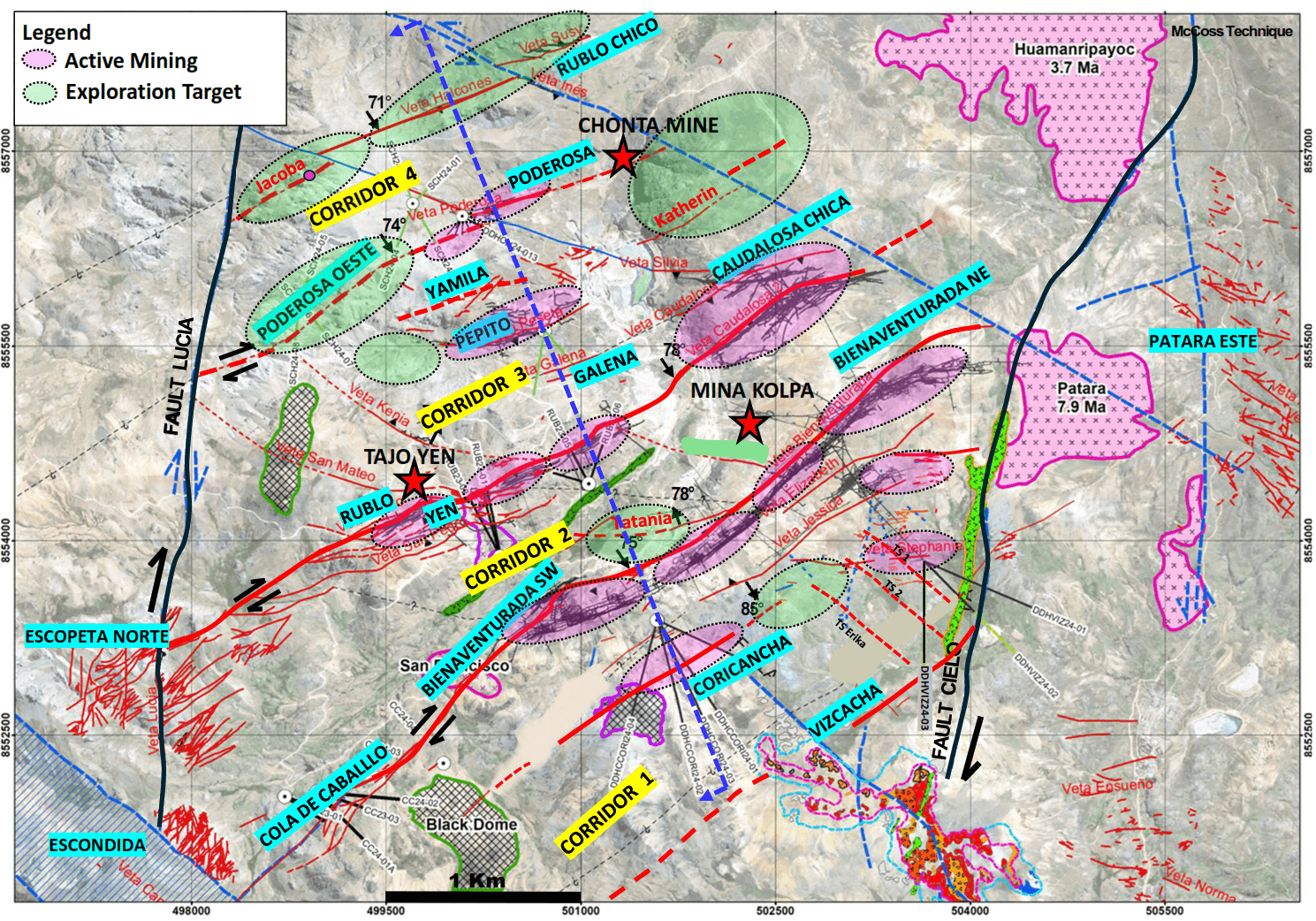

Endeavour Silver Corp. ("Endeavour" or the "Company") (TSX: EDR, NYSE: EXK) is pleased to announce positive drill results from its ongoing exploration program at the Kolpa Mine, located in Peru's Huancavelica province. The area is marked by sub-vertical geological structures formed by compressive forces associated with the Andean Orogeny. These forces have created well-developed vein systems trending southwest to northeast, which are significant for guiding mineralization.

Importantly, these structural patterns can repeat and extend across neighboring vein sets that are oriented differently. This creates adjoining sequences—referred to as ‘structural pairing'—that enhance the potential for mineral discovery. The Company has successfully identified corridors where these structural pairings occur, targeting prospective areas for brownfields exploration.

