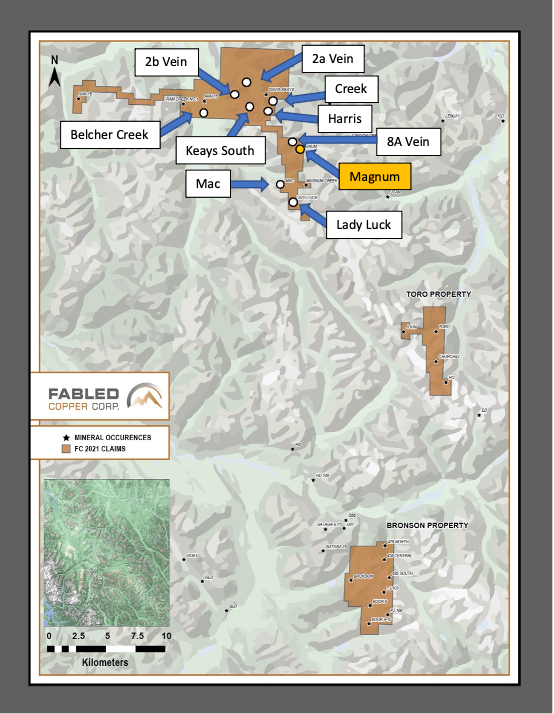

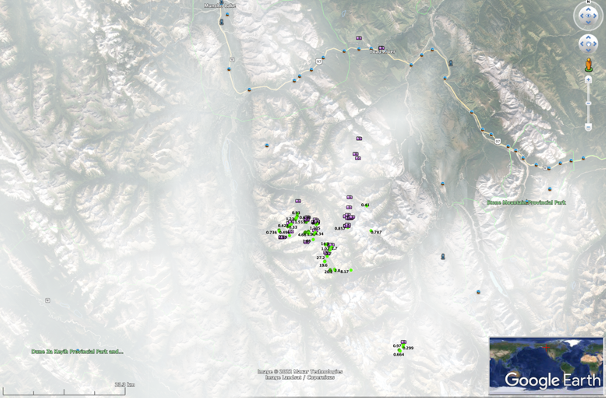

Fabled Copper Corp. ("Fabled Copper" or the "Company") (CSE:FABL)(FSE:XZ7) announces the 11th set of results of 2021 surface field work on it's Muskwa Copper Project comprised of the Neil Property and the Toro Property in Northern British Columbia. The Company also holds rights to the Bronson Property. See Figure 1 below

Figure 1 - Location Map

Peter Hawley, President, CEO reports; A total of 19 specific areas were mapped and prospected during the 2021 field season and we have previously reported our findings on the Lady Luck occurrence in the south end of the Neil Property, followed by the Mac; the 8A, Harris, the 2a and 2b, the Creek, Keays south, Belcher Creek, the Magnum Drone Survey Mission and now the Magnum Mine copper deposit." See Figure 2 below.

Figure 2- Neil Property, Magnum Mine Copper Deposit Location

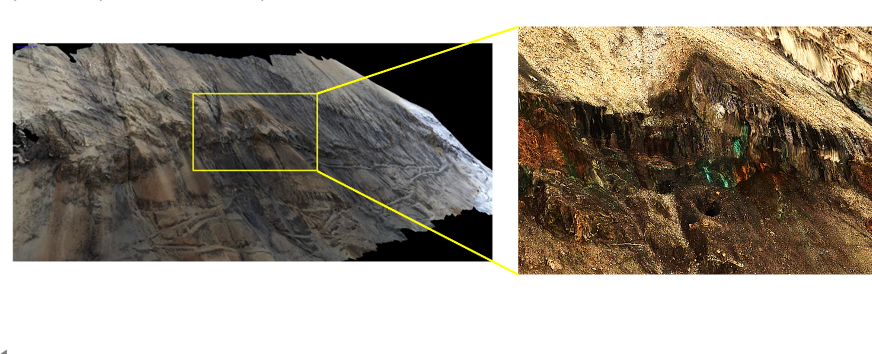

Mineralization at the Magnum deposit consists of varying proportions of ankerite, quartz, chalcopyrite, and pyrite, in partly replaced remnants of the sedimentary host rock.

