Highlights:

- Drill program follows the successful completion of an Ambient Noise Tomography Survey

- First drillhole to target the unconformity above a historic zone of anomalous uranium

Foremost Clean Energy Ltd. ( NASDAQ: FMST ) ( CSE: FAT ) ("Foremost" or the " Company ") is pleased to announced that crews have mobilized to commence an anticipated 8-hole, 2,500m diamond drill at its Murphy Lake South Uranium Property (" Murphy ") located in the world-renowned Athabasca Basin region of northern Saskatchewan. The Phase 1 fully-funded diamond drill program follows the successful completion of the Company's ambient noise tomography (" ANT ") survey, announced July 21, 2025 which generated a 3D velocity model to optimize drill hole placement to test high-priority target areas at Murphy. A Phase 2 follow-up program can be expected for the 20252026 winter drill season program to expand upon any initial exploration results.

" The Murphy Lake South drill program will test high-priority targets in a world-class uranium district. This strategic exploration is particularly timely, as recent production cuts from major producers like Cameco are forecast to further tighten uranium supply, highlighting the critical need for new discoveries." comments Jason Barnard President and CEO of Foremost.

"W e are excited to build on the results of our ANT survey, which provides a much sharper picture of the subsurface architecture to refine our targeting in the hopes of turning historic anomalies into a uranium discovery. Testing the up-dip potential of the mineralized graphitic structure at drill hole MP17-19 is a compelling opportunity, as it represents a classic setting for unconformity-hosted uranium deposits. By combining modern geophysics with these proven geological controls, we are methodically and systematically evaluating the highest-priority targets and are positioning Foremost for potential meaningful discovery."

