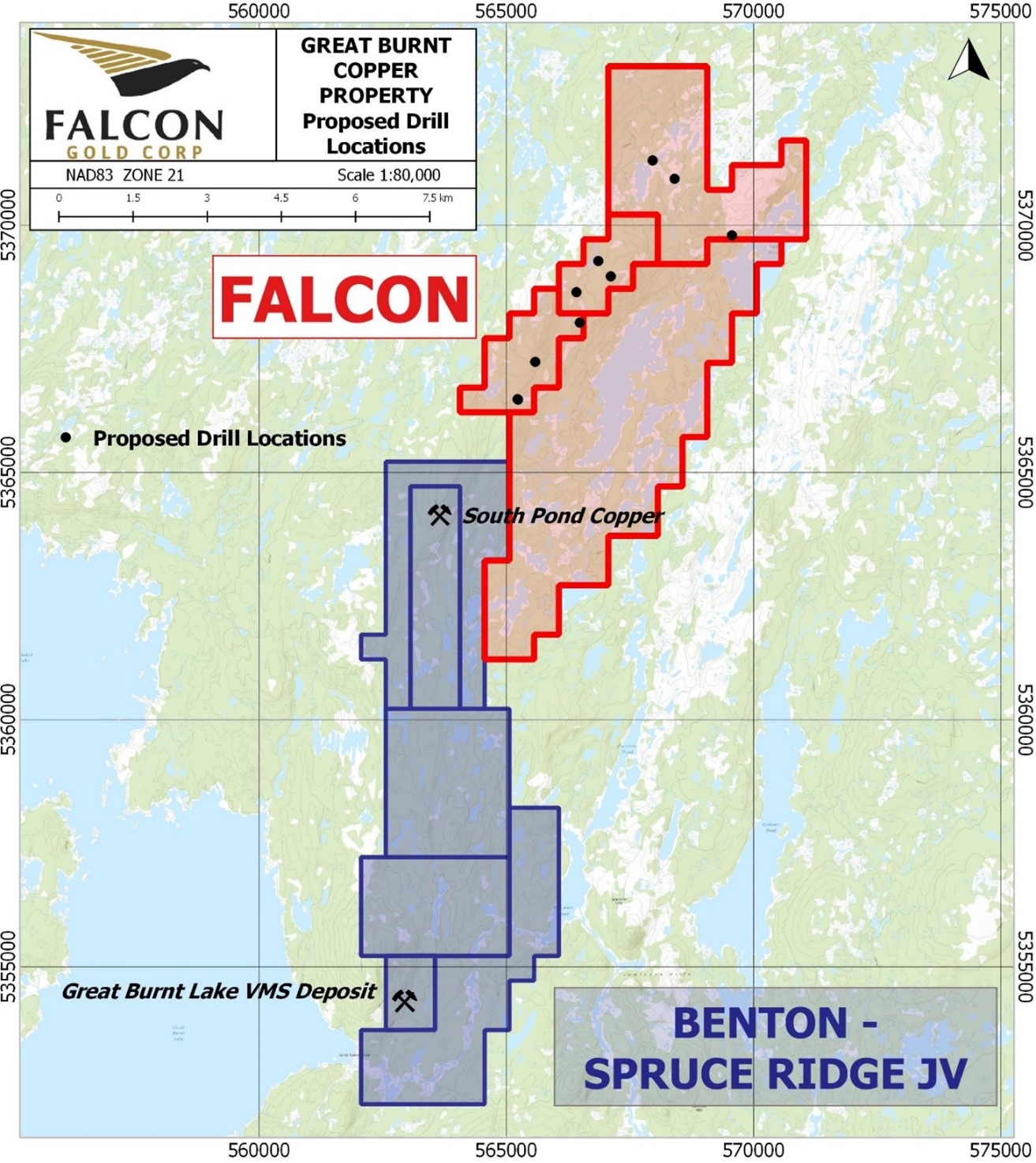

Falcon Gold Corp. (TSXV:FG)(GR:3FA)(OTCQB:FGLDF); ("Falcon" or the "Company") is pleased to announce that the Company is to commence drilling at its 100% owned Great Burnt Copper Project in Central Newfoundland. The Company plans to test up to ten geophysical anomalies with a maximum of 1100 metres of drilling