Within Corridor 3, the Company carried out drilling on the Poderosa West and Caudalosa Chica veins, targeting the establishment of mineral resources. The Poderosa West vein, previously identified through both surface outcrops and earlier drilling, has now been mapped at surface for approximately 2.5 kilometers. Since acquiring the project, Endeavour has completed 14 drill holes totaling 2,343 meters near existing underground workings, intersecting significant zones of mineralization. Key highlights from this program include:

- 247 gpt Ag, 0.77% Pb, 10.70% Zn and 0.55% Cu over 8.20 metres estimated true width in hole DDH-H1-25-88

- 266 gpt Ag, 1.34% Pb, 4.73% Zn and 0.23% Cu over 5.15 metres estimated true width in hole DDH-H1-25-92

Additionally, Caudalosa Chica has been mapped for over 1.5 kilometers where three drill holes were completed in July and August, two intersected significant mineralization.

Management is currently evaluating both surface exploration and recent drill results to design a comprehensive, systematic exploration program at the Kolpa Mine. At Poderosa West, ongoing underground development is facilitating access for new underground drill stations, which will support further step-out drilling. Additionally, the Company has submitted applications for surface drilling along the entire 2.5-kilometer vein. Drilling activity in Corridor 3, targeting these two key structures, is scheduled to resume in late Q4 2025.

"Kolpa's geology continues to demonstrate outstanding potential, with multiple underexplored targets that point to a long runway of discovery," said Dan Dickson, Chief Executive Officer. "We are only scratching the surface and the opportunity to unlock further value through exploration is both exciting and significant. The latest results highlight the exploration potential for Kolpa and the hard work that the team has put into this asset."

Table 1. Significant Drill Results

| Hole | Structure | From (m) | To (m) | True Width (m) | Ag (gpt) | Pb | Zn | Cu |

| (%) | (%) | (%) | ||||||

| DDH-H1-25-106 | Ramal (HW Caudalosa 1) | 66.1 | 68.3 | 2.2 | 107 | 1.10 | 1.43 | 0.19 |

| Caudalosa 1 | 109.65 | 112.05 | 2.4 | 0.93 | 0.01 | 0.03 | 0.00 | |

| DDH-H1-25-109 | Caudalosa 1 | 117.85 | 120.1 | 1.7 | 33 | 0.25 | 0.28 | 0.03 |

| Ramal (FW Caudalosa 1) | 158.85 | 159.15 | 0.3 | 313 | 8.16 | 30.00 | 0.18 | |

| DDH-H1-25-74 | Poderosa West | 388.55 | 389.15 | 0.6 | 95 | 4.02 | 2.74 | 0.72 |

| DDH-H1-25-76 | Poderosa West | 136.65 | 137.95 | 1 | 45 | 0.92 | 2.49 | 0.15 |

| DDH-H1-25-80 | Poderosa West | 142.15 | 143.85 | 1.3 | 35 | 2.68 | 2.96 | 0.09 |

| DDH-H1-25-83 | Poderosa West | 166.9 | 168.15 | 1 | 9 | 0.16 | 0.68 | 0.07 |

| DDH-H1-25-88 | Poderosa West | 37.55 | 45.75 | 8.2 | 247 | 0.77 | 10.70 | 0.55 |

| DDH-H1-25-92 | Poderosa West | 53.05 | 58.2 | 5.15 | 266 | 1.34 | 4.73 | 0.23 |

Abbreviations include: gpt: grams per tonne; Au: gold; Ag: silver; m: metre.

Note: An additional six holes were drilled including holes DDH-H1-25-70, 71, 72 and 73 intercepted the Poderosa West vein and were assayed internally and not supervised by a Qualified Person. DDH-H1-25-90 was abandoned and DDH-H1-25-102 targeted a separate vein that returned no significant results.

Figure 1. Structural Corridors

Table 2. Drill Hole Locations and Orientation

| Hole | East | North | Elevation | Azimuth | Dip | Area |

| DDH-H1-25-70 | 500117.57 | 8556436.51 | 4514.60 | 215.5 | 25.1 | Poderosa West |

| DDH-H1-25-71 | 500117.08 | 8556435.59 | 4513.30 | 199.9 | -33.7 | Poderosa West |

| DDH-H1-25-72 | 500117.26 | 8556435.53 | 4513.00 | 146.9 | -37.4 | Poderosa West |

| DDH-H1-25-73 | 500116.78 | 8556435.80 | 4513.50 | 112.6 | -30.0 | Poderosa West |

| DDH-H1-25-74 | 499706.85 | 8556574.35 | 4756.80 | 188.1 | -14.9 | Poderosa West |

