April 21, 2024

Global Oil & Gas Ltd (ASX:GLV) (Global or the Company) which will be renamed Condor Energy Limited (ASX: CND) (Condor) following approval by shareholders at an Extraordinary General Meeting held on 10 April 2024, is pleased to provide the following activities report for the quarter ending 31 March 2024.

Highlights

- Review of recently acquired TEA licence area offshore Peru identifies over 20 prospects and leads in proven basin with producing oil fields

- High priority areas totalling 1,000km2 within Tumbes TEA selected for 3D seismic reprocessing to mature targets to drill ready

- Priority areas include existing Piedra Redonda gas field with an independently audited ‘Best Estimate’ Contingent Resources of 404 billion cubic feet (Bcf) plus ‘Best Estimate’ Prospective Resources of 2.2 trillion cubic feet (Tcf)#

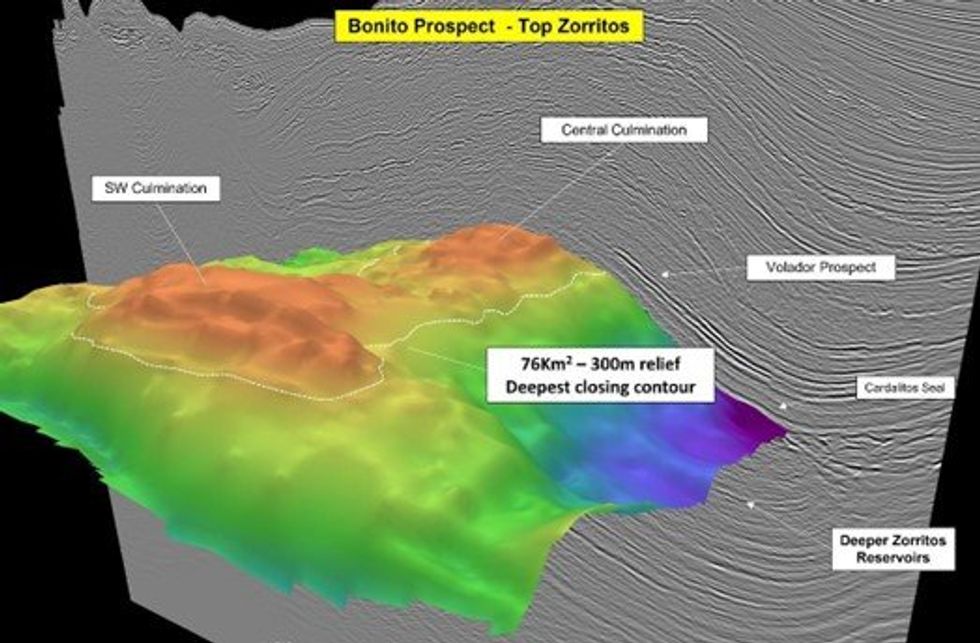

- High potential Bonito, Volador and Raya prospects undergoing additional studies in conjunction with 3D seismic reprocessing

Technical Evaluation Agreement (TEA) LXXXVI - Offshore Oil and Gas Block (GLV 80% Working Interest)

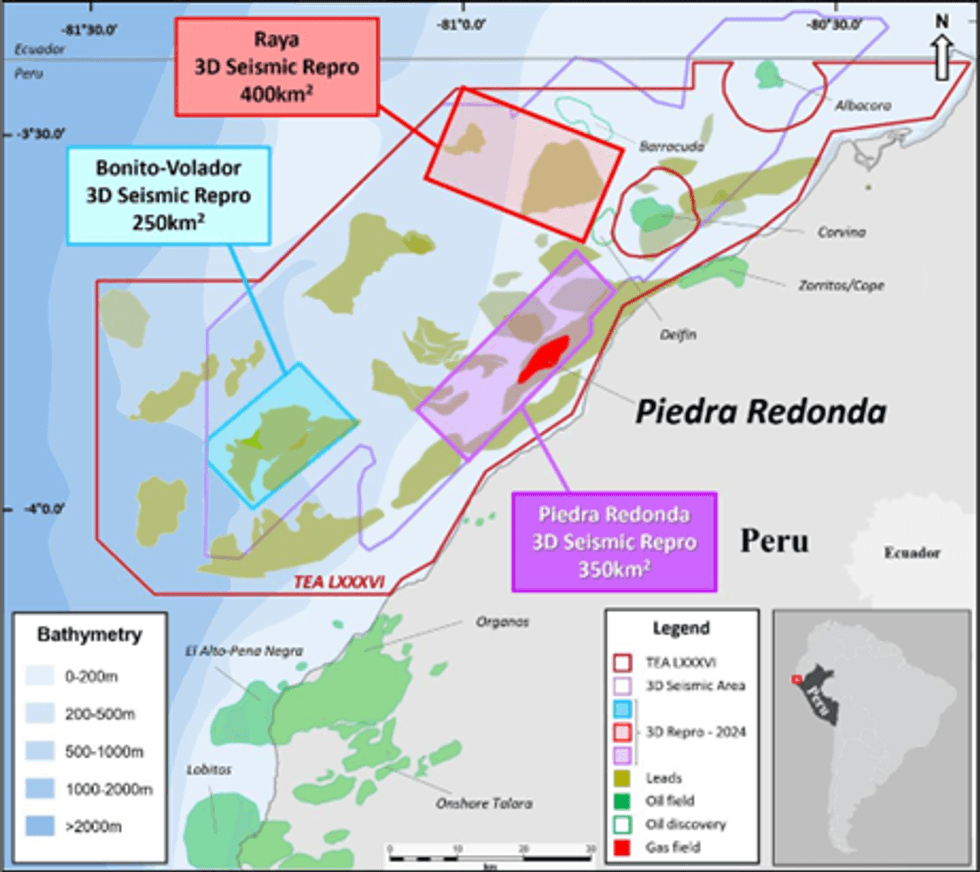

During the March 2024 quarter, Global and US-based joint venture partner Jaguar Exploration Limited (Jaguar), continued the evaluation of their 4,585km2 Technical Evaluation Agreement (TEA or block) offshore Peru.

The block comprises over 3,800km2 of existing 3D seismic data and more than 7,000 line kilometres of 2D seismic. An aggregate of 1,000km2 of 3D seismic was selected during the quarter to undergo reprocessing and interpretation across three discrete highly prospective areas. Reprocessing will include pre-stack depth migration (PSDM) work across each of the three areas (Figure 2).

The areas were selected following a review of the seismic data and other historical reports and information related to the TEA. Global identified more than twenty prospects and leads as detailed in the ASX release on 23 January 2024 of which three large scale oil and gas prospects, Bonito, Raya and Volador and one already discovered gas field, Piedra Redonda have been prioritised.

Piedra Redonda Gas Field

As part of the Company’s review of the Tumbes Basin, to identify areas in the TEA for additional studies including seismic repreocessing, the Piedra Redonda gas field, discovered in 1978 by the C-18X well, was reviewed.

The review of the Piedra Redonda gas field including a historical assesment contingent and prospective resource is detailed in the ASX release on 18 March 2024.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

20h

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00