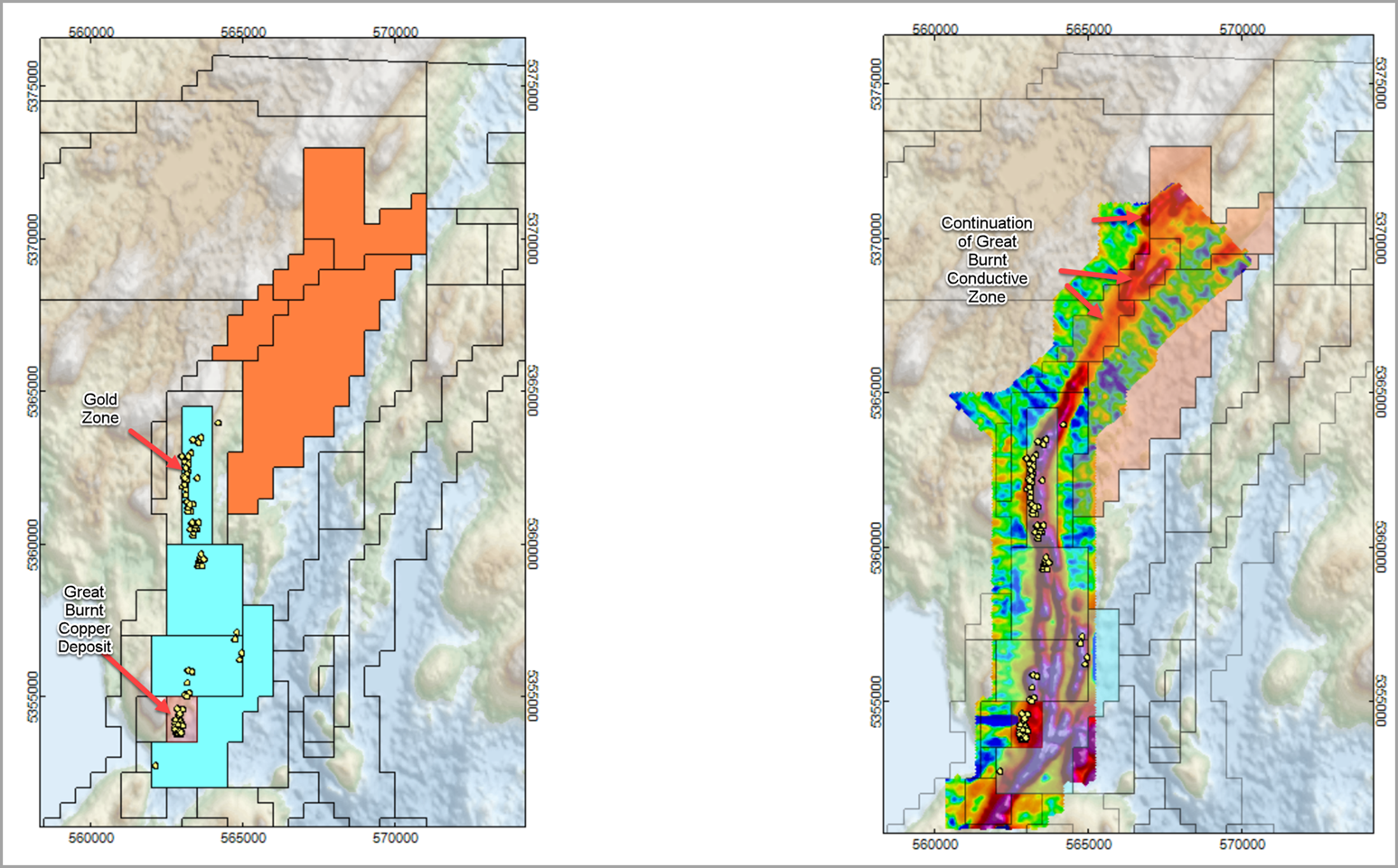

Falcon holds 2,275 hectares in the Great Burnt camp, with licenses located north of, and contiguous to, Benton Resources Inc. - Spruce Ridge Resources Ltd. Great Burnt Copper-Gold joint venture (see Figure 1). Benton Resources Inc. ("Benton") recently optioned the Great Burnt Copper-Gold Project from Spruce Ridge Resources Ltd. ("Spruce Ridge") in an agreement that allows Benton to earn a 70% interest in the property (see press release dated August 17, 2023). The Benton-Spruce Ridge property is host to the Great Burnt Copper Zone, a deposit with an indicated resource of 381,300 tonnes at 2.68% Cu and inferred resources of 663,100 tonnes at 2.10% Cu (https://www.spruceridgeresources.com/great-burnt.php). Recent drilling by Benton at the Great Burnt Copper Deposit reported drill results that returned 7.20% Cu, 7.12 g/t Ag, and 0.05% Co over 12.30 metres (see press release dated December 5, 2023). Previous drilling in 2020 by Spruce Ridge reported 8.06% Cu over 27.2 m (TSXV: SHL press release dated March 18, 2021).

The Great Burnt Greenstone Belt is prospective for copper and gold, and further hosts the South Pond A and South Pond B copper-gold zones, and the End Zone copper prospect along a 14 km mineralized corridor. The mineralized corridor occurs along a conductive trend, and this conductive trend continues into Falcon's Great Burnt Copper Property (see right-hand-side image in Figure 2).

Karim Rayani, Chief Executive Officer, commented; "We are very excited to move forward on our first phase of drilling at our Great Burnt Copper Project. Drilling along the Great Burnet copper trend by neighbour Benton Resources has shown significant success. We believe that Benton's recent success at Great Burnt is a testament to the untapped VMS potential of the Great Burnt area, and we are thrilled to hold an extensive strike extent of this unexplored, never-drilled horizon."

The Great Burnt Copper Property

