May 05, 2023

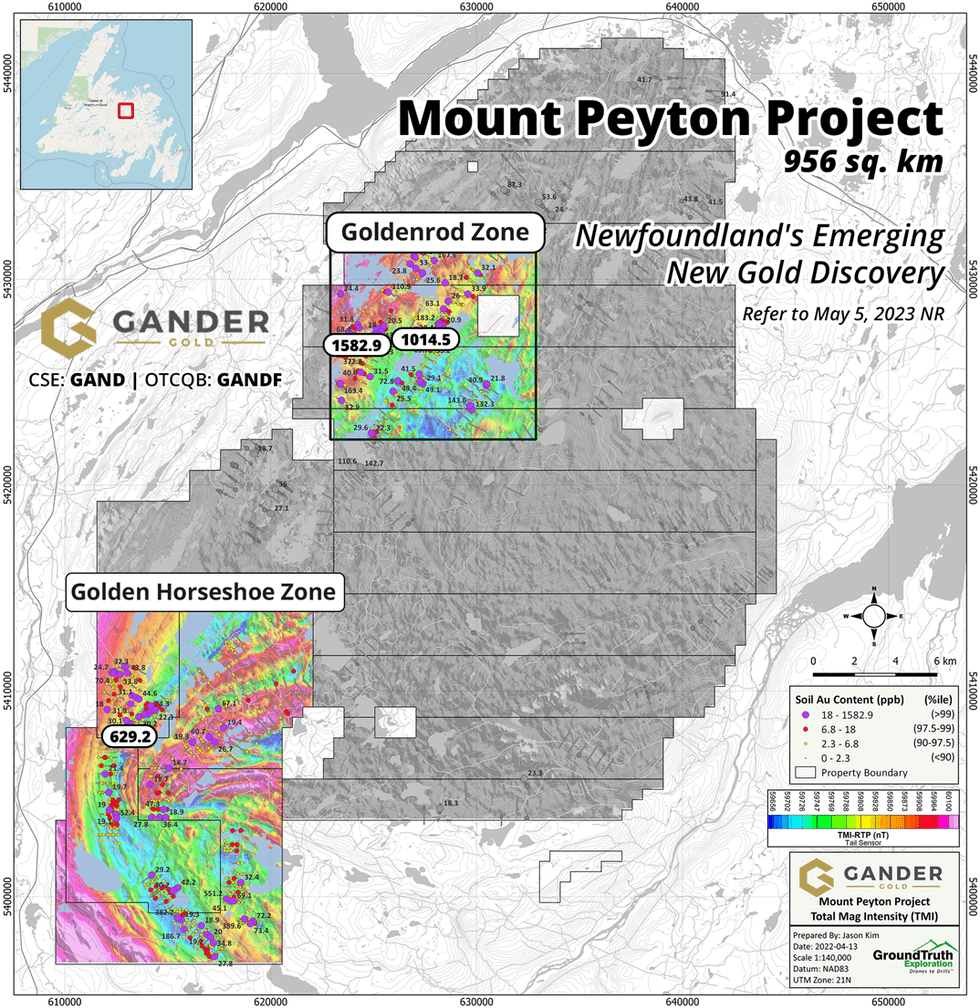

Gander Gold Corp. ("Gander" or the "Company") (CSE:GAND)(OTCQB:GANDF) is pleased to provide a further update on its 956 sq. km Mount Peyton Project in Newfoundland, strategically located between Sokoman Minerals' Moosehead discovery to the west and New Found Gold's series of high-grade gold discoveries to the east highlighted by the Keats, Lotto and Golden Joint Zones.

Gander Gold has carried out more work on the large Mount Peyton Project than any other company in Newfoundland exploration history, completing over 13,000 soil samples, airborne geophysical surveys (MAG-VLF, LiDAR), and structural analysis. Results to date are extremely encouraging, significantly elevating Mount Peyton's prospectivity within Gander's pipeline of eight separate projects. First-ever drilling at Mount Peyton is planned for 2023.

