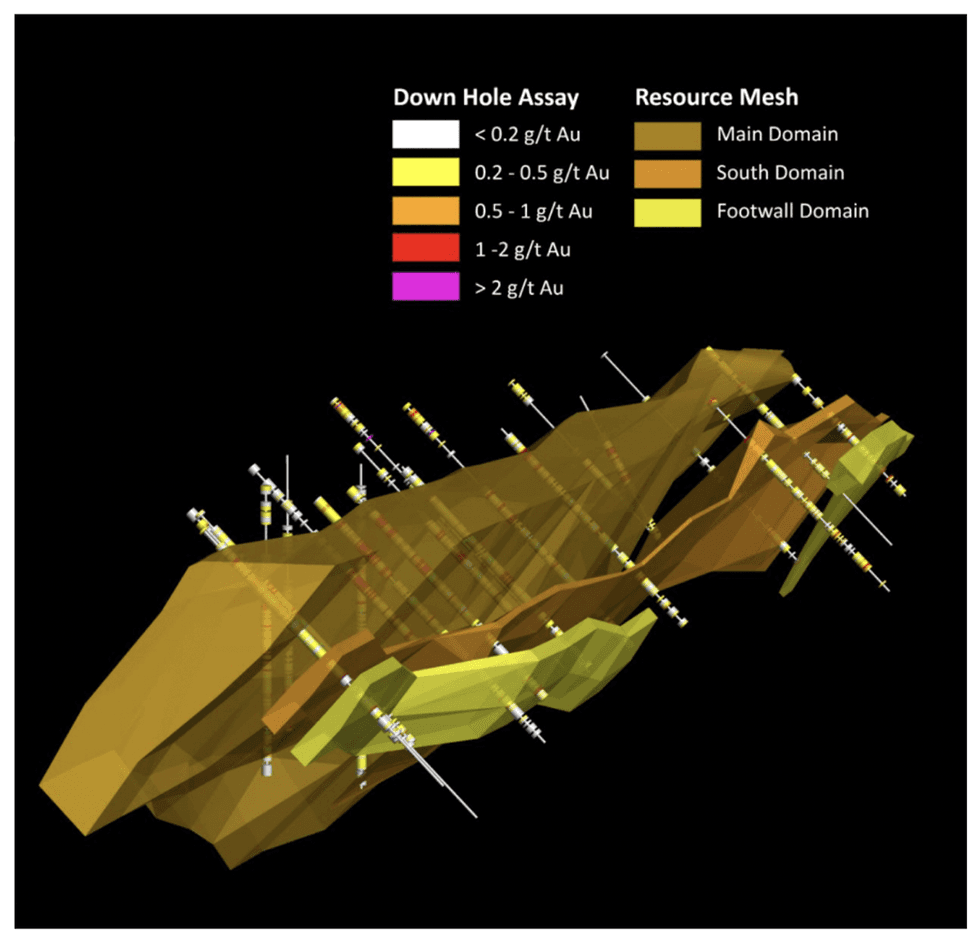

Gold Port (CSE:GPO, OTCQB:GPOTF), OTCQB:GPOTF) is now preparing for its upcoming drill campaign at its 100 percent owned gold asset in Guyana. The company’s Groete gold-copper project has an NI 43-101 AuCuEq resource estimate with an inferred 1.57 million ounces of gold equivalent. The asset is in close proximity to deep water and road access to support potential future production development.

Guyana consistently has a gold mining history and is one of the best places to work in South America. This mining-friendly jurisdiction allows new operations to receive permits and license projects relatively quickly to support exploration and development. Gold Port holds, through a common law agreement, three mining permits that comprise the Groete project’s 1,384-hectare area.

Groete Gold Deposit Inferred Resource Calculation based on 2012 Drilling

Groete Gold Deposit Inferred Resource Calculation based on 2012 DrillingThe upcoming drill program includes 35 targets totaling 8,102 meters, with depths ranging from 60 to 370 meters. These priority targets were chosen to confirm the continuity of the known higher-grade zone. In addition, the drill program aims to establish an indicated mineral resource estimate for the zone. Exploration upside to the east identified by surface work in 2012 will also likely be drill-tested. Gold Port designed a brand new tracked rig specifically for this program. Upon road access completion, the unit and support equipment will be moved to site to initiate the program.

Company Highlights

- Gold Port is a gold exploration company with a 100 percent owned gold asset in Guyana.

- The company’s Groete asset has an inferred resource estimate of 1.57 million ounces of gold equivalent. Details of the Mineral Resource Estimate are contained in a National Instrument 43-101 report titled, Technical Report and Updated Mineral Resource Estimate on the Groete Gold Copper Deposit, Groete Property, Guyana, South America by P & E Mining Consultants Ltd., dated April 16, 2019.

- Guyana is a highly ranked South American mining jurisdiction with a mining-friendly government.

- Gold Port’s Groete project has three mining permits covering 1,384 hectares of relatively unexplored land.

- The company is embarking on its 2023 35-hole drill program. The campaign aims to follow up on priority targets and to increase the quality of the historic resource.

- Gold Port’s upcoming drill campaign targets 35 priority locations totaling 8,102 meters.

- A highly competent management team, with experience operating within Guyana, leads the company toward fully realizing the potential of its asset.

This Gold Port profile is part of a paid investor education campaign.*

GPO:CC

The Conversation (0)

9h

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

12h

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

22h

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

22h

Gold, Silver Prices Spike on US-Iran War

Prices for gold and silver spiked higher over the weekend and in early morning trading on Monday (March 2) as a full-blown war broke out in the Middle East.Tensions between Iran on one side and the US and Israel on the other have been intensifying over the past few weeks. On Sunday (February... Keep Reading...

02 March

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

02 March

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00