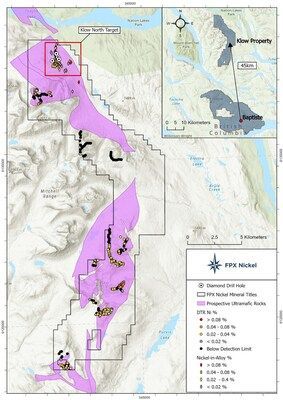

FPX Nickel Corp. (TSX-V: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to announce planned exploration activities at the Company's Klow property (" Klow " or the " Property "), located 45 km north of the Company's Baptiste Nickel Project. Exploration will be 100% funded by the Japan Organization for Metals and Energy Security (" JOGMEC ") under the terms of an earn-in agreement which provides JOGMEC the option to earn up to a 60% interest in the Property. The Company has recently expanded the mineral claims at Klow by 600%, bringing the Property to 164 km 2 and is currently preparing a wide-ranging surface rock sampling program over the summer of 2025 with the goal of advancing Klow to drill-ready status.

Highlights

- Previous rock sampling and drilling has identified multiple large-scale awaruite nickel targets within the overall district-scale Klow Property (164 km 2 land package)

- Historic drill results at the Klow North Target include a near-surface intercept of 316 m at a grade of 0.097% nickel-in-alloy (a chemical dissolution used to estimate nickel contained in awaruite mineralization, see Note 1 below)

- Planned Property-wide rock sampling program aims to expand known mineralized zones and identify new awaruite mineralization with the goal of delineating drill targets

- Exploration at Klow will be 100% funded by JOGMEC

"Located north of our flagship Baptiste Nickel Project, and underlain by the same Trembleur ultramafic rocks that host Baptiste, Klow is one of the most highly prospective areas for awaruite mineralization in Canada ," commented Keith Patterson , FPX's Vice President, Exploration. "Past results include surface samples and drill hole intercepts comparable to those from Baptiste, and large areas of the Property remain untested to date. We look forward to deepening our collaboration with JOGMEC in pursuit of advancing Klow to the drill-ready stage."

Historic Work

The Klow Property is located 120 km northwest of Fort St. James and 45 km north of FPX's flagship Baptiste Nickel Project. An all-season public road runs along the eastern margin of Klow, with a rail alignment located approximately 12 km west of the property.

Previous work at Klow includes mapping and rock sampling from 2009 to 2012, and a limited diamond drill program at the Klow North Target in 2012. Wide-spaced rock sampling has delineated several additional targets which will be further investigated with planned sampling in 2025.

The Klow North Target includes a broad zone of awaruite mineralization measuring approximately 1.0 by 1.5 km defined by surface rock samples containing elevated grades of up to 0.13% nickel-in-alloy (a targeted chemical dissolution used to estimate nickel contained in awaruite mineralization, more fully described in Note 1 below). A five-hole drill program was completed in 2012; DH-04 returned a significant result of 316 m at 0.097% nickel-in-alloy, from 10 m below surface.

Recent test work on 68 archived samples from this drill hole shows an excellent correlation between Davis Tube Recoverable (" DTR ") Ni grades and nickel-in-alloy grades with DTR producing values approximately 7-10% higher than historic nickel-in-alloy analysis. The Klow Target remains one of FPX's highest priority targets outside the Decar Nickel District.

Elsewhere on the recently expanded Klow Property, historic rock sampling has delineated numerous target areas which remain largely open for expansion, with those samples having returned grades of up to 0.09% DTR nickel.

Planned 2025 Exploration Program

It is expected that crews will mobilize to the Property in early July to begin a comprehensive grid-based rock sampling program. In areas of known awaruite mineralization, sampling will target 100 x 200 metre spacing where possible. Further from known mineralization or in areas that were previously unsampled, sampling will target 200 x 1,000 metre spacing. FPX and JOGMEC have jointly approved a budget of $325,000 for work at Klow in 2025, which will be funded 100% by JOGMEC.

Klow Property Earn-In Agreement

On April 1, 2023 , FPX and JOGMEC entered into an earn-in agreement (the " Klow Earn-In Agreement ") which provides JOGMEC the option to earn a beneficial interest in FPX's Klow Project (" Klow ") in central British Columbia .

The key terms of the Klow Earn-in Agreement are as follows:

- FPX grants to JOGMEC the option to earn a 60% beneficial interest in Klow by funding $1,000,000 in exploration expenditures by no later than March 31, 2027 (extended from a prior deadline of March 31, 2026 by mutual agreement of the parties)

- Once JOGMEC has earned its 60% beneficial interest in Klow, the parties will thereafter fund exploration expenditures pro rata to their ownership interest

- If either party's beneficial interest in Klow is diluted below 10%, that party's beneficial interest will be converted into a 1.5% NSR royalty over Klow, with the other party retaining a right to buy-back 1.0% of the NSR royalty for $3,500,000

The Klow Property is located on the traditional territories of multiple First Nations, many of whom are engaged on FPX's nearby Baptiste Nickel Project.

Note 1: Historic Sampling and Analytical Methods

Many of the historic rock and drill-core results within the Company's Klow Property database were analyzed for "nickel-in-alloy" by a proprietary geochemical extraction which selectively targets nickel in awaruite (nickel-iron alloy) and does not recover significant nickel from sulphide or silicate minerals. Current industry best practices for analysis of magnetically recoverable nickel (awaruite) utilize Davis Tube Recoverable (DTR) analysis. DTR nickel values refer to the portion of the total contained nickel that is recovered from a magnetically separated fraction of the sample. While both methods measure nickel in awaruite, awaruite particle exposure and grain size influence each method slightly differently; therefore these results are not directly comparable. All analytical work on 2025 Klow samples will utilize Davis Tube Recoverable (DTR) analysis.

Keith Patterson , P.Geo., FPX's Vice President, Exploration, FPX's Qualified Person under NI 43-101, has reviewed and approved the scientific and technical content of this news release.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron mineralization known as awaruite. For more information, please view the Company's website at https://fpxnickel.com/ or contact Martin Turenne , President and CEO, at (604) 681-8600 or ceo@fpxnickel.com .

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2025/27/c7472.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2025/27/c7472.html