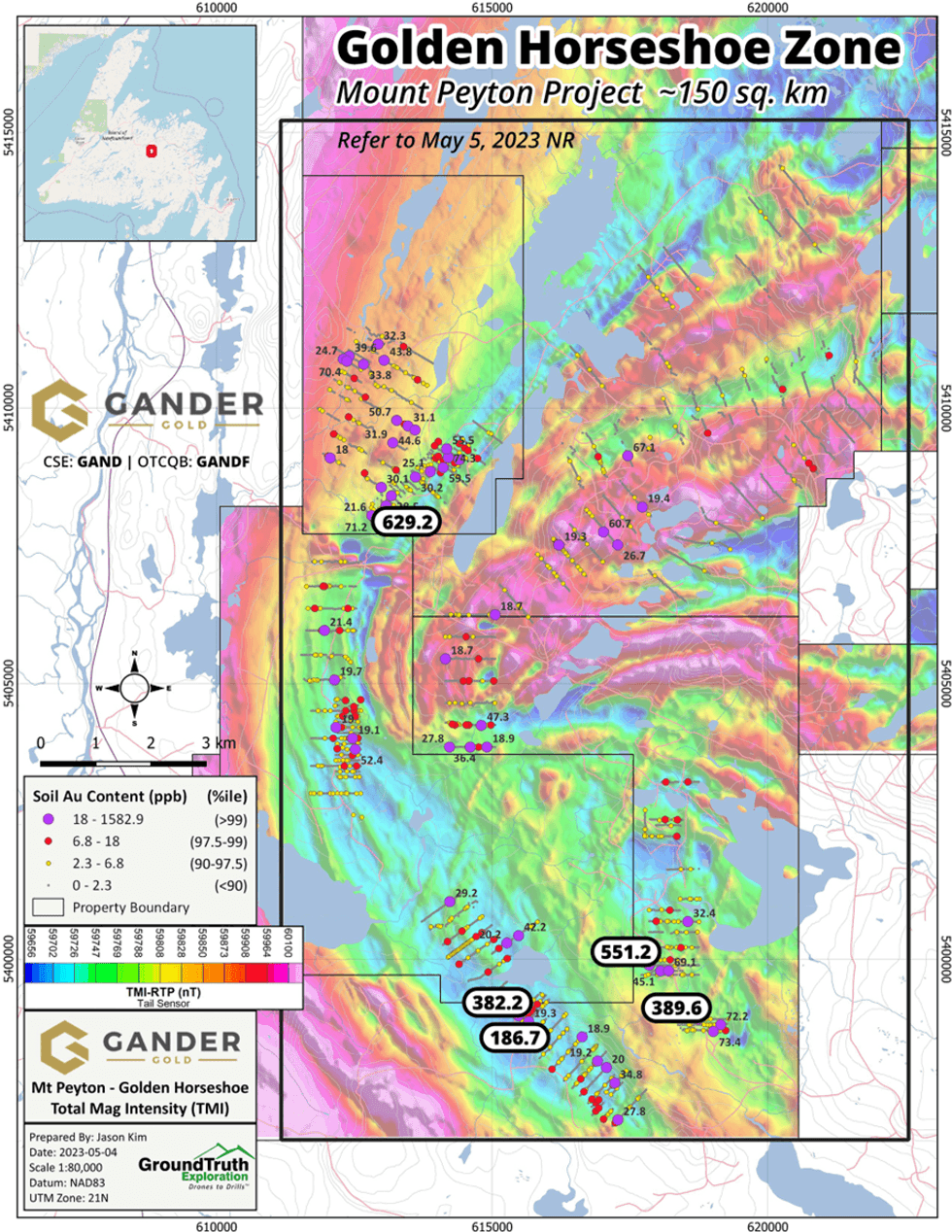

In addition to the new Goldenrod Zone in the northwest portion of the property (refer to April 17, 2023 news release), most recent work has expanded the Golden Horseshoe Zone in the southwest corner of the property while also revealing an emerging target area in the southeast.

Additional Golden Horseshoe Highlights:

- Gander has taken approximately 4,669 B and C-horizon soil samples within the Golden Horseshoe Zone area (2021 and 2022), showing anomalous to extremely anomalous values across the approximate 150 sq. km target area (see attached maps);

- Of the 17 Au-in-soil samples reporting >100 ppb Au at the Mount Peyton Project, five occur in the Golden Horseshoe Zone (186.7 - 629.2 ppb Au);

- The Golden Horseshoe Zone, interpreted to be a fold hinge, defines the western margin of an area of "major structural discordance";

- Associated with Au-in-soil anomalies are NE-SW trending Cu-in-soil anomalies which align with the axial plane of the Golden Horseshoe interpreted fold structure;

- Based on soil geochemistry results and geophysical survey interpretation, the area's geology may be significantly different from that which is indicated in available coarse public data;

- The large egg-shaped Mt. Peyton Property is made up of a granite intrusive surrounded by gabbro. It is conceivable given the location of the property relative to recent gold discoveries within the Gander Gold Belt that the granite intrusive is a possible heat engine which provided an impetus for gold to remobilize in deep-rooted favourable structures.