The property is hosted within the Great Burnt Greenstone Belt (GBGB) which hosts massive sulphide deposits that have been interpreted as Besshi-type copper-rich VMS. These types of deposits generally occur as laterally extensive sheets of pyrrhotite- or pyrite-rich sulphide rock within mixed volcanic-sedimentary environments. Sulphide lenses can be several metres thick and extend for several kilometres. Besshi-type massive-sulphide deposits are generally copper dominant, commonly contain other lithophile elements like cobalt or lead, and can contain precious metals such as gold and silver. The property is also located four km west of the Crest Resources-Exploits Discovery joint venture project within the Exploits Subzone. The Exploits Subzone contains deep-seated gold-bearing structures of the Dog Bay-Appleton Fault-GRUB Line deformation corridor that contains the high-grade Keats Gold Zone of New Found Gold Corp.

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Falcon Gold Corp.

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km southeast of Agnico Eagle's Hammond Reef Gold Deposit which has currently an estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major northeast-trending splay of the QFZ.

The Company holds multiple additional projects: the Viernes and Area 51 Gold/Silver/Copper projects in the world class copper cluster located Antofagasta Chile; the Springpole West Property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario; the Spitfire-Sunny Boy, and Gaspard Gold claims in B.C.; the Great Burnt, and Golden Brook projects adjacent to First Mining, Matador, Benton-Sokoman's JV, and Marvel Discovery in Central Newfoundland; and most recently battery metals projects, Timmins West Nickel-Copper-Cobalt Property Ontario, Outarde Nickel-Copper-Cobalt Property, HSP Nickel -Copper property in northern Quebec and the Havre St. Pierre Anorthosite Complex respectively.

CONTACT INFORMATION:

Falcon Gold Corp.

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

CHF Capital Markets

Cathy Hume

Chief Executive Officer

Telephone: (416) 868-1079 x 251

Email: cathy@chfir.com

Website: www.falcongold.ca

Twitter: @FalconGoldCorp

Facebook: @FalconGoldCorp

LinkedIn: @FalconGoldCorp

Instagram: @FalconGoldCorp

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Language and Forward-Looking Statements

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

SOURCE: Falcon Gold Corp.

View the original press release on accesswire.com