Westgold enhances capital management programmes in FY26

Westgold Resources Limited (ASX: WGX) (TSX: WGX) (Westgold or the Company) is pleased to announce the declaration of a 3 cents per share (cps) final dividend for FY25, an enhancement to its dividend policy for FY26, and an on-market share buy-back programme of up to 5% of Westgold's ordinary shares ( Westgold Shares ) over the next 12 months ( Share Buy-Back ).

Highlights

FY25 - Final dividend of 3cps declared

- 78% dividend payout ratio

FY26 - Dividend policy enhanced

- Minimum dividend per share increased by 100% - to 2cps

FY26 – Board approves a buy-back of up to 5% of Westgold Shares

- Executed at the Company's discretion in on-market purchases - throughout the next 12 months

Westgold Managing Director and CEO Wayne Bramwell commented:

"In conjunction with our 3cps ( $28.3M ) dividend announced today, the Share Buy-Back is a clear signal of confidence from Westgold in the Company's ability to generate future cash flows and return capital to shareholders.

FY25 was a transformational year – we integrated the Southern Goldfields assets, invested in key mine infrastructure across the Group and delivered record gold production of 326koz. Our FY25 financial results reflect this growing scale, and while we have work to do in FY26 to deliver consistent operational outputs, we demonstrated the latent capability within Westgold's portfolio.

Against this backdrop, our stock remains materially undervalued. As part of an enhanced capital management programme, a Share Buy-Back rewards our shareholders by increasing their interest in a business that is poised to self-fund an increase in cash generation, gold production, market relevance and value."

FY25 final dividend

In recognition of solid financial performance in FY25 and after considering Westgold's forecast cash flows, Westgold's Board of Directors ( Westgold Board ) has approved a 3cps unfranked final dividend for FY25.

The total dividend of $28.3M represents a dividend payout ratio of 78% and will be paid out on 10 October 2025. The ex-dividend date for ASX purposes is 11 September 2025 , with the record date being 12 September 2025 .

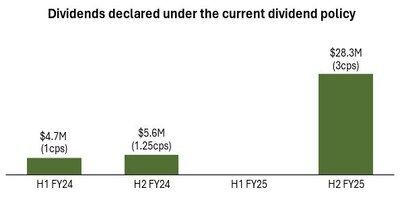

Since the inception of Westgold's dividend policy in FY24, Westgold has paid a total of $38.6M in dividends.

FY26 dividend policy

In recognition of Westgold's new operating scale, capability to generate cashflow, and with a view to improving shareholder returns, the Westgold Board has elected to update and enhance Westgold's dividend policy.

The updated FY26 dividend policy 1 will:

- increase the minimum dividend per Westgold Share from 1cps ( $0.01 /Westgold Share) to 2cps ( $0.02 /Westgold Share); and

- increase the required minimum net cash balance from $100M to $150M (after the payment of any dividend).

On-market Share Buy-Back

The Company is pleased to announce that the Westgold Board has approved the on-market Share Buy-Back programme of up to 5% 2 of Westgold Shares, to be undertaken over the next 12 months, unless completed or terminated earlier. The Share Buy-Back will be undertaken in compliance with Australian and Canadian securities laws with all purchases made through the facilities of the ASX.

Westgold cash flow will continue to lift in FY26 with projected free cash flows enabling the Company to fund ongoing organic growth and pay dividends. As the business evolves, our capital management strategies evolve in unison, with the addition of a Share Buy-Back programme reflecting the Company's confidence in the intrinsic value within our portfolio and the business outlook.

Under the Share Buy-Back programme, the Company proposes to acquire a maximum of 47,183,455 Westgold Shares being 5% of the Westgold Shares on issue and thus is within the "10/12 limit" as defined in section 257B (4) of the Corporations Act 2001 (Cth) ( Corporations Act ) and the size limits prescribed by Canadian securities laws and accordingly does not require shareholder approval.

The number of Westgold Shares purchased (if any), is subject to prevailing share prices 3 and market conditions and will be executed at the Company's discretion through on-market purchases throughout the next 12 months.

Full details of the Share Buy-Back are detailed in the Appendix 3C filed with ASX today.

This announcement is authorised for release to the ASX by the Westgold Board.

Compliance Statements

Forward Looking Statements

These materials prepared by Westgold include forward looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward looking words such as "may", "will", "expect", "intend", "believe", "forecast", "predict", "plan", "estimate", "anticipate", "continue", and "guidance", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on the Company and its management's good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company's business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the Company's business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company's control.

Although the Company attempts, and has attempted, to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. In addition, the Company's actual results could differ materially from those anticipated in these forward-looking statements as a result of the factors outlined in the "Risk Factors" section of the Company's continuous disclosure filings available on SEDAR+ or the ASX, including, in the Company's current annual report, half year report or most recent management discussion and analysis.

Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances.

_________________________

| 1 Subject to the full discretion of the Westgold Board, taking into consideration Westgold's underlying financial performance and cash flow, commodity price expectations, balance sheet and treasury risk management, working capital needs and competing internal and external investment opportunities necessary for future growth, development and exploration and any other factors that the Westgold Board may consider relevant. Free cash flow is defined as net cash flows from operating and investing activities before debt/equity and dividends. |

| 2 The 5% limit on the Share Buy Back programme is a requirement of the TSX. |

| 3 In accordance with the ASX Listing Rules, Westgold Shares will not be purchased at a price exceeding 5% above the volume-weighted average price of Westgold Shares over the five trading days prior to the purchase. In accordance with Canadian securities laws, the value of the consideration paid for the Westgold Shares will not be greater than the market price, plus reasonable brokerage fees or commission actually paid. For the purposes of Canadian securities laws, "market price" is defined as the simple average of the closing price of Westgold Shares for each of the business days on which there was a closing price in the 20 business days preceding the date of acquisition. |

SOURCE Westgold Resources Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/27/c5740.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/27/c5740.html