To date a total of ten veins have been identified, varying in width from less than 3 feet (0.9 meters) up to 25 feet (7.6 meters), showing continuity on strike and at depth. The main developed veins are nearly vertical. See Photo 1 below.

Photo 1 - Magnum Vein Outcrop

The main haulage, 5200 foot Level adit and the remaining adits into the Magnum Vein were inspected. The blocked entrances of 6 adits and 1 opening (possible a cave-adit) were located and 20 samples of the exposed Magnum Vein were taken over a vertical elevation of 332 meters.

A large (0.4 by 0.4 m.) piece of highly mineralized rubble was discovered on an old road 300 m. south of the main haulage adit. Sample D723266 of this rubble contained 90% chalcopyrite, 3% bornite and Co bloom and assayed an impressive 27.2% Cu. See Table 1 and Photo 2 below.

Photo 2 - Rubble Sample D - 723266

The Magnum Vein was sampled at 3 locations along the northwest facing slope, approximately 400 m. east of Magnum Creek. The northern most exposure was sampled at an elevation of 1903 meters. At this area the vein is 2.00 meters wide and strikes 040 degrees, dipping vertically, in sheared sediments.

A 2.30-meter section containing 2 meters of vein (samples D-723373-375) and 0.30 meters of footwall sediments averaged 6.43% copper. The 2.0 m section of vein alone without the low-grade footwall sediments contained a copper average of 7.380%. See Table 1 and Photo 3 below.

Photo 3 - Channel Sample D - 723374 over 0.70 meters

High-grade grab sample (D-723377) of the vein, collected 1 m. to the north, contained 95% massive chalcopyrite and assayed 25.10% Copper and 11.9 ppm Ag. See Table 1 and Photo 4 below.

Photo 4 - Grab Sample D - 723377

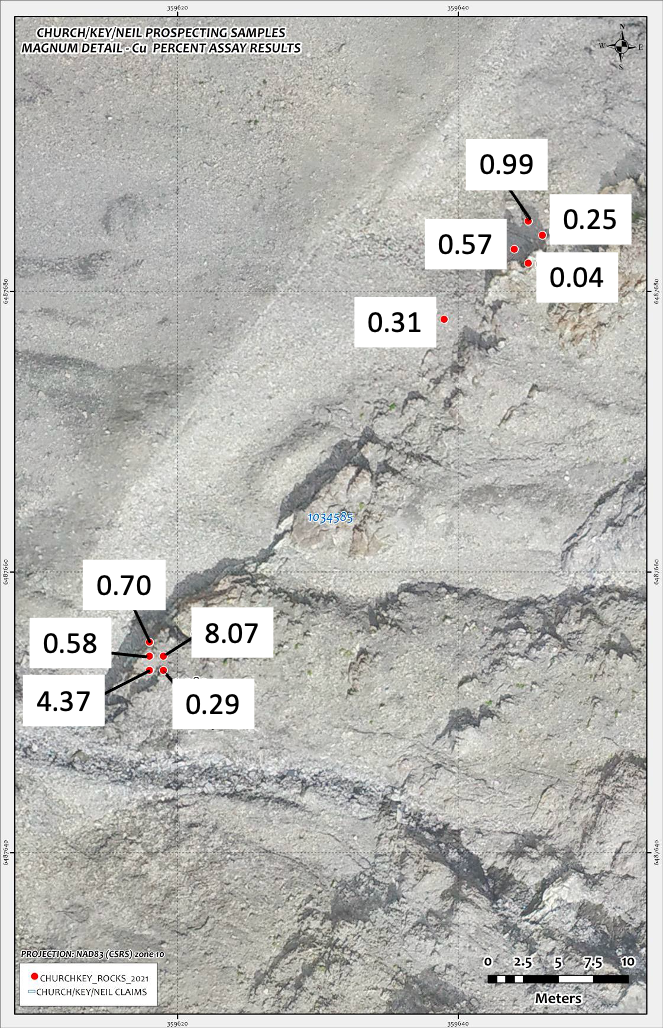

Five hundred to 530 meters along strike to the southwest, between the two 5,900-foot adits 2 exposures were sampled. The 2 exposures strike 040 degrees and dip 85 degrees and are located 30 meters apart at elevations of ~1866 and 1834 meters.

