February 10, 2022

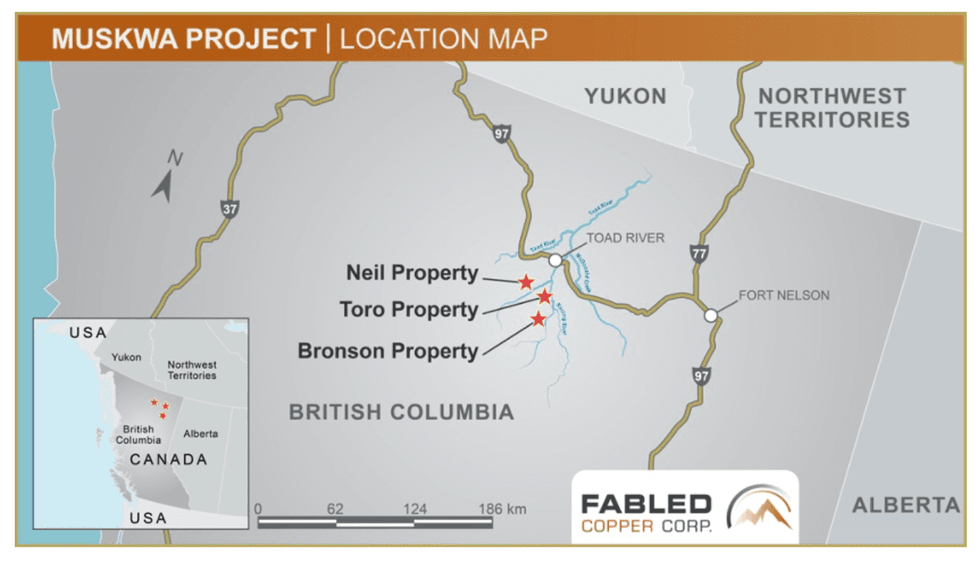

VANCOUVER, BC / ACCESSWIRE / February 9, 2022 / Fabled Copper Corp. ("Fabled Copper" or the "Company") (CSE:FABL);(FSE:XZ7) announces the fifth set of results of 2021 surface field work on it's Muskwa Copper Project comprised of the Neil Property (previously referred to as the North Block) and the Toro Property (previously referred to as the South Block) in Northwestern British Columbia. The Company also holds rights to the Bronson Property. See Figure 1 below.

"We started the New Year by reporting our findings on the Lady Luck occurrence in the south end of the Neil Property, followed by the Mac occurrence; the 8A copper occurrence, the Harris copper occurrence, and now the 2A copper occurrence in the central sector of the Neil Property.

