October 13, 2023

Frontier Energy (ASX:FHE, OTCQB:FRHYF) is perfectly positioned to potentially become not only a key part of Western Australia's energy solution in the immediate future but also benefit from what is forecasted to be record-high energy prices.

Frontier Energy, a near-term, fully integrated renewable energy and hydrogen developer, will be able to meet the market’s urgent requirement for energy with the development of their Stage One (120MW) solar project to commence construction in 2024.

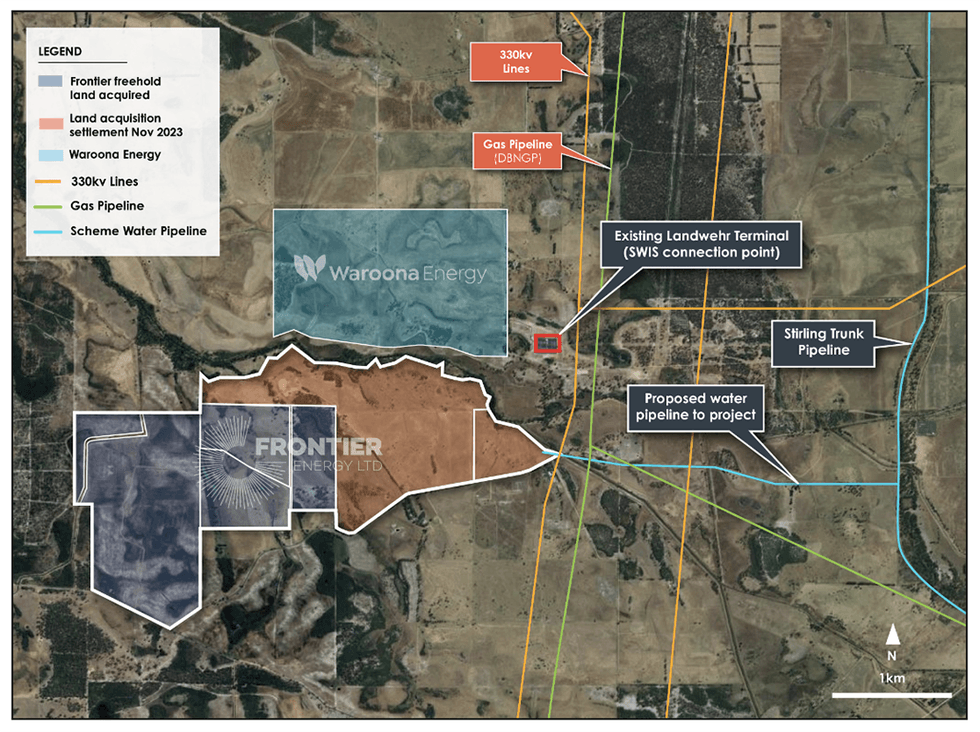

Frontier's Bristol Springs Renewable Energy and Green Hydrogen project is on track to commence construction of Stage One solar development in 2024. The 868-hectare project is located on flat, predominantly cleared freehold land which is just 3.5 kilometres from the Landwehr Power Terminal. The company is working on a proposed acquisition of Waroona Energy for which it has already signed a Letter of Intent that will provide Frontier with a unique, accelerated turnkey solution for the development and consumption of green hydrogen courtesy of Waroona's proposed 120 MW dual fuel peaking plant, potentially positioning Frontier as the leading developer of green hydrogen in the country.

Company Highlights

- Frontier's flagship project, Bristol Springs, has access to world-class infrastructure which considerably reduces both upfront capex and its overall development timeline.

- The acquisition of Waroona Energy will serve as a capstone on Frontier's development strategy, adding 355 MW of solar power generation with the capacity to expand up to 1 GW.

- The company is expected to generate major news flow as it moves towards FID on multiple development opportunities in 2024.

- These are the strongest ever market conditions for both renewable energy and hydrogen deployment. A near-term, fully integrated renewable energy and hydrogen producer, Frontier Energy is ideally positioned to benefit from these conditions.

- The South West Interconnected System, Western Australia's primary power grid and energy market, is in dire need of investment in new electricity generation.

- The current demand forecast over the next decade ranges from 78 percent to 220 percent. Meeting this demand will be even more challenging given that the State intends to close all coal-fired power capacity, which currently accounts for roughly 30 percent of power generation, by 2030.

- SWIS currently generates only 35 percent of its power through renewables, far below the Australian government's target of 82 percent.

- The company has a three-pronged development strategy, beginning with the establishment of solar infrastructure as a foundation followed by the planned construction of a dual-fuel hydrogen peaking plant and entry into the green hydrogen market.

- Frontier's end goal is to develop a scalable renewable energy hub which will create long-term sustainable value and provide a significant contribution to both the State and Federal decarbonisation strategy.

This Frontier Energy profile is part of a paid investor education campaign.*

Click here to connect with Frontier Energy (ASX:FHE) to receive an Investor Presentation

FHE:AU

The Conversation (0)

06 February 2024

Frontier Energy

Clean energy to help fill WA’s growing power supply gap

Clean energy to help fill WA’s growing power supply gap Keep Reading...

04 February

Charbone Announces its First Hydrogen Supply Hub in the Ontario Market

(TheNewswire) Brossard, Quebec, February 4, 2026 TheNewswire Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

04 February

Charbone annonce l'etablissement de son premier pole d'approvisionnement en hydrogene sur le marche Ontarien

(TheNewswire) Brossard, Quebec, le 4 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

02 February

10 Biggest EV Stocks to Watch in 2026

The energy revolution is here to stay, and electric vehicles (EVs) have become part of the mainstream narrative. The shift toward green energy is gathering momentum, with governments adding more incentives to accelerate this transition. Increasing EV sales are good news for battery metals... Keep Reading...

01 February

MOU with Yinson and Himile to Advance LCO2 Tank Production

Provaris Energy (PV1:AU) has announced MOU with Yinson and Himile to Advance LCO2 Tank ProductionDownload the PDF here. Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

RZOLV Technologies Inc. (TSXV: RZL) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development ("ERD") to... Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00