In the north, the vein is 1 to 1.30 meters in width and contains 1-3% chalcopyrite with the hanging wall being comprised of sediments and quartz-carbonate stringers. Five chip samples (D-723382-386) were collected across 3 sections with the average Cu grades across each section are: vein & hanging wall - 0.67% / 2.30 meters, (D-723385 & 386) and 0.34%/ 2.10 meters, (D-723383 & 384) and just vein - 0.31%/ 1.00 m. (D-723382). See Table 1 below and Photo 5 below.

Photo 5 - Composite Samples

Thirty meters farther along strike to southwest, at an elevation of 1,834 meters, 2 sections of the vein and surrounding stringer zones were chip sampled (D-723387 & 389-392). The 1.20- to 1.30-meter-wide vein is exposed along 15 meters, dips sub-vertically and is mineralized with 3-5% chalcopyrite. The northern,1.60-meter-wide section (D-723387 & 389), averages 6.704% Cu, with the 1.30-meter-wide chip sample of the vein containing 8.09% Cu. The southern 2.30-meter-wide section (D-72390-392) averages 2.50% Cu, with the 1.20-meter-wide vein assaying 4.37% Cu. See Table 1 below.

On the road to the main haulage adit a 040-degree striking 0.8 m. wide vein is exposed. This vein contains 2% chalcopyrite and 0.96% Cu. Four heavily mineralized (up to 25% chalcopyrite) samples (D-723371, 372, 379 & 381) of quartz-carbonate rubble / float were sampled downslope from the adits, at elevations of 1755 to 1802 meters. See Table 1 and Photo 6 below.

Photo 6 - Float Sample D - 723379

Samples D-723371, 372 & 381 also contained a high pyrite content of 30 to 80% and assayed 3.4% to 14.4% copper. Sample D-723379 with no pyrite and 20% chalcopyrite contained 11.45% copper. See Table 1 below and Photo 6 above

