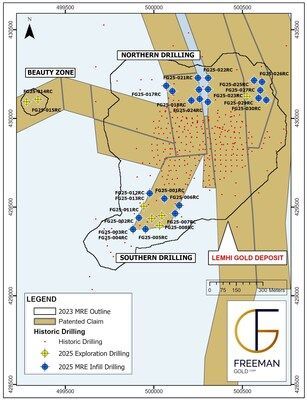

Freeman Gold Corp. (TSXV: FMAN) (OTCQB: FMANF) (FSE: 3WU) (" Freeman " or the " Company ") is pleased to announce that it has received results from the northern portion of its 2025 reverse circulation drilling program at the Lemhi Gold Project (" Lemhi " the " Project " or " Property ").

The reverse circulation ("RC") drill program consisted of approximately 2,860 metres of drilling in 30 drill holes. The drilling was designed to:

- Convert the inferred ounces from the current mineral resource estimate (" MRE ") (see Freeman's news release dated May 15, 2025 ) to either measured or indicated (approximately 1,820 metres in 23 drill holes) for those which are contained within the pit shell as designed as part of Freeman's Preliminary Economic Assessment (" PEA ") (see Freeman's news release dated October 16, 2023 ); and

- Complete further exploration at the north, south and at the Beauty zone. Table 1 shows the results from the northern portion of the deposit only. The results will form the basis of an updated MRE to be used within the recently commissioned Feasibility Study.

Bassam Moubarak , CEO, stated, "These drilling results demonstrate there is continued exploration potential beyond the northern extent of the 2023 PEA pit shell. Furthermore, these promising near surface results, with the majority within the first 100 metres, will likely increase the resource base for the Lemhi Feasibility Study currently being prepared."