| DDH-H1-25-76 | 500152.27 | 8556317.94 | 4515.06 | 10.6 | -57.2 | Poderosa West |

| DDH-H1-25-80 | 500147.64 | 8556316.60 | 4514.32 | 293.7 | -52.8 | Poderosa West |

| DDH-H1-25-83 | 500152.51 | 8556318.81 | 4514.88 | 45.0 | -40.0 | Poderosa West |

| DDH-H1-25-88 | 500226.92 | 8556466.85 | 4513.14 | 165.0 | -42.0 | Poderosa West |

| DDH-H1-25-90 | 499707.51 | 8556574.15 | 4756.90 | 170.0 | -12.0 | Poderosa West |

| DDH-H1-25-92 | 500227.66 | 8556467.22 | 4513.32 | 120.0 | -35.0 | Poderosa West |

| DDH-H1-25-102 | 499707.02 | 8556583.04 | 4755.74 | 359.7 | -38.8 | Silvia-Vanessa |

| DDH-H1-25-106 | 502253.65 | 8555492.11 | 4393.05 | 348.6 | -23.0 | Caudalosa |

| DDH-H1-25-109 | 502253.64 | 8555492.26 | 4394.91 | 9.5 | 16.5 | Caudalosa |

Kolpa is a silver-focused polymetallic mine in the districts of Huachocolpa and Santa Ana in the province and department of Huancavelica, approximately 490 km southeast of Lima, Peru. The Company directly or indirectly holds mining rights to 143 mining concessions and claims covering 25,177 hectares and 1 beneficiation concession covering 366 hectares. Mineralization at Kolpa occurs mainly as polymetallic epithermal deposits rich in silver, lead, zinc and copper.

About Endeavour Silver

Endeavour is a mid-tier precious metals company with a strong commitment to sustainable and responsible mining practices. With operations in Mexico and Peru, and the development of the new cornerstone mine in Jalisco state, the company aims to contribute positively to the mining industry and the communities in which it operates. In addition, Endeavour has a portfolio of exploration projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer.

Qualified Person

Dale Mah, P.Geo., Vice President Corporate Development, a qualified person under NI 43-101, has approved the scientific and technical information contained in this news release.

Drill core samples, with the exception of DDH-H1-25-106 and DDH-H1-25-102, were shipped to Certimin Laboratory, located in Lima, Peru, for sample preparation and analysis. The Certimin lab is ISO/IEC 17025, ISO 9001, 14001 and 45001 certified. Silver and base metals were analyzed using a multi-acid digestion with four acids with an ICP-OES finish and gold was assayed by 30-gram fire assay, read by atomic absorption spectroscopy (AAS). Over limit analyses for silver were re-assayed by 30-gram fire assay and gravimetric finish and for lead, zinc and copper re-assayed by ore-volumetric assay.

Drill core samples for drill holes DDH-H1-25-106 and DDH-H1-25-102 were sent to the Bureau Veritas Laboratory in Lima, Peru, for sample preparation and analysis. This laboratory holds international certifications such as ISO/IEC 17025, ISO 9001, ISO 14001, ISO 45001, and ISO 22000, which guarantee the quality of its processes. Silver and base metals were analyzed using a multi-acid digestion with four acids with an ICP-OES finish and gold was assayed by 30-gram fire assay, with atomic absorption spectroscopy (AAS) reading. Over limit analyses for silver were re-assayed by 30-gram fire assay and gravimetric finish and for lead, zinc and copper re-assayed using volumetric methods.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance/quality control protocol.

Contact Information

Allison Pettit

Vice President, Investor Relations

Tel: (604) 685 - 9775

Email: apettit@edrsilver.com

Website: www.edrsilver.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the United States private securities litigation reform act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding the Company's exploration and drilling plans and programs at Kolpa, exploration potential at Kolpa, Kolpa's potential to create shareholder value, the opportunity for mineral discovery and the timing and results of various activities. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited to changes in production and costs guidance; the ongoing effects of inflation and supply chain issues on mine economics; changes in national and local governments' legislation, taxation, controls, regulations and political or economic developments in Peru, Canada and Mexico; financial risks due to precious metals prices; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development; risks in obtaining necessary licenses and permits; fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Peruvian sol, Mexican peso, Chilean peso, Canadian dollar and U.S. dollar); and challenges to the Company's title to properties; as well as those factors described in the section "risk factors" contained in the Company's most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company's mining operations, no material adverse change in the market price of commodities, mining operations will operate and the mining products will be completed in accordance with management's expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ba2f1d9e-5689-457f-8876-d87a1d5a5e5c