Drill Program Overview

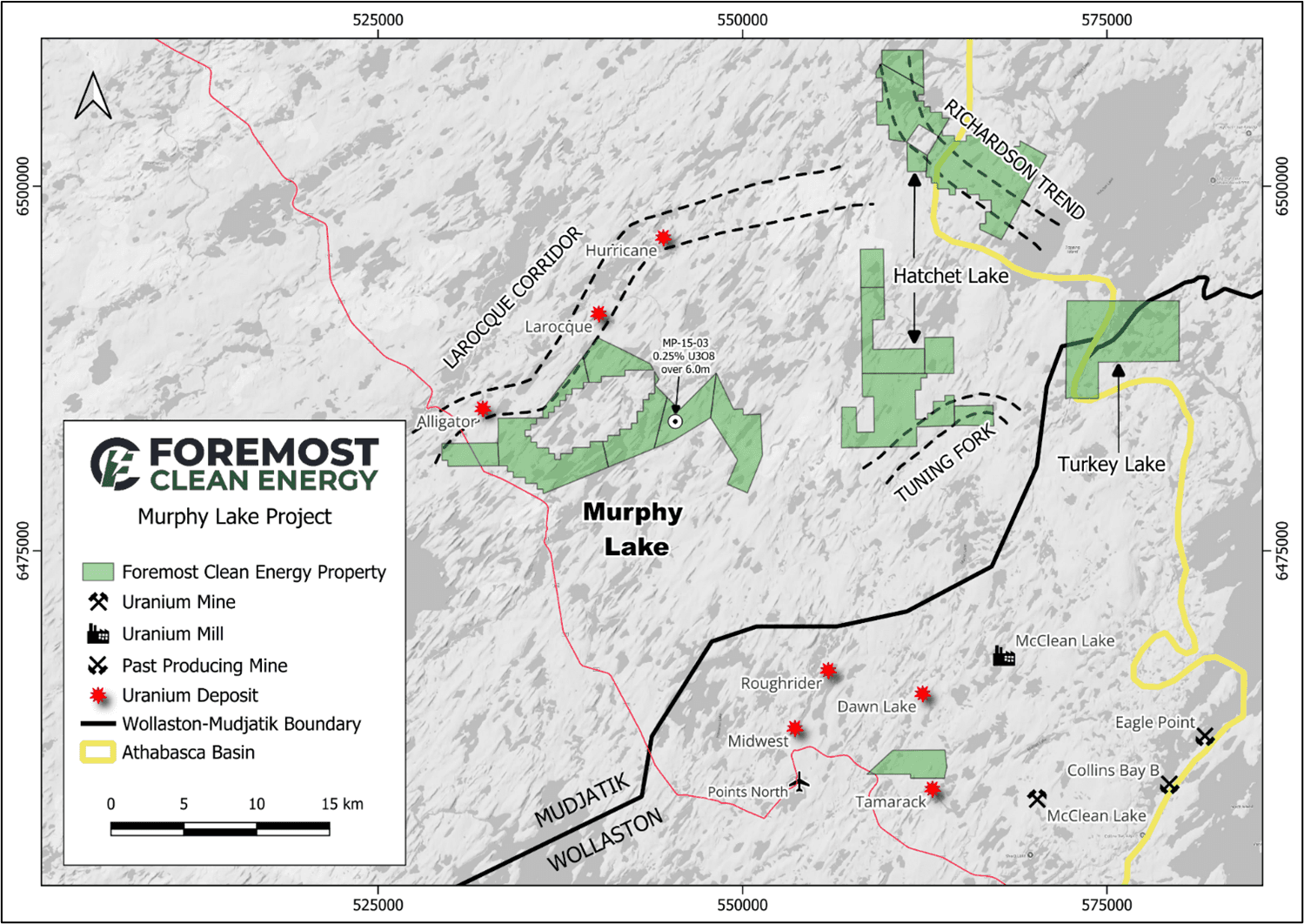

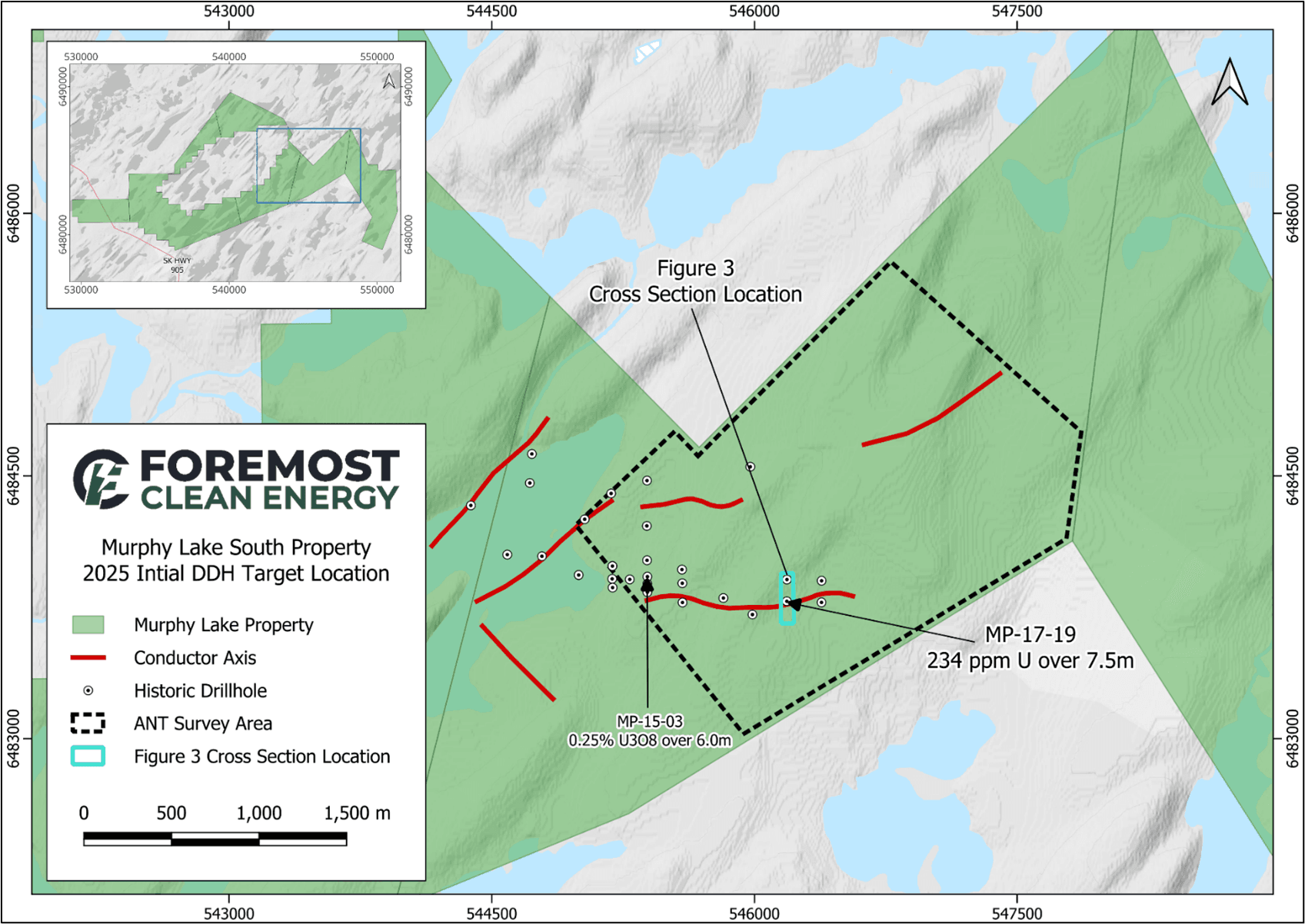

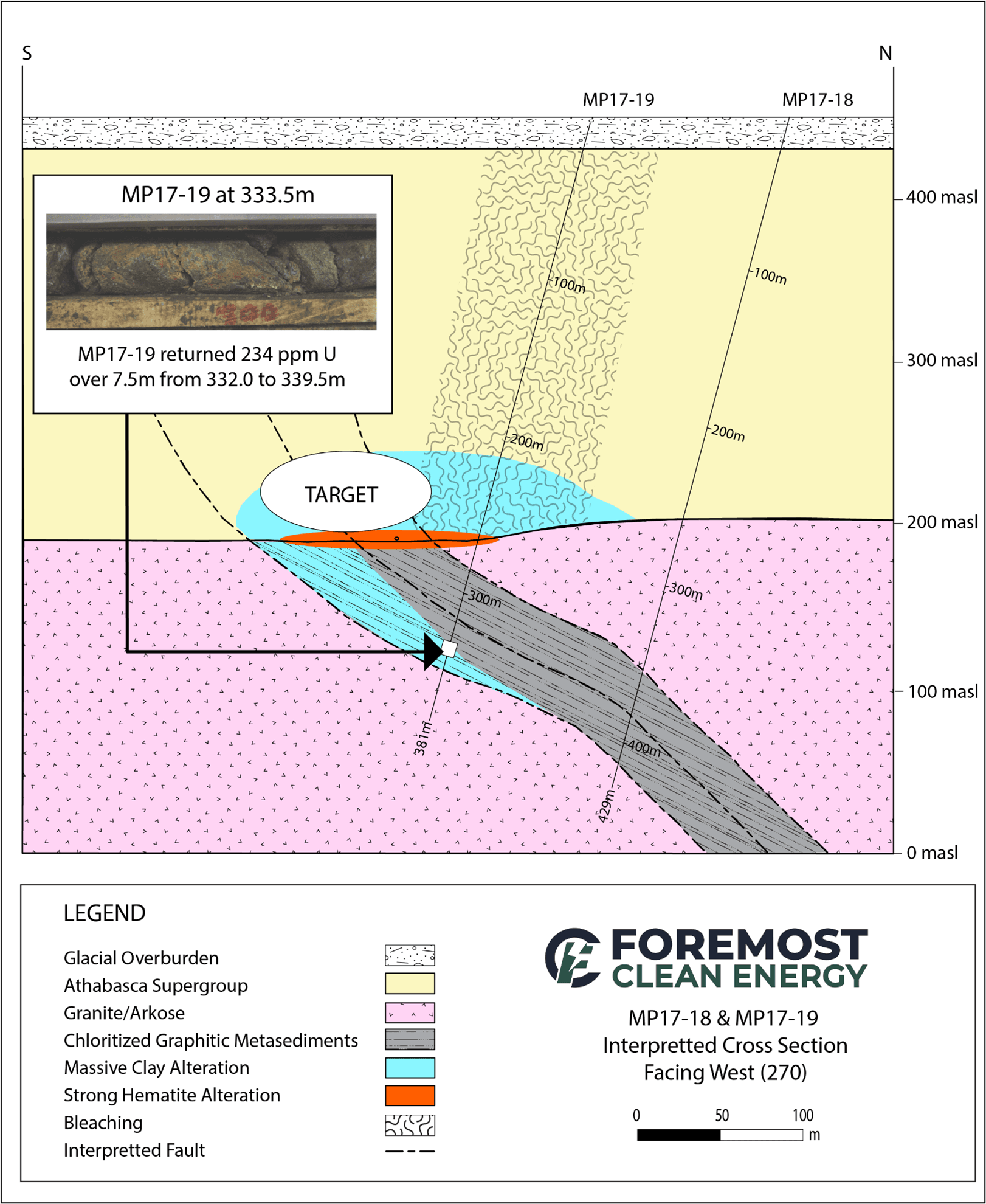

Murphy is situated in the eastern Athabasca Basin within the Mudjatik Domain, a region with strong uranium potential (see figure 1 below). Recent exploration successes along the LaRocque corridor have underscored the potential of this area often overshadowed by the eastern Athabasca's Wollaston Domain. The first hole of the program will test the up-dip projection of drill hole MP17-19, which previously intersected 7.5 metres of 234 ppm U 1 (see figures 2 and 3 below) within a graphitic structure in the basement rocks. This significant interval has remained a priority follow-up target representing an ideal setting for unconformity-style uranium mineralization. Drillhole depths are expected to be between 300 and 450 metres.