Table 1: Significant Drill Results – Lemhi North*

| | DEPTH | | | | | |

| DRILL HOLE | (METRES) | AZI | DIP | FROM | TO | HIGHLIGHT |

| FG25-016RC | 61 | n.a. | -90 | 4.6 | 56.4 | 0.4 g/t Au over 51.8m |

| | including | | | 38.1 | 56.4 | 0.8 g/t Au over 18.3m |

| FG25-017RC | 150.9 | 270 | -50 | 6.1 | 126.5 | 0.37 g/t Au over 120.4m |

| | including | | | 27.4 | 68.6 | 0.85 g/t Au over 41.2m |

| | including | | | 51.8 | 54.9 | 5.2 g/t Au over 3.1m |

| | | | | 149.4 | 150.9 | 1.7 g/t Au over 1.5m |

| FG25-018RC | 91.4 | n.a. | -90 | 15.2 | 35 | 1.2 g/t Au over 19.8m |

| | including | | | 25.9 | 35 | 2.5 g/t Au over 9.1m |

| | | | | 45.7 | 47.2 | 0.54 g/t Au over 1.5m |

| | | | | 68.5 | 85.3 | 0.39 g/t Au over 16.8m |

| FG25-019RC | 80.8 | n.a. | -90 | 27.4 | 32 | 0.27 g/t Au over 4.6m |

| | | | | 61 | 80.8 | 0.25 g/t Au over 19.8m |

| FG25-020RC | 65.5 | n.a. | -90 | 22.9 | 30.5 | 0.35 g/t Au over 7.6m |

| | | | | 39.6 | 64 | 0.33 g/t Au over 24.4m |

| | including | | | 57.9 | 64 | 0.68 g/t Au over 6.1m |

| FG25-021RC | 65.5 | n.a. | -90 | 3 | 6.1 | 0.24 g/t Au over 3.1m |

| | | | | 53.3 | 65.5 | 0.26 g/t Au over 12.2m |

| FG25-022RC | 50.3 | 270 | -70 | 7.6 | 50.3 | 0.6 g/t Au over 42.7m |

| | including | | | 41.1 | 50.3 | 2.1 g/t Au over 9.2m |

| FG25-023RC | 45.7 | 270 | -70 | 3 | 4.5 | 0.27 g/t Au over 1.5m |

| | | | | 36.5 | 39.6 | 0.4 g/t Au over 3.1m |

| FG25-024RC | 70.1 | 270 | -60 | 27.4 | 28.9 | 0.89 g/t Au over 1.5m |

| | | | | 35 | 41.1 | 0.38 g/t Au over 3.1m |

| FG25-014RC | 150.9 | 90 | -50 | 91.4 | 92.9 | 0.18 g/t Au over 1.5m |

| Beauty | | | | 144.8 | 146.3 | 0.33 g/t Au over 1.5m |

| FG25-015RC | 111.3 | 100 | -55 | 65.5 | 77.7 | 0.37 g/t Au over 12.2m |

| Beauty | including | | | 65.5 | 68.6 | 0.93 g/t Au over 3.1m |

| | | | | 106.7 | 108.2 | 1.7 g/t Au over 1.5m |

| *Intervals are drill run-length. True width is estimated between 90-95 percent ("%") of length. Using 0.15 g/t Au cut-off. 'RC' denotes RC (Reverse Circulation) hole. |

All drill samples were sent to ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada , an independent and fully accredited laboratory (ISO 9001:2008) for analysis for gold by Fire Assay. Freeman Gold has a regimented Quality Assurance, Quality Control ("QA/QC") program where at least 10% duplicates, blanks, and standards are inserted into each sample shipment.

About the Company and Project

Freeman Gold Corp. is a mineral exploration company focused on the development of its 100% owned Lemhi Gold property. The Project comprises 30 square kilometres of highly prospective land, hosting a near-surface oxide gold resource. The pit constrained National Instrument 43-101 (" NI 43- 101 ") compliant mineral resource estimate is comprised of 988,100 ounces gold (" oz Au ") at 1.0 gram per tonne (" g/t ") in 30.02 million tonnes (4.7 million tonnes Measured (168,800 oz) & 25.5 million tonnes Indicated (819,300 oz)) and 256,000 oz Au at 1.04 g/t Au in 7.63 million tonnes (Inferred). The Company is focused on growing and advancing the Project towards a production decision. To date, 525 drill holes and 92,696 m of drilling has historically been completed (Murray K., Elfen, S.C., Mehrfert, P., Millard, J., Cooper, Schulte, M., Dufresne , M., NI 43-101 Technical Report and Preliminary Economic Assessment, dated November 20, 2023 ; www.sedarplus.ca ).

The recently updated price sensitivity analysis (see Freeman's news release dated April 9, 2025 ) shows a PEA with an after-tax net present value (5%) of US$329 million and an internal rate of return of 28.2% using a base case gold price of US$2,200 /oz; Average annual gold production of 75,900 oz Au for a total life-of-mine of 11.2 years payable output of 851,900 oz Au; life-of-mine cash costs of US$925 /oz Au; and, all-in sustaining costs of US$1,105 /oz Au using an initial capital expenditure of US$215 million *.

*Note: Mineral resources that are not mineral reserves do not have demonstrated economic viability. The preliminary economic assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

The technical content of this release has been reviewed and approved by Dean Besserer , P. Geo., the VP Exploration for the Company and a Qualified Person as defined by the National Instrument 43-101.

On Behalf of the Company

Bassam Moubarak

Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release contains "forward‐looking information or statements" within the meaning of Canadian securities laws, which may include, but are not limited to, all statements related to the 2023 PEA, statements relating to exploration, results therefrom, and the Company's future business plans, and statements regarding the price sensitivity analysis and impact thereof on the evaluation of the Project's economic potential. All statements in this release, other than statements of historical facts that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ from those in the forward-looking statements. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties, and assumptions. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Data Analysis and Retrieval + (SEDAR+) at www.sedarplus.ca for a more complete discussion of such risk factors and their potential effects. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

SOURCE Freeman Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/15/c2993.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/15/c2993.html