June 24, 2024

Avenira Limited (ASX: AEV) (“Avenira” or “the Company”) is pleased to advise that Advanced Lithium Electrochemistry Ltd (“Aleees”) and the Northern Territory (“NT”) Government has agreed to further extend and amend the Memorandum of Understanding (“MOU”) initially executed in September 20221 and extended in July 20232.

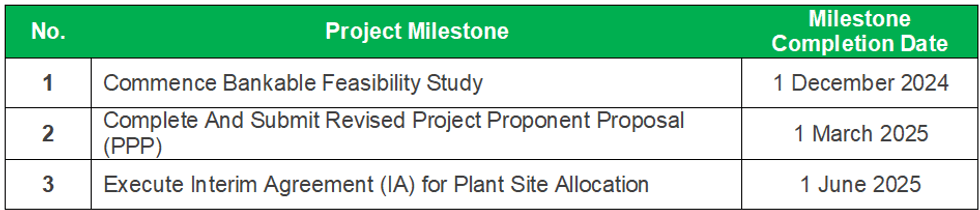

Parties have now agreed a revised project development timeline below:

The MOU builds on the ongoing project development workstreams undertaken by Avenira, Aleees and the NT government. The extension is valid until 30 June 2025.

Avenira continues to pursue the LFP battery manufacturing project following the completion of a positive Scoping Study3, which demonstrated the strong economic and technical viability of the project.

Under the September 2022 announcement, a tripartite non-binding MOU was signed whereby Avenira, Aleees and the NT Government would work towards the development of a LFP battery cathode manufacturing facility, with the NT Government assisting and advising where appropriate in relation to necessary infrastructure including water, energy, power, telecommunications, road, port and rail access and service requirements.

This agreement has been extended to 30 June 2025 to allow the NT Government to continue to provide Aleees and Avenira with support through to the completion of the next stage studies.

Commenting on the extension of the MOU, Avenira’s Charman and Chief Executive Officer, Brett Clark, said:

“The MOU extension demonstrates the continuing support of the Northern Territory Government and Aleees with this significant LFP cathode project in Darwin.”

Click here for the full ASX Release

This article includes content from Avenira Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEV:AU

The Conversation (0)

17 June 2025

Wonarah Mine Management Plan Approved by the NT Government

Avenira Limited (AEV:AU) has announced Wonarah Mine Management Plan Approved by the NT GovernmentDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Avenira Limited (AEV:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

09 March 2025

Investment from Sichuan Hebang Biotechnology

Avenira Limited (AEV:AU) has announced Investment from Sichuan Hebang BiotechnologyDownload the PDF here. Keep Reading...

11 February 2025

Termination of Aleees License and Technology Agreement

Avenira Limited (AEV:AU) has announced Termination of Aleees License and Technology AgreementDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00