Forte Minerals Corp . (" Forte " or the " Company ") ( CSE: CUAU ) ( OTCQB: FOMNF ) ( Frankfurt: 2OA ) is pleased to announce the expansion of its capital markets capabilities with three strategic initiatives:

- The engagement of Mills Dunlop Capital Partners as M&A and strategic advisors;

- The appointment of Port Guichon Strategic Advisory, as Investor Relations and Capital Markets Specialist;

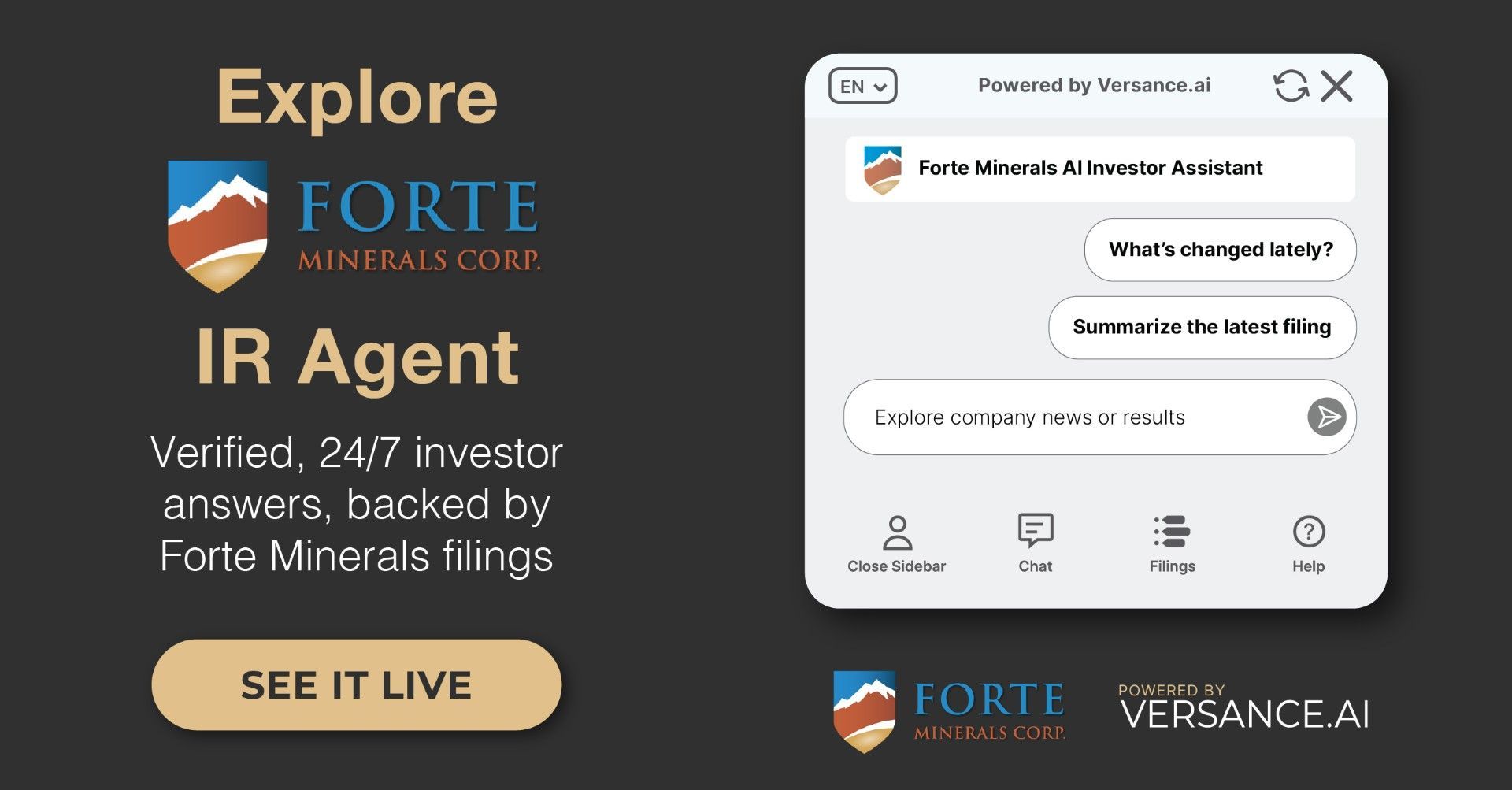

- And the launch of a new AI-powered investor platform via Versance.ai.

These additions support Forte's commitment to investor engagement, capital markets excellence, and digital transparency.

Strategic Advisory from Proven Mining Dealmakers

Forte has retained Mills Dunlop Capital Partners (MDCP), an independent M&A and strategic advisory firm led by Russell Mills and Brodie Dunlop, to provide strategic and advisory guidance. With deep experience in structuring complex mining transactions, MDCP brings a proven record of execution and capital markets insight.

