June 02, 2025

Empire Metals Limited (LON:EEE), the AIM-quoted and OTCQB-traded exploration and development company,is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or the 'Project'). This programme will target high-grade titanium mineralisation within the in-situ weathered cap at the Thomas Prospect, with the objective of delivering a maiden JORC Compliant Mineral Resource Estimate ('MRE').

Highlights

- A total of 164 drill holes planned:

- 124 Air Core ('AC') drillholes for approximately 6,700 metres, and

- 40 Reverse Circulation ('RC') drillholes for approximately 4,000 metres,

- totalling 10,700 metres of drilling.

- The Thomas Prospect was selected for the maiden MRE due to the extensive, thick and high-grade titanium mineralisation hosted within the broad, in-situ weathered zone.

- This programme, the largest at Pitfield to date, will cover over 11 square kilometres and aims to deliver a globally significant MRE.

- Notable intercepts within the in-situ weathered cap from previous drilling at Thomas include:

- 51m @ 7.88% TiO₂ from surface (AC25TOM039)

- 57m @ 7.48% TiO₂ from surface (AC25TOM040)

- 52m @ 7.43% TiO₂ from surface (AC25TOM042)

Shaun Bunn, Managing Director, said:"We are pleased to commence this important drilling campaign at Pitfield, focused on delivering our maiden MRE from the Thomas Prospect.The Thomas Prospect contains broad, continuous, high-grade zones of high-purity titanium dioxide mineralisation within the in-situ weathered cap: confirmed by assay results from the February 2025 AC drill campaign, averaging 6.20% TiO₂ over an average depth of 54m (announced 28 April 2025).

"This fully funded campaign, scheduled to run over the next four to five weeks, is the largest undertaken to date at Pitfield. With 164 holes planned over an 11 square kilometre area and to an average depth of 65 metres, this work is designed to deliver a globally significant Mineral Resource Estimate."

MRE Drilling Programme

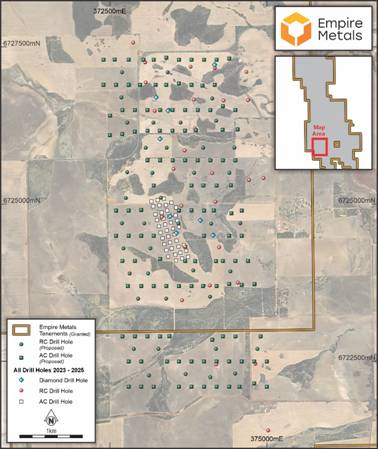

The location and spacing of the planned AC drillholes have been designed, with the input of mineral resource consultants Snowden-Optiro, to provide the necessary drill assay data density to allow the preparation of an MRE at the Thomas Prospect. The programme consists of 124 AC drillholes, on a 400 x 200m drillhole-spaced grid with an average forecast depth of 54.1m, for a total of 6,700 metres, and 40 RC drillholes within the AC drilling grid, to a depth of 100m, for a total of 4,000 metres. The overall drillhole grid extends 5.2km by 2.2km and totals an area of 11.4 sq km (refer Figure 1).

The drilling is targeting the near surface, highly weathered zones within the Thomas Prospect; drilling has now commenced and will run over several weeks, with laboratory analysis scheduled for completion in August.

Figure 1. Planned Air Core drill hole collar locations within the Thomas Prospect priority area.

The near-surface, in-situ weathered cap at the Thomas Prospect contains a high percentage of the key titanium bearing minerals, primarily anatase and rutile. The drilling targets areas were selected on the basis of three key parameters: high-purity TiO2 mineral assemblage, high average TiO2 grades and significant depth of weathering (refer Table 1).

The AC and RC drillholes will be geologically logged and sub-sampled on 2m intervals and geochemically analysed; this data will provide the basis for geological modelling and for the development of the MRE at the Thomas Prospect.

Air core drilling has previously been utilised at Pitfield to drill-test the weathered cap and collect bulk metallurgical samples (announced 28 April 2025). It is a cost-effective and efficient drilling method that is commonly used for shallow exploration projects and the success of the previous campaign confirmed its suitability for the preparation of the MRE.