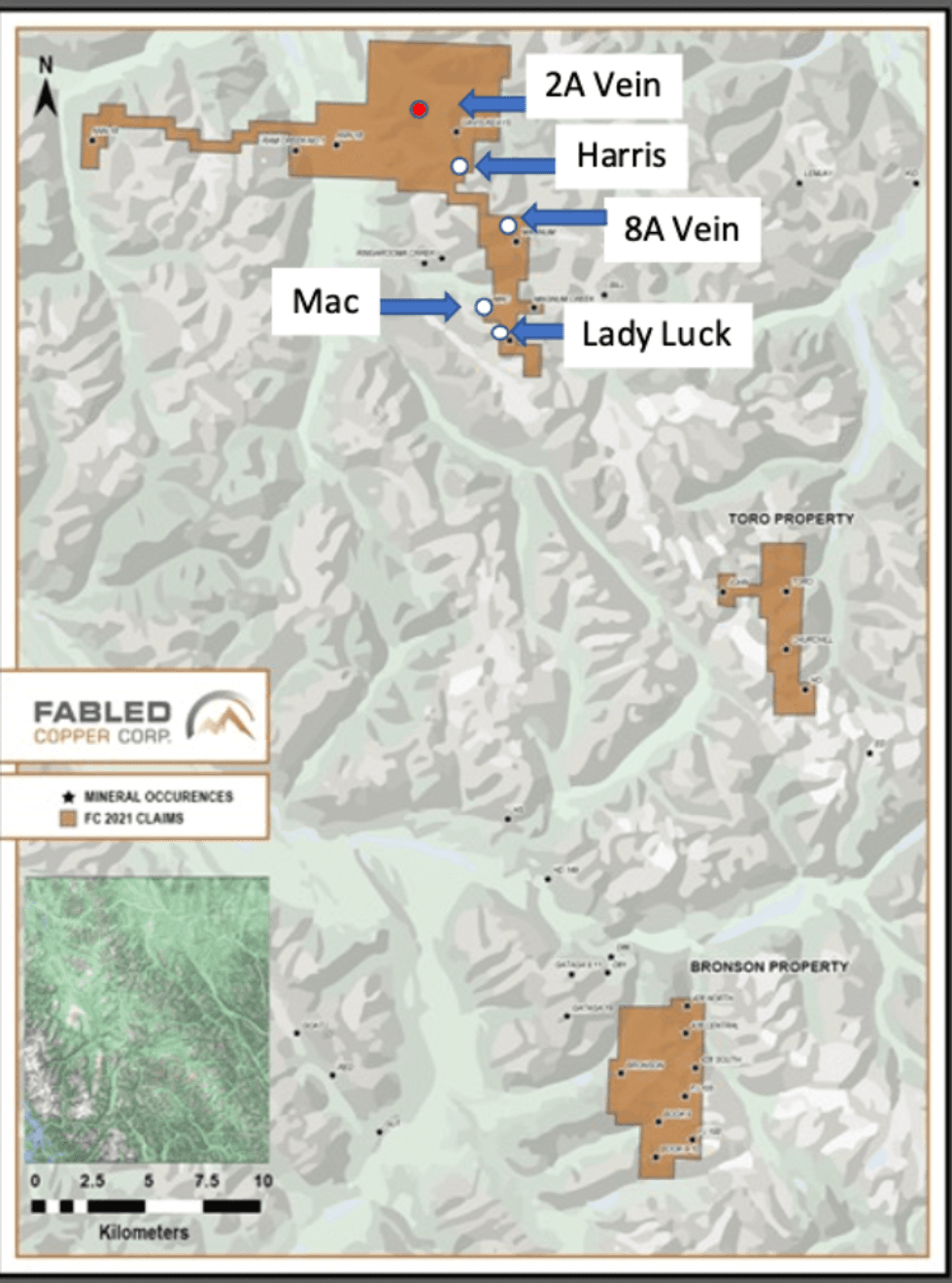

The 2A copper occurrence was sampled over a vertical distance of 56 meters starting from 1,401 meters. See Figure 2 below.