Table 1 - Magnum Deposit Surface Samples

Sample Number | Elevation | Sample | Width | Copper | Composite |

D - 723266 | 1,571 | Rubble | 27.20 | ||

D - 723371 | 1,802 | Rubble | 14.40 | ||

D - 723372 | 1,802 | Rubble | 3.40 | ||

D - 723373 | 1,903 | Chip | 0.70 | 1.02 | 6.43 / 2.30 |

D - 723374 | 1,903 | Chip | 0.70 | 17.75 | 6.43 / 2.30 |

D - 723375 | 1,903 | Chip | 0.60 | 2.70 | 6.43 / 2.30 |

D - 723376 | 1,903 | Chip | 0.30 | 0.07 | 6.43 / 2.30 |

D - 723377 | 1,903 | Grab | 25.10 | ||

D - 723378 | 1,775 | Chip | 0.80 | 0.96 | 0.96 / 0.80 |

D - 723379 | 1,755 | Float | 11.45 | ||

D - 723381 | 1,789 | Rubble | 9.50 | ||

D - 723382 | 1,856 | Chip | 1.00 | 0.31 | 0.31 / 1.00 |

D - 723383 | 1,857 | Chip | 1.20 | 0.31 | 0.34 / 2.10 |

D - 723384 | 1,857 | Chip | 9.90 | 0.57 | 0.34 / 2.10 |

D - 723385 | 1,855 | Chip | 1.30 | 0.04 | 0.67 / 2.30 |

D - 723386 | 1,855 | Chip | 1.00 | 0.99 | 0.67 / 2.30 |

D - 723387 | 1,834 | Chip | 0.30 | 0.70 | 6.70 / 1.60 |

D - 723389 | 1,834 | Chip | 1.30 | 8.09 | 6.70 / 1.60 |

D - 723390 | 1,834 | Chip | 0.60 | 0.58 | 2.50 / 2.30 |

D - 723391 | 1,834 | Chip | 1.20 | 4.37 | 2.50 / 2.30 |

D - 723392 | 1,834 | Chip | 0.50 | 0.29 | 2.50 / 2.30 |

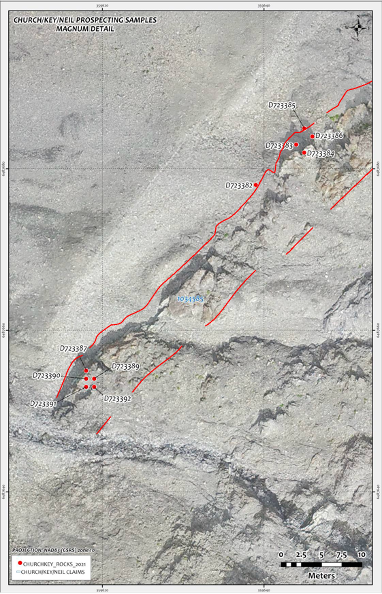

As discussed in the previous release of the UAV Drone work on the Magnum the data generated was used for in-field targeting of visual copper occurrences on the color orthophoto due to the 3 cm resolution which lead to field examination of the mineralized unit to sampling of the Magnum vein where a total of 20 samples were collect as a first pass evaluation. See Figures 9, 10 below.

Figure 9/ 10 - Blow Up of Copper Mineralization on Magnum Deposit

As you can see above the drone video and orthophoto was used to determine where to sample this sped up the boots on the ground process and also once sampled the data obtained was plotted with GPS coordinates on the orthophoto below. Press link here to view drone flight mission.

Figure 10- 2021 Magnum Sample Locations Plotted On 3-D Tilt Digital, Red Line Vein Trace

In addition to the sample locations the copper assay values were not only plotted on the orthophoto but geotagged with all relevant information and incorporated into a .KMZ format to be used with general global position systems such as google earth. See Figures 11, 12 below.

Figure 11 - Plotted Copper Values % on Magnum Vein.

Figure 12 - Plotted Assay Values / Photos in .kmz Format

Going Forwards

Using the results of the data gathered by the UAV drone in the 2021 field season the field crew will further sample in detail and map the Magnum deposit in addition to traversing the southeast side of the hill side to investigate the silica anomalies. Once drill permits are received this will be one of the drill target areas.

QA QC Procedure

Analytical results of sampling reported by Fabled Copper Corp represent rock samples submitted by Fabled Copper Corp staff directly to ALS Chemex, Vancouver, British Columbia Canada. Samples were crushed, split, and pulverized as per ALS Chemex method PREP-31, then analyzed for ME-ICP61 33 element package by four acid digestion with ICP-AES Finish. ME-GRA21 method for Au and Ag by fire assay and gravimetric finish, 30g nominal sample weight.

Over Limit Methods

For samples triggering precious metal over-limit thresholds of 10 g/t Au or 100 g/t Ag, the following is being used:

Au-GRA21 Au by fire assay and gravimetric finish with 30 g sample.

Ag-GRA21 Ag by fire assay and gravimetric finish.

Fabled Copper Corp. monitors QA/QC using commercially sourced standards and locally sourced blank materials inserted within the sample sequence at regular intervals.

About Fabled Copper Corp.

Fabled Copper is a junior mining exploration company. Its current focus is to creating value for stakeholders through the exploration and development of its existing copper properties located in northern British Columbia. The Muskwa Project comprises a total of 76 claims in two non-contiguous blocks and totals approximately 8,064.9 hectares, located in the Liard Mining Division in northern British Columbia.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Copper Corp.

Phone: (819) 316-0919

peter@fabledcopper.org

For further information please contact:

info@fabledcopper.org

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition and development plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

SOURCE: Fabled Copper Corp.

View source version on accesswire.com:

https://www.accesswire.com/694345/Fabled-Copper-Report-up-to-2720-Copper-on-the-Magnum-Mine-Deposit