Table 1: Weathered Zone drill intercepts from the Thomas Prospect (previously released results) including high-grade intervals to be followed up by MRE drilling

Hole ID | Easting | Northing | Depth From (m) | Depth To (m) | EOH (m) | Weathered Interval (m) | Grade TiO2 (%) |

RC24TOM021 | 373699 | 6724326 | 4 | 76 | 154 | 72 | 6.75 |

including | 4 | 58 | 54 | 6.90 | |||

including | 4 | 12 | 8 | 9.03 | |||

including | 8 | 10 | 2 | 9.98 | |||

RC24TOM022 | 373329 | 6724796 | 0 | 54 | 154 | 54 | 7.02 |

including | 4 | 12 | 8 | 8.54 | |||

RC24TOM023 | 373639 | 6724978 | 0 | 58 | 154 | 58 | 5.68 |

including | 6 | 20 | 14 | 6.09 | |||

DD24TOM006 | 373947 | 6724741 | 0 | 46.5 | 70.5 | 46.5 | 5.94 |

including | 4.5 | 45 | 40.5 | 6.10 | |||

including | 10.5 | 22.5 | 12 | 6.95 | |||

AC25TOM021 | 373250 | 6724746 | 0 | 49 | 49 | 49 | 7.49 |

including | 20 | 26 | 6 | 10.71 | |||

AC25TOM036 | 373358 | 6725089 | 2 | 54 | 54 | 52 | 7.21 |

AC25TOM039 | 373506 | 6724612 | 0 | 51 | 51 | 51 | 7.88 |

AC25TOM040 | 373599 | 6724639 | 0 | 57 | 57 | 57 | 7.48 |

including | 6 | 22 | 16 | 10.00 | |||

AC25TOM041 | 373572 | 6724737 | 0 | 54 | 54 | 54 | 7.19 |

including | 4 | 18 | 14 | 10.06 | |||

including | 4 | 12 | 8 | 11.67 | |||

AC25TOM042 | 373546 | 6724823 | 0 | 52 | 52 | 52 | 7.43 |

including | 4 | 16 | 12 | 10.17 | |||

including | 4 | 12 | 8 | 11.32 |

The Pitfield Titanium Project

Located within the Mid-West region of Western Australia, near the northern wheat belt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region's capital and major port. Western Australia is ranked as one of the top mining jurisdictions in the world according to the Fraser Institute's Investment Attractiveness Index published in 2023, and has mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines as well as a green energy hydrogen fuel hub, which is under planning and development (refer Figure 2).

Figure 2. Pitfield Project Location showing the Mid-West Region Infrastructure and Services

Competent Person Statement

The technical information in this report that relates to the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr Faragher is a Member of the Australian Institute of Mining and Metallurgy. Mr Faragher has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

Empire Metals Ltd Shaun Bunn / Greg Kuenzel / Arabella Burwell | Tel: 020 4583 1440 |

S. P. Angel Corporate Finance LLP (Nomad & Broker) Ewan Leggat / Adam Cowl | Tel: 020 3470 0470 |

Shard Capital Partners LLP (Joint Broker) Damon Heath | Tel: 020 7186 9950 |

St Brides Partners Ltd (Financial PR) Susie Geliher / Charlotte Page | Tel: 020 7236 1177 |

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Click here to connect with Empire Metals (OTCQB:EPMLF, AIM:EEE) to receive an Investor Presentation

EPMLF

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 October 2025

Empire Metals

Advancing a game-changing, globally significant titanium project in Western Australia.

Advancing a game-changing, globally significant titanium project in Western Australia. Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

01 December 2025

Empire to Present at the Precious Metals & Critical Minerals Virtual Investor Conference

Empire Metals Limited (AIM: EEE, OTCQX: EPMLF), announces that Greg Kuenzel (Finance Director) will present live at the Precious Metals & Critical Minerals Virtual Day Conference in partnership with OTC Markets and hosted by VirtualInvestorConferences.com, on December 4 th at 9am ET. The... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work alongside S. P. Angel Corporate Finance LLP and Shard... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

LONDON, UK / ACCESS Newswire / November 13, 2025 / Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work... Keep Reading...

7h

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

Latest News

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00