August 25, 2025

Earthwise Minerals Corp. (CSE:WISE)(FSE:966) ("Earthwise" or the "Company") has completed the first part of its two-phase 2025 field program at the Iron Range Gold Project ("the Project") in southeastern British Columbia. The program, led by TerraLogic Exploration Inc., included the collection of 538 soil samples over 13.5 line-km and 15 rock samples, along with structural mapping and prospecting across key target zones. Analytical results are pending and will be released once received, compiled, and interpreted.

Earthwise holds the exclusive option to acquire up to an 80% interest in the Iron Range Gold Project, which is 100% owned by Eagle Plains Resources Ltd. (TSXV:EPL) ("EPL" or "Eagle Plains"), with part of the property subject to an underlying 1.0% Net Smelter Royalty.

The 2025 field program advanced geochemical and mapping work across multiple targets at Iron Range:

- Sampling: A total of 538 soil samples were collected along 13.5 line-km, together with 15 rock samples.

- Soil Coverage: Tight-spaced grids were completed within known geochemical anomalies and extended into new areas, including fault splays and gold-in-till anomalies identified by Eagle Plains.

- Mapping & Prospecting: Geological mapping and prospecting were carried out at the Pyromorphite Zone and DIP Zone, with additional sampling at Golden Cap and Star West.

- Next Steps: All samples have been submitted for analysis, with results to be disclosed once received, compiled, and interpreted.

EXPLORATION ZONES - 2025

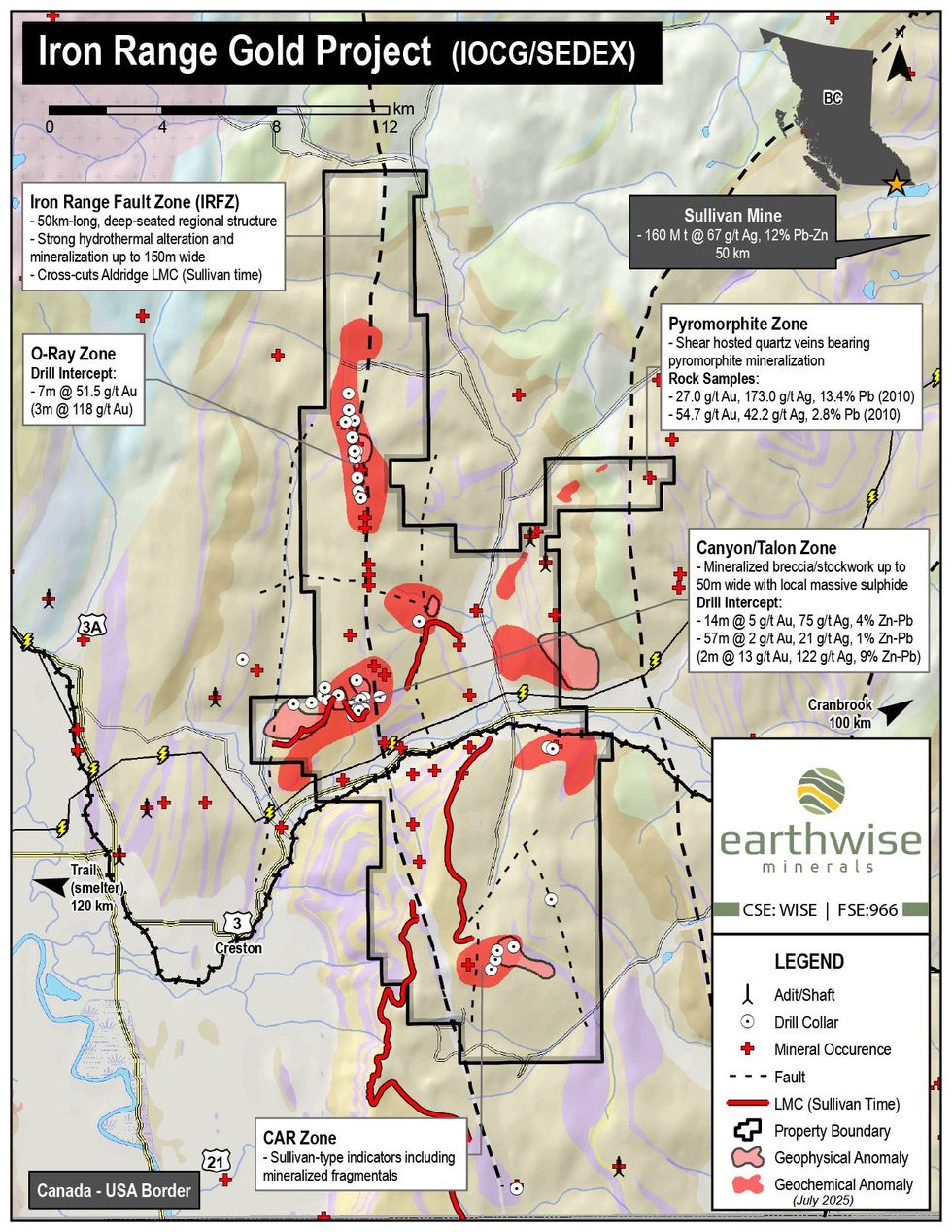

Pyromorphite Zone (BC MinFile 082FSE141): Mineralization was first discovered in 2009 when logging road construction exposed sheared and brecciated sediments hosting cm-scale quartz veins bearing pyromorphite (lead) mineralization. No significant work has been carried out at the zone since its initial discovery by the previous tenure holder. Historic rock (grab) samples include SK10-207, which reported 27.0 g/t Au, 173.0 g/t Ag, and 13.4% Pb, and MK10-170, which reported 54.7 g/t Au, 42.2 g/t Ag, and 2.8% Pb (BC Assessment Report 31659).

