October 19, 2023

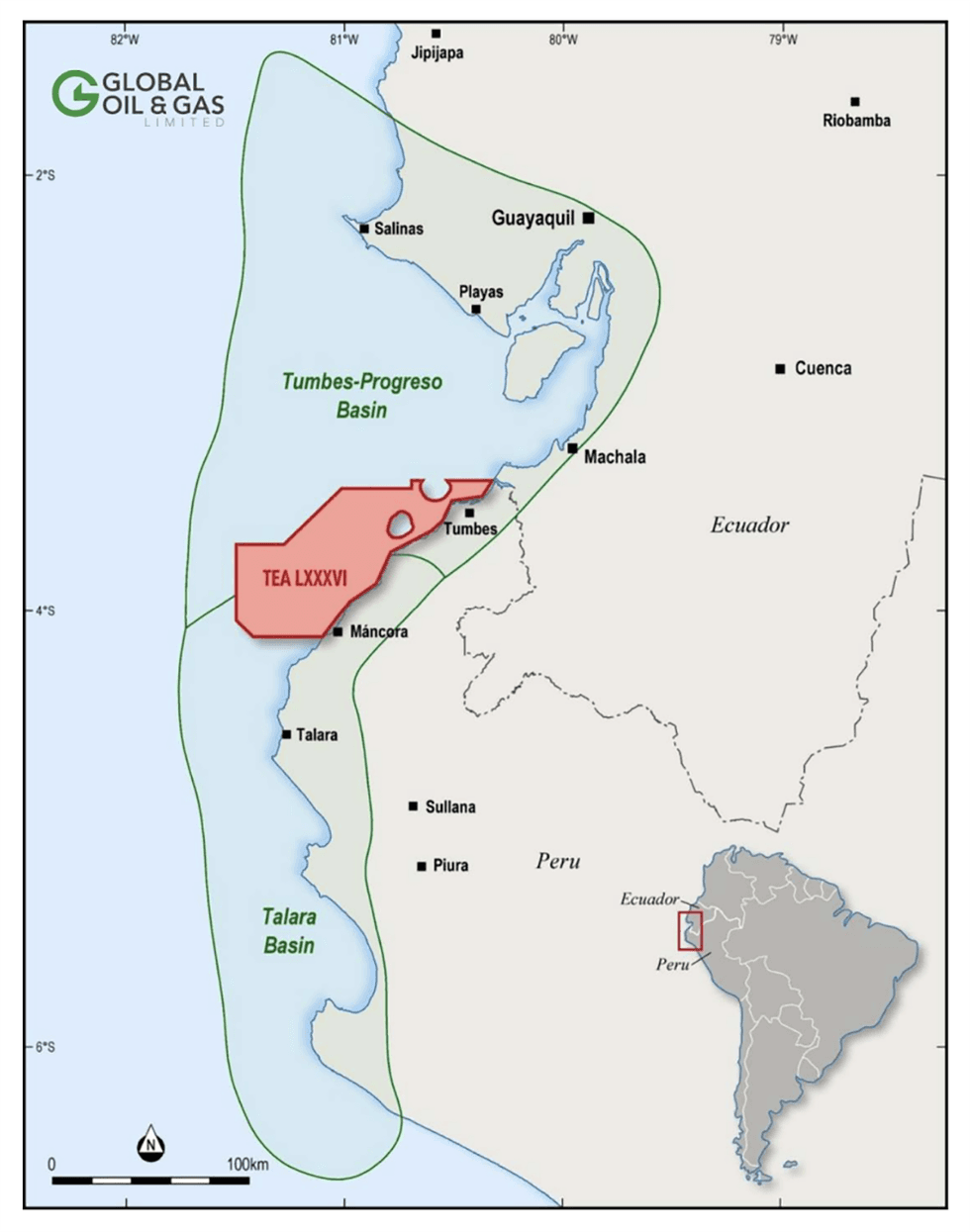

Global Oil & Gas (ASX:GLV) focuses on developing its Tea LXXXVI oil and gas block in Peru, within the Tumbes-Progreso basin and near the prolific Talara basin. The project’s hydrocarbon exploration potential leverages Peru’s long history as an oil and gas producer, which dates back to the late 19th century when the country drilled its first well more than 150 years ago.

The Tea LXXXVI project comprises a 4,858-square-kilometer oil and gas block in proven offshore hydrocarbon-bearing basins in Peru, including the prolific Talara basin. Offshore, Peru remains dramatically underexplored and has immense potential for hydrocarbon plays.

The TEA LXXXVI Project includes the Corvina oil field which generated past production rates of up to 4,000 barrels of light oil per day. In the south is the Talara basin, which is one of the most productive basins in Peru having produced more than 1.6 billion barrels of oil. To the southeast is the Alto-Pena Negra oil field, one of Peru’s most productive fields, currently producing around 3,000 barrels of oil per day and with a total historical production of more than 143 million barrels of oil.

The project benefits from excellent infrastructure, including a refinery that is only 70 kilometers away.

Company Highlights

- Global Oil & Gas Ltd. is an Australia-based oil & gas exploration company focused on developing its recently acquired oil and gas block in Peru, TEA LXXXVI

- The TEA LXXXVI project comprises a 4,858 square-kilometer oil & gas block in proven hydrocarbon-bearing basins offshore including the prolific Talara basin (1.6 billion barrels produced, so far). GLV holds an 80 percent interest in the asset with the remaining 20 percent held by US-based oil & gas exploration company, Jaguar Exploration.

- The block is in proximity to multiple historic and current producing oil & gas fields. This includes the Corvina oil field, producing 4,000 barrels of oil per day, and the Alto-Pena Negra oil field which is currently producing around 3,000 barrels of oil per day, along with a total historical production of more than 143 million barrels of oil. This increases confidence regarding the hydrocarbon exploration potential of TEA LXXXVI.

- The company is undertaking a detailed work program on the project, including 3D seismic data processing, and geological and geophysical studies. This should help GLV generate certified prospective resources along with three to four drill-ready targets over the next 12-18 months.

- A world-class technical team with more than 200 years of collective experience was appointed by GLV to develop and advance the TEA LXXXVI offshore block.

- The company's other projects include the Georgina Basin project (EP-127) and the Sasanof Prospect (WA-519-P).

- EP-127 is located in the Southern Georgina Basin in the Northern Territory. The Basin covers more than 100,000 square kilometers in the Northern Territory and the western part of Queensland. This basin is one of the most prospective onshore basins in Australia with potential for both very large conventional and unconventional oil and gas deposits.

- The Sasanof Prospect is located in permit WA-519-P, where GLV holds a 25 percent interest. The Sasanof Prospect covers an area of up to 400 square kilometers and is estimated to contain a 2C prospective resource of 7.2 trillion cubic feet of gas and 176 million barrels of condensate.

This Global Oil & Gas profile is part of a paid investor education campaign.*

Click here to connect with Global Oil & Gas (ASX:GLV) to receive an Investor Presentation

GLV:AU

The Conversation (0)

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00