Results of the ANT survey were processed to generate a 3D velocity model of the subsurface to enhance targeting confidence by imaging structural offsets, fault zones, and alteration halos in both the sandstone and basement rocks. Similar surveys in the Athabasca Basin have demonstrated the ability to identify velocity anomalies that correlate with known uranium deposits, such as IsoEnergy's Hurricane Deposit. Murphy Lake 3D velocity model results assisted with drill hole placement and to optimize the testing of high-priority conductive corridors.

The 17,676 acre/7,153 hectare Murphy Lake South Project is situated approximately 30km northwest of the McClean Lake mill and lies adjacent to the LaRocque Lake Conductive Corridor, host to IsoEnergy's Hurricane Deposit, one of the world's highest-grade published indicated uranium resources of 48.6Mlbs U 3 O 8 at 34.5% U 3 O 8 and inferred resource of 2.7Mlbs at 2.2% U 3 O 8 2 . Historical drilling on the property by Denison intersected anomalous uranium mineralization and key alteration signatures, such as:

- 0.25% U₃O₈ over 6 meters (drill hole MP-15-03) 3

- 0.13% U₃O₈ over 12.5 meters just above the unconformity (drill hole MP-16-11) 4

- 0.03% U₃O₈ over 22.5 meters from 255 to 277.5 meters (MP-16-17) 5

The Company believes that these results, together with confirmed structural complexity make Murphy a compelling Property for a uranium discovery.

Figure 1. Murphy Lake South Property – Regional Map

Figure 2. Murphy Lake South Property – 2025 Initial DDH Target Location

Figure 3. MP17-18 and MP17-19 Interpreted Cross Section and Initial Target Area

Qualified Person

The technical content of this news release has been reviewed and approved by Cameron MacKay, P. Geo., Vice President of Exploration for Foremost Clean Energy Ltd., and a Qualified Person under National Instrument 43-101.

A qualified person has not performed sufficient work or data verification to validate the historical results in accordance with National Instrument 43-101. Although the historical results may not be reliable, the Company nevertheless believes that they provide an indication of the property's potential and are relevant for any future exploration program.

About Foremost

Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) (WKN: A3DCC8) is a rapidly growing North American uranium and lithium exploration company. The Company holds an option from Denison Mines Corp. ("Denison") to earn up to a 70% interest in 10 prospective uranium properties (with the exception of the Hatchet Lake, where Foremost is able to earn up to 51%), spanning over 330,000 acres in the prolific, uranium-rich Athabasca Basin region of northern Saskatchewan. As the demand for carbon-free energy continues to accelerate, domestically mined uranium and lithium are poised for dynamic growth, playing an important role in the future of clean energy. Foremost's uranium projects are at different stages of exploration, from grassroots to those with significant historical exploration and drill-ready targets. The Company's mission is to make significant discoveries alongside and in collaboration with Denison through systematic and disciplined exploration programs.

Foremost also has a portfolio of lithium projects at varying stages of development, which are located across 55,000+ acres in Manitoba and Quebec. For further information, please visit the Company's website at www.foremostcleanenergy.com

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Follow us or contact us on social media:

X: @fmstcleanenergy

LinkedIn: https://www.linkedin.com/company/foremostcleanenergy

Facebook: https://www.facebook.com/ForemostCleanEnergy

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute "forward-looking statements" as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect," "is expected," "anticipates" or "does not anticipate," "plans," "estimates" or "intends," or stating that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the option agreement with Denison, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company's ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company's filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company's most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov for further information respecting the risks affecting the Company and its business.

The CSE has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

1 Saskatchewan Mineral Assessment File MAW02389

2 Technical Report on the Larocque East Project, Northern Saskatchewan, Canada, effective July 8, 2022, prepared by SLR Consulting (Canada) Ltd., available under IsoEnergy's profile on ww.sedarplus.ca.

3 Saskatchewan Mineral Assessment File MAW01724

4 Saskatchewan Mineral Assessment File MAW02234

5 Saskatchewan Mineral Assessment File MAW02243

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/915f88dd-2080-490e-87d8-96a0f1dafb84

https://www.globenewswire.com/NewsRoom/AttachmentNg/e1e89303-24d3-4b7e-8a6c-88b3222518fb

https://www.globenewswire.com/NewsRoom/AttachmentNg/93970cd3-26c5-4420-89d9-0eda84f5deba