June 10, 2024

NT Geological Survey co-funding grant to support geophysical ground survey along strike from the Home of Bullion deposit

Eastern Metals Ltd (ASX:EMS) (“Eastern Metals” or “the Company”) is pleased to announce that it has been successful in its application for co-funding in Round 17 of the Northern Territory (NT) Geophysics and Drilling Collaborations Program (GDCP), part of the NT Government’s ‘Resourcing the Territory’ initiative. This is a competitive grants program administered by the Northern Territory Geological Survey (NTGS) to address geoscientific knowledge gaps, advance exploration activity and support the discovery and development of resources in the NT.

HIGHLIGHTS

- Eastern Metals secures co-funding for up to $100,000 through the NT’s Geophysics and Drilling Collaborations Program, Round 17, under the ‘Innovative Targeting’ category.

- Funding will support the completion of an Induced Polarisation (IP) survey at the Arunta Project to generate drill targets along the ~9km northwest extension from Home of Bullion to the Mulbangas prospect.

- The area offers strong potential for the discovery of additional high-grade structurally controlled Volcanic Massive Sulphide-style lodes.

Eastern Metals’ Chief Executive Officer Ley Kingdom said: “We are delighted to have been successful in Round 17 of the NT Government’s exploration grants program. The program is highly competitive and highlights the NT Government’s proactive approach to the exploration for globally recognised critical minerals in the Aileron Province.

“The funding will help the Company to improve its geological understanding of the structurally complex Home of Bullion deposit and generate targets between Home of Bullion and the Mulbangas prospect to the northwest. We look forward to commencing the survey and I would like to extend my appreciation to the NT Geological Survey for their support.”

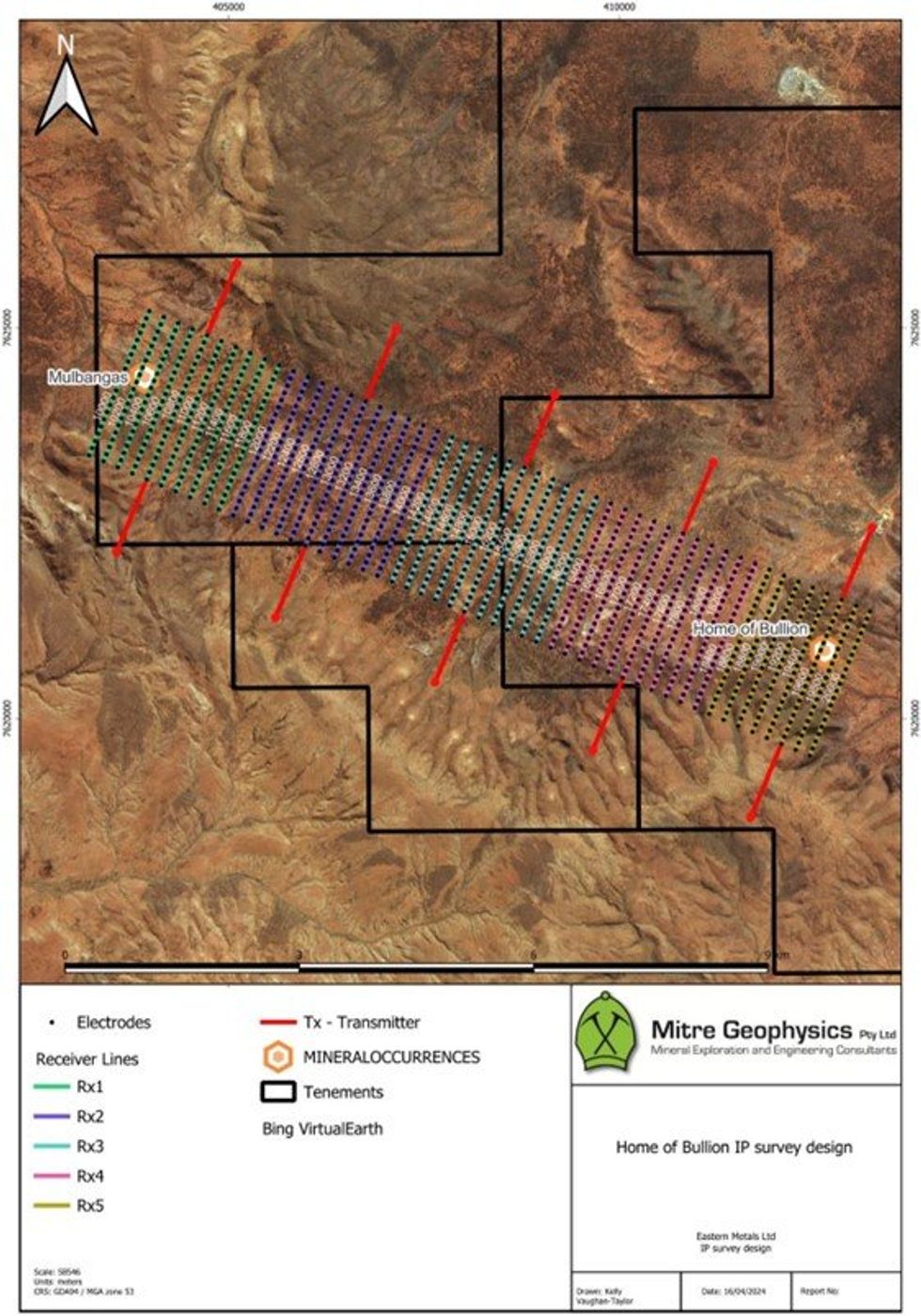

The proposed survey includes a combined gradient array IP (GAIP) and pole-dipole IP (PDIP), over an area of ~10km by 2km in a northwest orientation (refer to Figure 1).

The program consists of 50m GAIP and a 100m PDIP electrode spacings, with a line length of 2,000m and a line separation of 200m. The survey will test the applicability of GAIP and PDIP to narrow, steeply dipping targets with a broad sulphide alteration halo.

The survey design between the Home of Bullion deposit and Mulbangas prospect, within EL23186, EL28615 and EL32027, is consistent with the orientation of the Bullion Schist host rock and the structural framework of the known areas of mineralisation at Home of Bullion. It is anticipated that the survey coverage will enable correlation of the Home of Bullion’s geological features along strike, such as key host faults and folds, mineralisation lodes within the Bullion Schist, magnetic anomalies and other geophysical signatures associated with alteration patterns. This will allow a more precise testing of previously defined exploration targets.

Click here for the full ASX Release

This article includes content from Eastern Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMS:AU

The Conversation (0)

07 October 2024

Eastern Metals

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces Keep Reading...

31 January 2025

Quarterly Activities and Cash Flow Reports 31 December 2024

Eastern Metals (EMS:AU) has announced Quarterly Activities and Cash Flow Reports 31 December 2024Download the PDF here. Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

16 February

How Rick Rule Reinvested His Silver Gains: 5 Silver Stocks He Owns

Over the past year, the spot price of silver has surged past a 40 year record and into triple-digit territory, reaching a high of US$121 per ounce this past January.For silver investors who bought into the physical market when the price was low, this first leg of the silver bull market has... Keep Reading...

16 February

Silver Institute: Market Heading for Sixth Straight Deficit in 2026

Silver surged past US$100 per ounce for the first time in January before retreating below the US$80 level, marking a volatile start to 2026 as the precious metal faces renewed investor appeal.In its latest annual outlook, published on February 10, the Silver Institute notes that the rally comes... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00