Fabled Silver Gold Corp. ("Fabled" or the "Company") (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) wishes to announce that its option agreement (the "Santa Maria Option Agreement") with Golden Minerals Company ("GMC") (NYSE American and TSX: AUMN) with respect to the Santa Maria Project will be terminated as of February 22, 2023

In addition the Company announces that on February 17, 2023 it entered into a binding letter of intent (the "Mecatona Agreement") with an arm's length vendor, Kootenay Silver Inc. (TSXV: KTN) ("Kootenay" or the "Vendor") to acquire the Mecatona Property (the "Mecatona Property") located in Chihuahua, Mexico (the "Proposed Transaction").

Fabled also announces that it has terminated its previously announced private placement, as described in its news release dated January 12, 2023 (the "Private Placement"). No subscriptions were closed pursuant to the Private Placement and therefore no cash sums were raised or securities issued.

Peter Hawley, President and CEO comments; "The planned use of the proceeds of the Private Placement included definition drilling on the Santa Maria Project. Current investment interest allowed either for making required property payments under the Santa Maria Option Agreement or putting the money in the ground by drilling, not both. Unfortunately an amendment to the property payment schedule under the Santa Maria Option Agreement was not able to be reached. This being the case the Company decided to cancel Private Placement.

In early 2022, the Company's Mexico team began a regional review and exploration program applying what was learned on the Santa Maria Project in respect to structures, breccias and hydrothermal and epithermal mineralization. This led the Company to the Mecatona Property for which we are delighted to have made an agreement to acquire."

Termination of Santa Maria Option Agreement

Following a review process by the Company's board of directors, and consultation with GMC, the Company has determined that is unable to make the required payments under the Santa Maria Option Agreement. This is due to the Company's current cash position and the unavailability of suitable financing to continue to make such payments and conduct sufficient work on the Santa Maria Project that would justify the Company's continued interest therein. The Company has received a notice of default from GMC and the Company expects the Agreement will be terminated as of February 22, 2023.

The Company would like to thank GMC for its cooperation during the period of the Santa Maria Option Agreement and expects to work with GMC to ensure an orderly termination of the relationship between the two companies.

Letter of Intent

Pursuant to the Mecatona Agreement, in consideration for acquiring 100% of the Mecatona Property Fabled expects to issue to the Vendor, on closing of the Proposed Transaction, two million (2,000,000) common shares of Fabled.

Fabled will also make a periodic payment of US$10,000 to the Vendor on January 13 and July 13, of each year (the "Periodic Payments") and upon commencement of commercial production pay to the Vendor the greater of US$15,000 or a 2% net smelter royalty ("NSR"), each paid on a quarterly basis.

No finders fee is payable in respect of the Proposed Transaction.

The Proposed Transaction is subject to customary closing conditions, including, among other things, receipt of requisite approvals from the TSX Venture Exchange (the "TSXV").

Fabled expects the Proposed Transaction to be a Fundamental Acquisition (as such term is defined in the policies of the TSXV) and therefore expects the common shares of Fabled to be halted until completion of the Proposed Transaction.

Information regarding the Mecatona Property

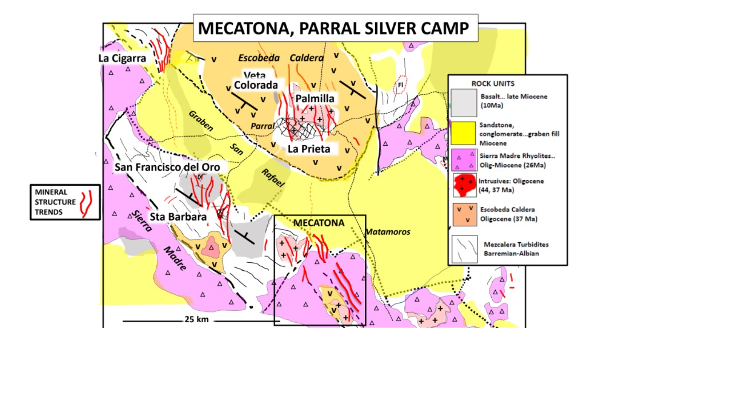

The Mecatona Property consists of 2,857 hectares in the Parral Silver Mining District, located south of the City of Parral in Chihuahua State, Mexico and 7 kilometers southeast of the Company's past Santa Maria Project.