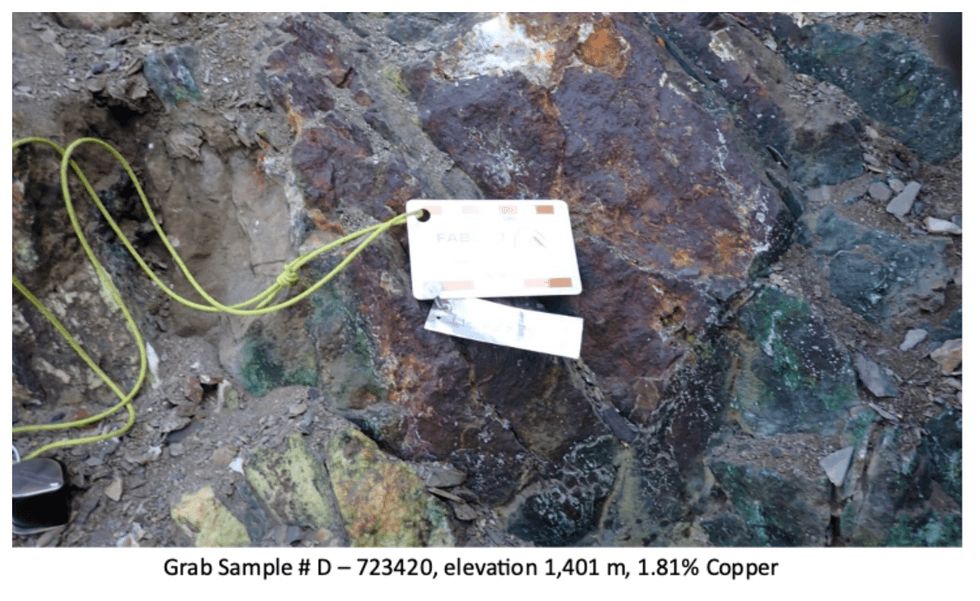

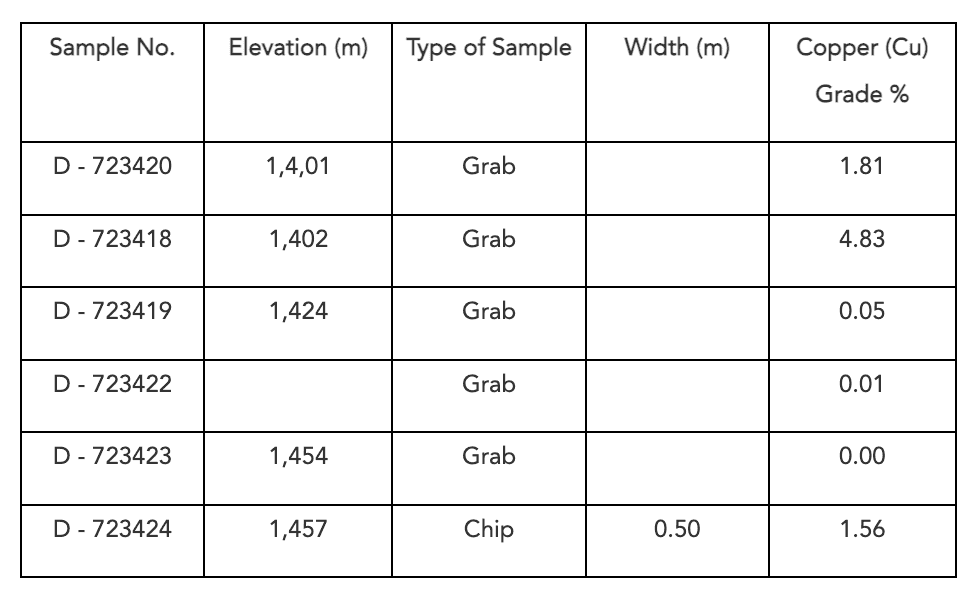

Grab sample D - 723420 taken at the 1,401 meter elevation consisted of quartz carbonate with iron staining. On the weathered surface it was white to light green in color with patches of dark brown and on the fresh surface it was white in color. It had moderate malachite copper alteration with 2% chalcopyrite as patches. This sample assayed 1.81% copper. See Table 1 and Photo 1 below.

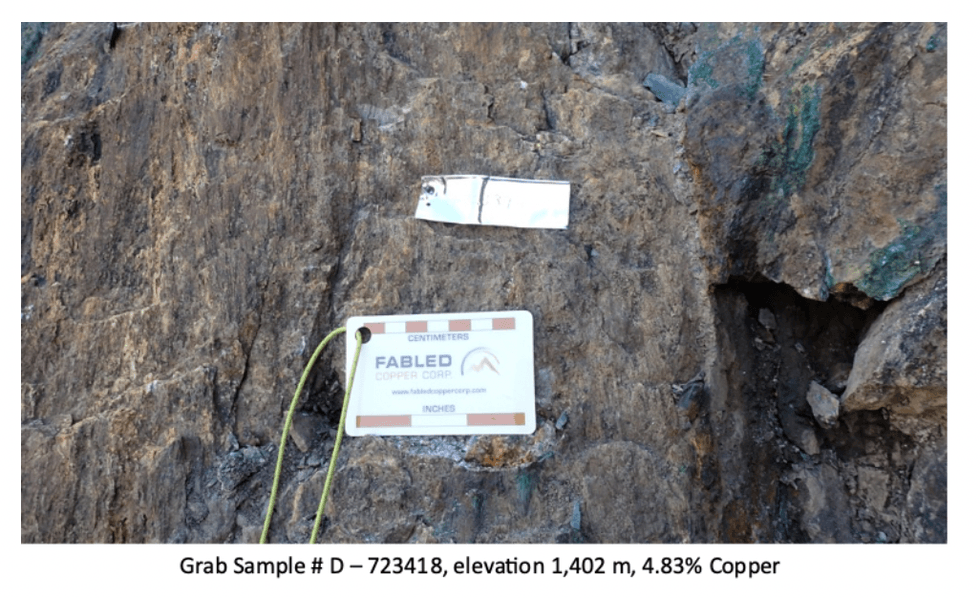

Grab sample D - 723418 was taken 1 meter vertical above the sample described above and consisted of quartz carbonate with vugs, patches of limonite with minor malachite copper alteration, with 10% chalcopyrite as patches, and with blebs and disseminations. This sample assayed 4.83% copper. See Table 1 and Photo 2 below.

Grab sample D - 723419 taken at the 1,424 elevation consisted of milk white quartz carbonate, with a trace of malachite alteration, and trace chalcopyrite. As expected, this sample returned 0.05% copper. See Table 1 below.

