February 11, 2025

Caprice Resources Ltd (ASX: CRS) (“Caprice” or “the Company”) is pleased to provide an update on its Phase 1 Reverse Circulation (RC) drill programme at the Island Gold Project. Phase 1 drilling has returned exceptional thick, high-grade gold intersections from testing previously unrecognised, high-grade, structurally controlled, cross-cutting “Break of Day”1 analogue gold targets.

HIGHLIGHTS

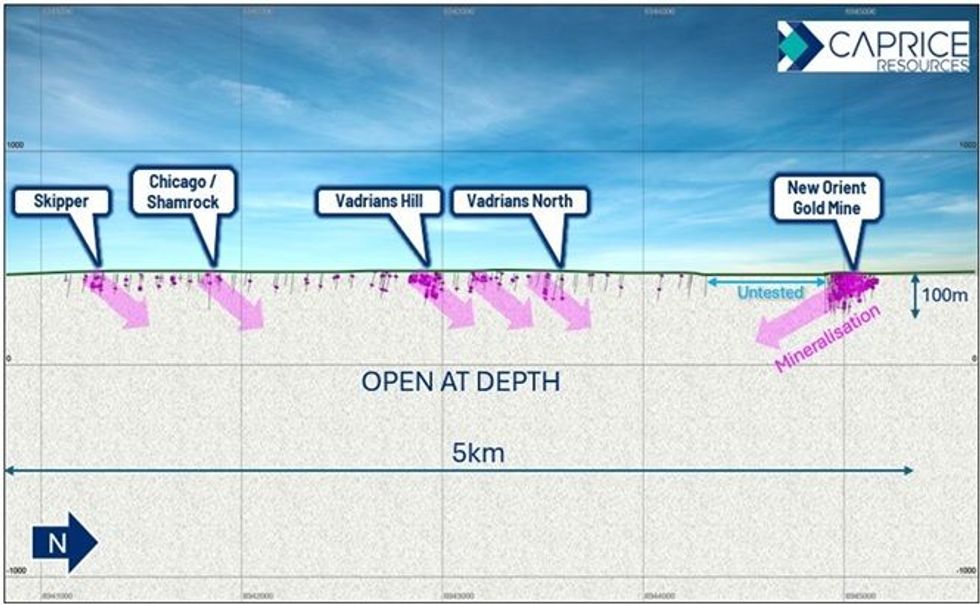

- Island Gold Project drilling intersects multiple zones of thick, shallow, high-grade gold mineralisation across numerous targets, open in multiple directions along 5km of strike

- Significant gold intercepts at Vadrians Hill include:

- 28m @ 6.4 g/t from 114m downhole in 24IGRC009, including:

- 12m @ 7.8 g/t from 114m; and

- 4m @ 16.4 g/t from 130m and a further mineralised sequence up-dip;

- 27m @ 3.0 g/t from 48m downhole in 24IGRC009, including:

- 4m @ 4.9 g/t from 61m; and

- 5m @ 6.9 g/t from 69m

- 15m @ 4.6 g/t from 112m downhole in 24IGRC008, including:

- 9m @ 7.0 g/t from 113m

- Significant gold intercepts at Baxter/Golconda include:

- 9m @ 2.8 g/t from 27m downhole in 24IGRC001, including:

- 3m @ 5.8 g/t from 30m

- 12m @ 3.9 g/t from 90m downhole in 24IGRC001, including:

- 6m @ 5.9 g/t from 94m

- 8m @ 1.5 g/t from 114m downhole in 24IGRC002, including:

- 2m @ 4.6 g/t from 118m

- 9m @ 2.8 g/t from 27m downhole in 24IGRC001, including:

- 28m @ 6.4 g/t from 114m downhole in 24IGRC009, including:

- 5km of highly prospective strike to be tested with numerous identical structures identified between the New Orient and Shamrock historical gold workings

- Multiple thick, stacked high-grade gold lodes intersected at depth and down plunge from surface workings that remain open in several directions with drilling constrained to less than 100m vertical depth - Substantial maiden resource opportunity

- 5,000m RC drill programme recommenced at the Island Gold Project:

- Phase 1 comprising 10 RC drill holes for 1,554m completed in December 2024

- Phase 2 comprising 30 RC drill holes for approximately 3,500m in progress

CEO, Luke Cox, commented:

“It’s a great pleasure to be delivering these exceptional gold results from our Island Gold Project December drill programme. These first 10-holes of the planned 40-hole drill programme have highlighted mineralisation thickening and increasing grade down plunge compared to the near surface gold mineralisation. Even more encouragingly, multiple stacked lodes were intersected by this drilling.

“Identical structural settings are present in historical workings at the New Orient Gold Mine in the north and at Shamrock in the south, and these fertile structures have been mapped at multiple locations within the host banded iron formations along the five kilometres of strike connecting these historic workings; providing numerous additional greenfield targets and highlighting an enlarged scale to the project.

“The Phase 2 RC drill programme will continue to test this highly prospective structural corridor through Baxter, Golconda and Vadrians Hill, before moving north to test additional cross-cutting structures, with the objective of delivering a potentially significant Island Gold Project maiden resource in the coming months.”

Gold Mineralisation

At the Island Gold Project (IGP), gold mineralisation occurs along a strike length of 5km from the New Orient Gold mine in the north to the Skipper prospect in the south within the IGP Corridor (Figure 1). The IGP Corridor is 700 to 1,000m wide and contains multiple BIFs up to 30m thick, which are the preferred host rock for gold mines in the Murchison. Prior to the Company’s recent Phase 1 drill programme, drilling was limited to an average depth of 70 vertical metres below the surface. Phase 1 RC drill hole 24IGRC009 intersected two thick sequences of mineralisation including 28m at 6.4 g/t gold from 114m down hole and 27m at 3.0 g/t gold (Table 1), highlighting the potential of the highly prospective 5km long by 1km wide IGP Corridor to host multiple significant gold ore bodies.

The IGP gold mineralisation and structural setting is displaying similarities to the high-grade gold deposits in the prolific +15Moz Murchinson Goldfields, with the key factors for high quality gold deposit formation being BIF host rocks and cross-cutting structures controlling high-grade gold lodes present at the Company’s IGP.

High-grade gold mineralisation appears to be associated with a series of en’echelon vein sets that have developed obliquely to the strike of the brittle and reactive host BIF. These en’echelon vein sets trend NNW-SSE and are sub-vertical to steep west dipping and are controlled by a major cross-cutting structure which also trends NNW-SSE (Figures 2 and 3).

High-grade gold mineralisation is controlled primarily by these major NNW-SSE structures, with ‘reef- style’ high-grade gold quartz lodes also developed in fold structures where the axial plane of the fold trends 330° to 350° and fold hinges plunges 45° to 60° to the NNW.

Click here for the full ASX Release

This article includes content from Infinity Lithium Corporation Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRS:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00