May 20, 2024

19-hole diamond drilling program expanded to include new high-grade gold & silver targets of up to 29.7 g/t gold & 44.1 g/t silver, along a22km strike within the prolific Lac Guyer Greenstone Belt

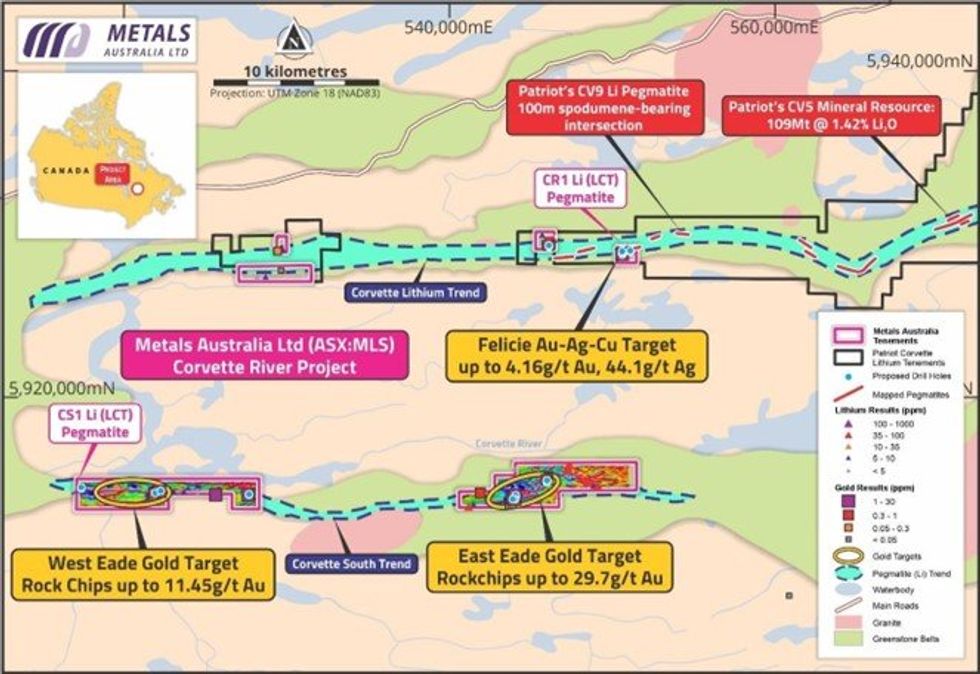

Metals Australia Ltd (ASX: MLS) (“the Company”) is pleased to announce that it has received all permitting approvals for an extensive new drilling and trenching program to test key high-grade gold/silver/copper targets and key lithium-caesium-tantalum (LCT) pegmatites identified within the Company’s Corvette River Project, along strike and on a parallel belt to the world-class Corvette Lithium Project of Patriot Battery Metals (ASX:PMT)1 in Quebec, Canada (see Figure 1).

Metals Australia has received all required permitting approvals for a major new drilling and trenching program. This fully-funded program will test new high-grade gold and silver targets and priority lithium bearing (LCT) pegmatite targets at the Company’s Corvette River Project.

The Project is along strike and on a parallel belt to Patriot Battery Metals’ world-class Corvette Lithium Project1 on the prolific Lac Guyer greenstone belt in the tier-one global mining jurisdiction of Quebec, Canada (see Figure 1).

High-Grade Gold with Silver and Copper Targets (see Figure 1 for locations):

- East Eade Gold Target on the Corvette South Trend, where previous rockchip sampling2 across a 300m wide complex fold-closure, never before drill-tested, included assays of up to 29.7 g/t gold (Au) and 12 g/t Au2 (see Figure 2).

- West Eade Gold Target on the Corvette South Trend (see Figure 3), which produced historical assays of up to 11.45g/t Au2 and more recent rockchip sampling results including 3.37 g/t Au over 3m2.

- Felicie Gold-Silver-Copper Target on the Corvette Trend (see Figure 1), where previous rockchip sampling produced grades of up to 4.16 g/t Au, 44.1 g/t silver (Ag) and 0.23% copper (Cu)2 from a zone of 180m strike-length open in all directions, and never before drill-tested.

Priority Lithium Pegmatite Targets (see Figure 1 for locations):

- CR1 Lithium-Caesium-Tantalum (LCT) Pegmatite3 which has been mapped over a 1.6km strike- length and across a 100m thick zone within the Company’s Felicie tenements. CR1 is located on the Corvette (CV) Lithium Trend, 2.5km west of the Patriot Battery Metals’ (ASX: PMT) CV9 pegmatite, which includes a 100m drill-intersection of spodumene-bearing pegmatite4 (Figure 1).

- CS1 LCT Pegmatite5 which produced high lithium results of 370ppm Li and 290ppm Li from the only two first-pass samples collected from the outcropping coarse-grained LCT pegmatite, located on the western side of the West Eade property (Figure 1). The two samples are located 44m apart on a north-south section, which indicates a more than 40m thick pegmatite zone, which remains open to both the east and west.

Metals Australia CEO Paul Ferguson commented:

“We are delighted to have received all necessary approvals to advance this priority drilling and trenching program at our Corvette River Project, which is located within one of Canada’s most prospective lithium, gold, and base metals regions.

In addition to the highly-prospective lithium pegmatite targets we have identified analogous to Patriot Battery Metals’ world-class Corvette Trend lithium deposits, we have also identified multiple new high- grade gold and silver target zones based on our geological team’s extensive re-interpretation of previous rockchip sampling results and magnetics. Significantly, these high-grade targets are located along Quebec’s highly-endowed Lac Guyer greenstone belt which, apart from the Corvette lithium discovery, also hosts many significant gold and silver deposits including Newmont Corp’s ~215,000 ounce per annum Eleonore gold mine6.

With the permitting now in place, Metals Australia is in the final stages of operational planning, budgeting, and contracting with our full-service exploration contractor, Magnor Exploration, to commence the drilling and trenching program as soon as possible.

I’d like to acknowledge the great work of the team at Magnor for working diligently with all required stakeholders, including members of the Cree First Nations community and the Quebec Ministry of Natural Resources and Forestry (MRNF) to apply, consult and achieve permit approvals as quickly as they have. This has all occurred in a positive and collaborative manner and we are now looking forward to demonstrating our credentials as a responsible explorer.

Supported by the Company’s extensive cash reserves, the initiation of the Corvette River drilling and trenching program is a further demonstration of the board’s strategy to accelerate exploration and development across its suite of assets in Canada and Australia in the wake of the recent strategic workshops to identify our next development project after the Lac Rainy graphite project. In addition to Corvette River and Lac Rainy, we expect to provide further announcements over the Quarter regarding plans we are finalising to unlock value from our other exploration assets, which we believe will provide catalysts for a valuation re-rating of Metals Australia shares, which are trading well below cash backing.”

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00