Mr. Ian Fraser, VP-Exploration for Gander Gold, commented: "We will be focusing our Mount Peyton 2023 exploration at the Goldenrod and Golden Horseshoe Zones. Both areas are structurally significant and also very anomalous in Au-As-Cu soil geochemistry. This project continues to surprise to the upside, so we're excited to be closing in on drill targets."

Emerging New Zone

A third target zone at Mount Peyton may emerge along the east -central portion of the project area, close to the Dog Bay Line and associated Appleton Fault structures. Here, As-Au-Sb-in-soil anomalies align with potential splays emanating from the Dog Bay Line - Appleton Fault system. Follow-up work will be performed in 2023 to further develop this emerging target zone.

Gander Gold Corporate Video

To view the latest Gander Gold corporate video, click on the link below:

Golden Horseshoe Zone Map

Gander Gold Issues Stock Options and Restricted Share Units (RSUs)

The Company alsoannounces that it has granted an aggregate of 225,000 incentive stock options ("Options") at an exercise price of $0.20 per common share for a period of five years to certain directors, officers and/or consultants (the "Eligible Persons") in accordance with the provisions of the Company's Option Plan and an aggregate of 2,975,000 restricted share units ("RSUs") to certain Eligible Persons in accordance with the Company's RSU Plan.

Quality Assurance/Quality Control

Gander Gold Corporation has contracted the services of GroundTruth Exploration to conduct its soil geochemistry programs in Newfoundland. Soil samples are collected at pre-determined sites, placed in soil sample bags and all metadata associated with a sample is recorded. Once sorted and logged, samples are shipped to Eastern Analytical in Springdale, Newfoundland for sample preparation. At Eastern Analytical individual samples are dried and sieved and 50g splits are prepared and then shipped by courier to Bureau Veritas Commodities Canada Ltd. (Bureau Veritas) in Vancouver, British Columbia for analyses. Eastern Analytical and Bureau Veritas are ISO / IEC 17025 certified laboratories and independent of Gander Gold Corporation. At Bureau Veritas 15g splits are partially digested by aqua regia digestion and analysed for gold plus 36 additional elements by ICP-ES/MS (method AQ201). GroundTruth Exploration crews took a field duplicate every 25th sample and inserted certified reference material (OREAS 47) at a frequency of 1 in 55 samples which were inserted into the sample stream to monitor the quality of analysis for the soil sampling program. In addition, the lab was requested to perform repeat analyses at multiple intervals within the sampling stream.

Qualified Person

The technical information in this news release has been reviewed and approved by Ian Fraser, P.Geo., Vice- President of Exploration for Gander Gold. Mr. Fraser is the Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

Acknowledgment

Gander Gold acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

About Gander Gold Corporation

Gander Gold is "All Newfoundland, All the Time". The Company is one of the island's largest claimholders targeting new high-grade gold discoveries with a current focus on the large Gander North, Mount Peyton, BLT (Botwood-Laurenceton-Thwart Island) and Cape Ray II projects where there has been very promising early exploration success. Other opportunities advancing through the pipeline are Carmanville, Gander South, Little River and Hermitage.

Contact Info:

Mark Scott

Chief Executive Officer & Director

info@gandergold.com

Terry Bramhall

Gander Gold - Corporate Communications

1.604.833.6999 (mobile)

1.604.675.9985 (office)

terry.bramhall@gandergold.com

Caution Regarding Forward Looking Statements

Investors are cautioned that, except for statements of historical fact, certain information contained in this document includes "forward looking information", with respect to a performance expectation for Gander Gold Corp. Such forward looking statements are based on current expectations, estimates and projections formulated using assumptions believed to be reasonable and involving a number of risks and uncertainties which could cause actual results to differ materially from those anticipated. Such factors include, without limitation, fluctuations in foreign exchange markets, the price of commodities in both the cash market and futures market, changes in legislation, taxation, controls and regulation of national and local governments and political and economic developments in Canada and other countries where Gander carries out or may carry out business in the future, the availability of future business opportunities and the ability to successfully integrate acquisitions or operational difficulties related to technical activities of mining and reclamation, the speculative nature of exploration and development of mineral deposits, including risks obtaining necessary licenses and permits, reducing the quantity or grade of reserves, adverse changes in credit ratings, and the challenge of title. The Company does not undertake an obligation to update publicly or revise forward looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Some of the results reported are historical and may not have been verified by the Company.

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.

The Conversation (0)

7h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

7h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

15h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

16h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00