Random grab sample D - 723422 consisted of 90% carbonate and quartz with rusty limonite, goethite as patches and micro seams with no apparent sulphides present and as expected returned 0.01% copper. No altitude reading was collected.

Grab sample D - 723423 taken at 1,454 meters consisted of white carbonate in a weakly shared siltstone with no apparent sulphides present and as expected contained no copper.

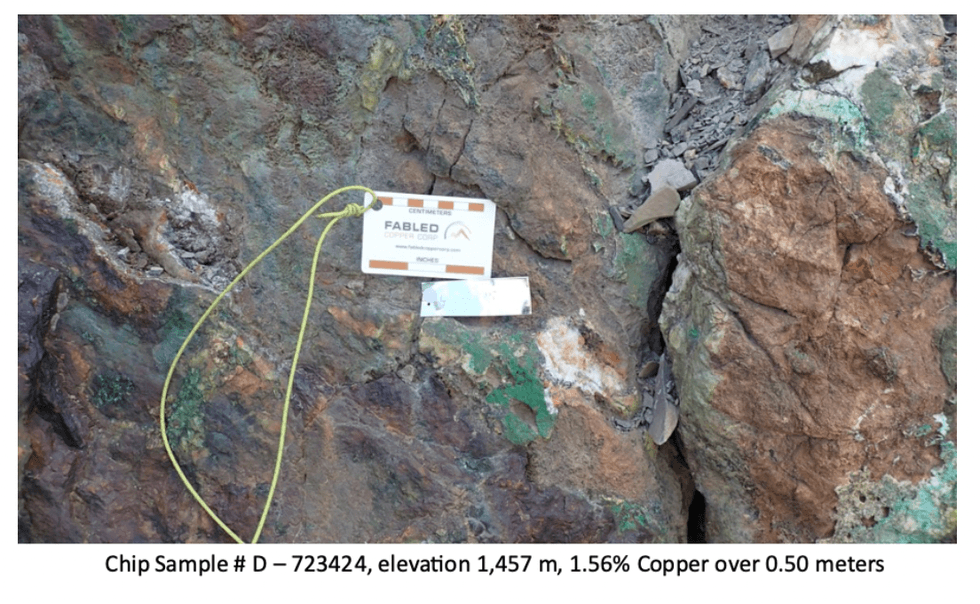

Chip sample D - 723424 was taken at the 1,457 meter elevation over a width of 0.50 meters and consisted of white quartz carbonate, with moderate malachite alteration, 4% chalcopyrite as patches and disseminations, and trace of bornite. This chip sample assayed 1.56% copper. See Table 1 above and Photo 3 below.

Table 1 - 2A Copper Occurrence - Neil Property

1% Copper per tonne = 22.20 lbs.

Moving Forwards

The Company will continue to evaluate the 2A copper occurrence as this copper occurrence has never been drilled and remains open in all directions.

QA QC Procedure

Analytical results of sampling reported by Fabled Copper Corp represent rock samples submitted by Fabled Copper Corp staff directly to ALS Chemex, Vancouver, British Columbia Canada. Samples were crushed, split, and pulverized as per ALS Chemex method PREP-31, then analyzed for ME-ICP61 33 element package by four acid digestion with ICP-AES Finish. ME-GRA21 method for Au and Ag by fire assay and gravimetric finish, 30g nominal sample weight.

Over Limit Methods

For samples triggering precious metal over-limit thresholds of 10 g/t Au or 100 g/t Ag, the following is being used:

Au-GRA21 Au by fire assay and gravimetric finish with 30 g sample.

Ag-GRA21 Ag by fire assay and gravimetric finish.

Fabled Copper Corp. monitors QA/QC using commercially sourced standards and locally sourced blank materials inserted within the sample sequence at regular intervals.

About Fabled Copper Corp.

Fabled Copper is a junior mining exploration company. Its current focus is to creating value for stakeholders through the exploration and development of its existing copper properties located in northern British Columbia. The Muskwa Project comprises a total of 76 claims in two non-contiguous blocks and totals approximately 8,064.9 hectares, located in the Liard Mining Division in northern British Columbia.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Copper Corp.

Phone: (819) 316-0919

peter@fabledcopper.org

For further information please contact:

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition and development plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

The Conversation (0)

24 February 2022

Fabled Copper

Exploring the Untapped Potential of Critical and Precious Metal Assets in British Columbia

Exploring the Untapped Potential of Critical and Precious Metal Assets in British Columbia Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

2h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00