MDCP offers:

- Execution expertise : Multiple M&A and strategic transactions across the mining sector over several decades.

- Sector specialization : Their independent model allows for conflict-free, tailored guidance.

- Comprehensive support : Forte will benefit from assistance in deal evaluation, due diligence, regulatory documentation, and strategic corporate negotiations.

"Russell and Brodie bring a rare combination of mining knowledge, transactional experience, and corporate connectivity," said Patrick Elliott , President & CEO. "Their advisory will be critical as we evaluate strategic opportunities and position Forte for long-term success."

Port Guichon Strategic Advisory Appointed as Investor Relations & Capital Markets Specialist

Forte Minerals Corp. is pleased to welcome Kevin Guichon , Principal of Port Guichon Strategic Advisory, to lead its Investor Relations and Capital Markets strategy. Kevin brings over a decade of experience in the Canadian securities industry, including his tenure at Haywood Securities Inc., where he progressed from operations to trading and advisory services.

He will oversee investor outreach and guide capital markets strategies, working closely with Anna Dalaire, VP of Corporate Development, to expand Forte's corporate messaging, strengthen relationships with existing shareholders, and build new connections across the investment community.

As part of his engagement, Kevin will be compensated at C$4,000 per month and has been granted 200,000 stock options, exercisable at C$0.80 per share for five (5) years, under the Company's incentive stock option plan, subject to regulatory approval.

"Kevin understands both the language of capital markets and the needs of investors," said Elliott. "His ability to simplify complex opportunities and build trusted relationships will elevate our investor communications."

Now Live: AI-Powered Investor Platform on ForteMinerals.com

Forte has officially launched its AI-powered investor engagement platform, a partnership with Versance.ai, providing instant access to the company's regulatory filings, investor questions and insights.

Now live at www.forteminerals.com , the platform offers:

- Instant Answers: Ask plain-language questions like "Summarize the latest news release." or "How many drill permits do they have?" and receive sourced, reliable responses in seconds.

- Side-by-side Filing Comparison: Compare MD&A sections and risk disclosures across time or against peer companies.

- 24/7 Multilingual Access: Available for free, globally, empowering investors to perform due diligence on their own terms.

"Transparency isn't optional," said Anna Dalaire , VP Corporate Development and Corporate Secretary. "At Forte, we believe in building real relationships with our shareholders; our team is always here to connect. But we also understand that today's investors want answers now. Communication doesn't just happen through press releases anymore; it's multi-channel, on-demand, and constant. This AI tool gives investors 24/7 access to the information they need, while keeping compliance front and center."

Corporate Update: Option Grants

The Company also announces that, pursuant to its existing stock option plan, it has granted an aggregate of 1,450,000 stock options (the "Options") to directors, officers, and consultants of the Company. These Options are exercisable at C$0.80 per share and expire five (5) years from the date of grant, subject to applicable regulatory approvals.

ABOUT Forte Minerals CORP.

Forte Minerals Corp. is an exploration company with a strong portfolio of high-quality copper (Cu) and gold (Au) assets in Peru. Through a strategic partnership with GlobeTrotters Resources Perú S.A.C. , the Company gains access to a rich pipeline of historically drilled, high-impact targets across premier Andean mineral belts. The Company is committed to responsible resource development that generates long-term value for shareholders, communities, and partners.

On behalf of Forte Minerals CORP.

(signed) " Patrick Elliott"

Patrick Elliott, MSc, MBA, PGeo

President & Chief Executive Officer

Forte Minerals Corp.

For further information, please contact:

Investor Inquiries

Kevin Guichon, IR & Capital Markets

E: kguichon@forteminerals.com

C: (604) 612-9976

Media Contact

Anna Dalaire, VP Corporate Development

E: adalaire@forteminerals.com

T: (604) 983-8847

info@forteminerals.com

www.forteminerals.com

Follow Us On Social Media : LinkedIn | Instagram | X | Meta | The Drill Down; Newsletter

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements relating to the intended use of proceeds of the Strategic Placement. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the Company with respect to the matter described in this press release. Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors and Uncertainties" in the Company's latest management's discussion and analysis, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future.

Forward-looking statements are not a guarantee of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include the continued availability of capital and financing, and general economic, market or business conditions. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, there can be no assurance that the statements will prove to be accurate or that management's expectations or estimates of future developments, circumstances or results will materialize. The Company assumes no responsibility to update or revise forward-looking information or statements to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company's forward-looking statements.

Neither the Canadian Securities Exchange (the "CSE") nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/75063682-5dba-4c3f-a217-79a1b9b82868