October 30, 2024

Golden Mile Resources Limited (“Golden Mile”; “the Company”; ASX: “G88”) is pleased to present its Quarterly Report for the period ending 30 September 2024.

COMPANY HIGHLIGHTS

Pearl Copper Project, Arizona, USA

- Golden Mile completed due diligence on the Pearl Copper Project and entered into a joint venture-acquisition agreement with Outcrop Silver & Gold Corporation

- Project adjacent to the super-giant San Manuel-Kalamazoo porphyry copper-molybdenum deposit

- Odyssey and Ford prospects identified within the Project as immediate highly prospective, exploration drill targets

- Rock chip sampling at the Odyssey prospect returned exceptional assay results:

- Silver assays up to 930 g/t

- Copper assays up to 10.05%

- Zinc assays up to 8.09%

- Mineralisation at the Odyssey prospect is visible at the surface with a strike length of >800m and includes multiple NNW trending extensional veins

- Historic data at the Ford prospect indicates grades up to 10.6% copper, 31.3% lead and 0.54oz (16.7 g/t) gold.

Corporate

- Appointment of Company Secretary Mr Justyn Stedwell, who has over 17 years’ experience as a Company Secretary of ASX listed companies

PEARL COPPER PROJECT (PEARL), ARIZONA, USA (G88 Earn In)

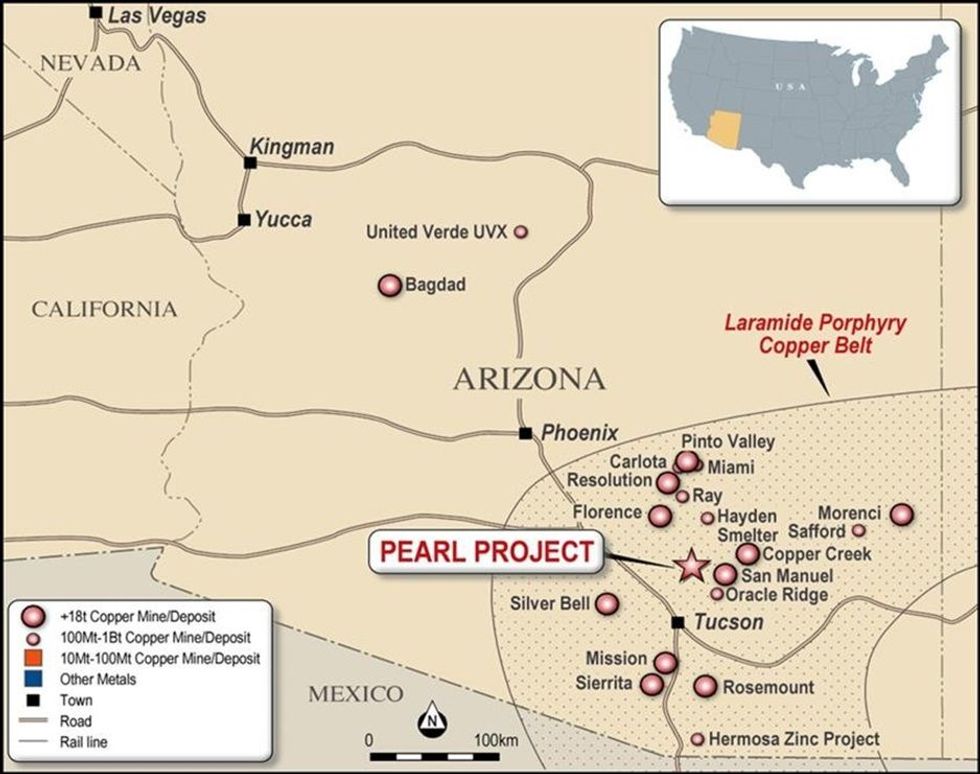

Pearl is located within a world-class mining jurisdiction of the Laramide Porphyry Copper Province within the Southwestern North American Porphyry Copper Province. This is the principal metallogenic province of the United States (US) accounting for approximately 70% of total US copper production.

The Project is adjacent to the world class San Manuel-Kalamazoo Mine, with historic production of approximately 1Bt @ 0.7% Cu. Many other deposits occur in the greater area around the Project, with Arizona being host to some of the world’s largest copper discoveries.

During the Quarter, Golden Mile completed its due diligence on the Pearl Copper Project and entered into a joint venture-acquisition agreement with Outcrop Silver & Gold Corporation (“Outcrop”) 2.

A field trip, undertaken as part of the due diligence, confirmed the very high prospectivity of the project area for company-making copper resources. This field examination, undertaken in late July, and while only preliminary in nature, delineated the Odyssey and Ford prospects within the Pearl project area as immediate, highly prospective, exploration drill targets.

Click here for the full Quarterly Appendix 5B Cash Flow Report

Click here for the full ASX Release

This article includes content from Golden Mile Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G88:AU

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

22 August 2025

Private Placement to Raise $510.8K

Golden Mile Resources (G88:AU) has announced Private Placement to Raise $510.8KDownload the PDF here. Keep Reading...

20 August 2025

Trading Halt

Golden Mile Resources (G88:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 July 2025

June 2025 Quarterly Activities and Cashflow Reports

Golden Mile Resources (G88:AU) has announced June 2025 Quarterly Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

07 July 2025

Aurora Prospect Delivers High-Grade Gold Assays

Golden Mile Resources (G88:AU) has announced Aurora Prospect Delivers High-Grade Gold AssaysDownload the PDF here. Keep Reading...

02 July 2025

Maiden Drilling Campaign Intersects Copper and Lead

Golden Mile Resources (G88:AU) has announced Maiden Drilling Campaign Intersects Copper and LeadDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00