- WORLD EDITIONAustraliaNorth AmericaWorld

October 25, 2023

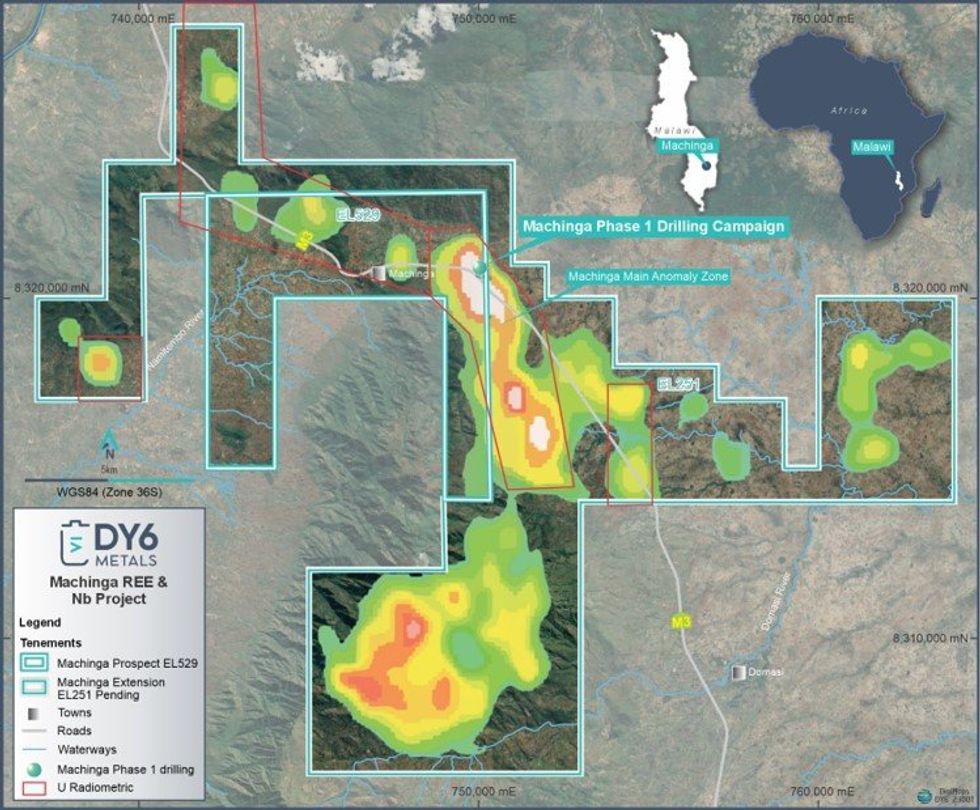

Heavy rare earths and niobium explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, the “Company”) is pleased to announce the receipt of the third and final batch of assays from the RC drilling program completed at the Machinga Main Northern Zone, part of the Company’s flagship Machinga project in southern Malawi.

HIGHLIGHTS

- Further high-grade HREE and Nb results returned from the remaining 13 holes of maiden 35-hole reverse circulation (“RC”) program at Machinga Main Northern Zone

- Continued widespread HREE and Nb intersections with assays including:

- 11m @ 0.74% TREO, 0.29% Nb2O5 from surface (3.8% DyTb/TREO) incl. 2m @ 1.36% TREO, 0.49% Nb2O5 from 6m (4% Dy/Tb/TREO) (MR024)

- 5m @ 0.56% TREO, 0.20% Nb2O5 from 103m (3.7% DyTb/TREO) (MR027)

- 12m @ 0.39% TREO, 0.10% Nb2O5 from 6m (3.5% DyTb/TREO) (MR034B)

- 6m @ 0.55% TREO, 0.18% Nb2O5 from 43m (4.1% DyTb/TREO) (MR026)

- 4m @ 0.58% TREO, 0.14% Nb2O5 from 16m (4.3% DyTb/TREO) (MR034)

- Results follow up on recent high-grade RC intercepts incl. 7m @ 1.42% TREO with 0.49% Nb2O5 from 65m (MR011) and 13m @ 0.65% TREO with 0.25% Nb2O5 from surface (MR019)

- Results returned an average of 29% HREO:TREO and 3.6% DyTb:TREO at a cutoff grade of >0.25% TREO

- First batch of assays from diamond drilling (“DD”) at Machinga Main North Zone (8 holes for 900m) expected to be received next month

The results are from 1m and 3m composite intervals from the third batch of 13 holes (1161m) drilled as part of DY6’s maiden 35-hole, 3,643m RC drill program at Machinga Main Northern Zone.

The two prior batches delivered high-grade RC intercepts including 7m @ 1.42% TREO with 0.49% Nb2O5 from 65m (MR011) and 13m @ 0.65% TREO with 0.25% Nb2O5 from surface (MR019).

A series of significant intercepts based on a 0.25% total rare earth oxide + yttrium (TREO) cut-off grade was returned in the latest batch of assays from the Machinga Main Northern Zone including:

- 11m @ 0.74% TREO, 0.29% Nb2O5 from surface (3.8% DyTb/TREO) incl. 2m @ 1.36% TREO, 0.49% Nb2O5 from 6m (4% Dy/Tb/TREO) (MR024)

- 5m @ 0.56% TREO, 0.20% Nb2O5 from 103m (3.7% DyTb/TREO) (MR027)

- 12m @ 0.39% TREO, 0.10% Nb2O5 from 6m (3.5% DyTb/TREO) (MR034B)

- 6m @ 0.55% TREO, 0.18% Nb2O5 from 43m (4.1% DyTb/TREO) (MR026)

- 4m @ 0.58% TREO, 0.14% Nb2O5 from 16m (4.3% DyTb/TREO) (MR034)

The mineralisation at the Machinga alkaline complex contains a higher proportion of valuable dysprosium-terbium (DyTb) with results indicating an average 3.6% DyTb:TREO in samples greater than 0.25% TREO.

A strongly mineralised hydrothermal breccia system striking NW-SE and dipping shallowly ~35° to the NE has been confirmed by the recent drilling. Pleasingly, very high-grade zones have been intersected, as well as the suggestion of the mineralised zones thickening at depth. Significant drill intercepts received from the third batch of assays are included in Table 2.

Samples will be selected for petrography from both the core and RC drill material. The Company has engaged a consulting metallurgist to review the lithology, and selected RC sample pulps will be assayed for major and trace elements followed by x-ray diffraction (“XRD”) for mineral characterisation. Once all the DD assays are completed, QEMSCAN will be used on selected core samples to determine minerology and assist with development of a metallurgical program.

Results for the first batch of DD assays (eight diamond holes drilled for 900m) are expected next month.

The host rocks to the mineralisation at Machinga are a complex mix of syenitic intrusives relating to the nearby Malosa pluton that have been emplaced in the basement metamorphic gneisses and migmatites. The mineralisation appears to be hosted within hydrothermal breccias dipping at approximately 35o to the NE. It is likely there are several parallel structures stacking within the intrusion itself, which have the potential to increase the volume of mineralisation.

The foliation of the host complex appears to have a steep southwesterly dip suggesting the structures hosting the breccias are at right angles to the foliation. How and when the emplacement of the breccias and mineralisation occurred will require additional study.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00