Previous work conducted on the Mecatona Property by Kootenay in 2018 (see Kootenay's news release dated October 29, 2018) consisted of 78 samples taken, which include both channel and grab samples, reported silver values ranging from trace to a high of 735 g/t and gold values ranging from trace to 6.94 g/t. Appreciable base metals are also present within the mineralized system with lead and zinc values returning up to 3.5% and 8.0%, respectively. See Figure 1.

Figure 1: Property location Map

The Property covers a silver-dominant epithermal mineral system hosted in veins and breccias. One mineralized structure had been traced for +1.7 kilometer by Kootenay and remains open along strike. Early stages of exploration by Kootenay also outlined other anomalous areas including a northeast trending zone outlined by stockworks and quartz veinlets within an 80 meter-wide argillic alteration zone.

A second phase reconnaissance exploration program completed at the Mecatona Property in 2019 by Kootenay (see Kootenay's news release dated Match 20, 2019) was successful in the discovery of a previously unknown silver, copper, gold zone hosted in pervasive skarn-altered Lower Cretaceous turbidites of the Mezcalera Group.

Silver, copper, gold and anomalous cobalt mineralization is distributed in a 200 by 400 meter zone with apparent uniformity. Highlights of the program include 51 samples (29 chips averaging 1 meter in length, 17 grabs and 5 dump) taken across the new zone returning silver values averaging 110 g/t with a high of 486 g/t silver.

Additional highlights of all samples taken within the mineralized zone include 12 of 51 samples grading > 100 g/t silver with 86% returning values greater than 20 g/t silver. Furthermore, the average of all 51 samples assayed for copper was 1.7% with 30 samples returning greater than 1%.

Fabled's initial due diligence work during 2022 and 2023 has been directed to systematic sampling of all old workings at the Mecatona Property to establish the apparent continuity of mineralization.

Fabled's initial exploration plan at the Mecatona Property (assuming completion of the Proposed Transaction) is expected to consist of mapping out and defining the mineralized structures, ground geophysics and LiDAR surveys. Although the Mecatona Property hosts several small to medium sized old workings there is no evidence of any modern exploration including drilling.

Based on the length of mineralized structures, adjacent producing properties and the context within the Parral-San Francisco Del Oro-Santa Barbara mineral camps, the Company believes the Mecatona Property has the potential to host high grade vein type silver deposits.

Regionally, the Property is part of the larger, productive Parral Silver District that includes the Santa Barbara and San Francisco del Oro mining facilities, Endeavour Silver's Veta Colorada and La Pamilla projects and Kootenay's La Cigarra deposit.

Resignation and Appointment of Directors

The Company also reports the resignations of David W. Smalley as Chairman and Director of the Company and Roger Scammell as Director of the Company effective February 16 and February 17, 2023, respectively. Mr. Smalley and Mr. Scammell have each resigned in order to concentrate on other opportunities.

The Company is pleased to announce that Mr. Chris Zerga has agreed to join the board of directors of the Company effective February 17, 2023.

Mr. Zerga has over 37 years of mining operations and management experience in Nevada with companies which include Newmont, Freeport McMoran, Anglo Gold, Minorco and Queenstake.

Mr. Zerga is currently the President, CEO and Director of Scorpio Gold Corporation and has held various roles within that company since its inception in 2009. Mr. Zerga is also the General Manager for Rawhide Mining LLC located in Fallon Nevada since August, 2020. He is also currently a director of NSJ Gold Corporation with holdings located in Arizona.

The appointment of Mr. Zerga remains subject to the approval of the TSXV.

About Fabled Silver Gold Corp.

Fabled is focused on acquiring and exploring properties in Mexico. The Company has an experienced management team with multiple years of involvement in mining and exploration in Mexico. The Company's mandate is to focus on acquiring precious metal properties in Mexico with blue-sky exploration potential.

The Company has entered into a binding letter of intent with Kootenay Silver Inc. and is seeking to acquire the Mecatona Property located in the Parral Silver Mining District.

Contact Information:

Mr. Peter J. Hawley, President and C.E.O.

Fabled Silver Gold Corp.

Phone: (819) 316-0919

peter@fabledfco.com

For further information please contact: info@fabledfco.com

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulations Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Information

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition and development plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking information in this document includes statements concerning the Company's intention to complete the Proposed Acquisition and all other statements that are not statements of historical fact.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

SOURCE: Fabled Silver Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/740197/Fabled-Silver-Gold-Corp-Reports-Termination-of-Santa-Maria-Option-Agreement-Binding-Letter-of-Intent-for-Acquisition-of-Mecatona-Property-Termination-of-Private-Placement-Resignation-of-Directors-and-Appointment-of-New-Director