Golden Cap (BC MinFile 082FSE014): Tight-spaced soil sampling in 2025 was designed to test cross-fault intersections along the main Iron Range Fault Zone. Historical soil sampling by Eagle Plains at this area returned values up to 230 ppb Au.

DIP Zone (Dakota - BC MinFile 082FSE023; Idaho - BC MinFile 082FSE024; Pacific - BC MinFile 082FSE025): Soil sampling in 2025 was conducted over an area with a historical multi-element soil geochemical anomaly that had not previously been analyzed for gold.

Star West (BC MinFile 082FSE089): Soil sampling in 2025 was conducted over an area with a historical multi-element soil geochemical anomaly that had not previously been analyzed for gold.

HISTORIC DRILLING & PROJECT OVERVIEW

Drilling at Iron Range in 2010 resulted in the discovery of the Talon Zone, where drill-hole IR10-010 intersected 2 intervals of strong and continuous mineralization including 14.0m grading 5.1g/t gold, 1.86% lead, 2.1% Zinc, 75.3g/t silver and 7.1m grading 8.13g/t gold, 2.84% lead, 3.07% zinc, 86.6g/t silver (Eagle Plains news release December 21st, 2010). Previous drilling 10km north of the Talon Zone in 2008 by Eagle Plains intersected gold mineralization in drill-hole IR08006 which assayed 7.0m grading 51.52g/t (1.50 oz/ton) gold (Eagle Plains news release dated April 20th, 2009).

All of the exploration data collected by Eagle Plains since 2001, as well as all of the available historic data, has been integrated into a GIS database, which is used to prioritize areas for ground follow up. Drill targeting at the Talon Zone discovery in 2010 was based on the presence of an extensive multi-element soil geochemical anomaly associated with a structural splay from the regional Iron Range Fault System. Drill hole locations and depths were successfully refined using Induced Polarization (IP) geophysics.

The 21,437ha Iron Range Project is considered by management of both Eagle Plains and Earthwise to hold excellent potential for the presence of structurally controlled gold-silver mineralization, iron-oxide copper-gold ("IOCG") and Sullivan-style lead-zinc-silver sedimentary-exhalative ("sedex") mineralization. The property is owned 100% by Eagle Plains, with a portion of the property subject to an underlying 1.0% Net Smelter Royalty held by a third party.

IRON RANGE GOLD PROJECT SUMMARY

The Iron Range Project, located near Creston, B.C., is owned 100% by Eagle Plains Resources Ltd., subject to a 1% NSR on a portion of the claim group. A well-developed transportation and power corridor crosses the southern part of the property, including a high-pressure gas pipeline and a high-voltage hydro-electric line, both following the CPR mainline and Highway 3. The rail line provides efficient access to Teck's smelter in Trail, B.C. The project is fully permitted under a Multi-Year Area Based (MYAB) permit issued by the B.C. Ministry of Mining and Critical Minerals. The permit allows for geophysical surveys, mechanical trenching, access trail construction, and diamond drilling.

The property covers an area of approximately 10 km x 32 km, overlying the regional Iron Range Fault System (IRFS). Prior to Eagle Plains' acquisition in 2001, the ground had seen little systematic exploration aside from iron resources documented since the late 1800s. Since 2001, Eagle Plains and its partners have completed:

- 21,593 m of diamond drilling in 87 holes

- 2,482 line-km of airborne and surface geophysical surveys

- 10,053 soil geochemical samples

- 495 rock samples

- 6,955 drill core samples

Rock grab samples are selective samples by nature and as such are not necessarily representative of the mineralization hosted across the property. Some of the above results were taken directly from MINFILE descriptions and assessment reports (ARIS) filed with the BC government. Management cautions that historical results were collected and reported by past operators and have not been verified nor confirmed by a Qualified Person but form a basis for ongoing work on the subject properties. Management cautions that past results or discoveries on proximate land are not necessarily indicative of the results that may be achieved on the subject properties.

Qualified Person

Charles C. Downie, P.Geo., a "qualified person" for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects and an officer and director of Eagle Plains, has reviewed and approved the scientific and technical disclosure in this news release.

About Earthwise Minerals

Earthwise Minerals Corp. (CSE: WISE; FSE: 966) is a Canadian junior exploration company focused on advancing the Iron Range Gold Project in southeastern British Columbia near Creston, B.C. The Company holds an option to earn up to an 80% interest in the fully permitted project, which is road-accessible and situated within a prolific mineralized corridor. The property covers a 10 km x 32 km area along the Iron Range Fault System and hosts multiple high-grade gold showings and large-scale geophysical and geochemical anomalies.

For more information, review the Company's filings available at www.sedarplus.ca.

EARTHWISE MINERALS CORP.,

ON BEHALF OF THE BOARD

"Mark Luchinski"

Contact Information:

Mark Luchinski

Chief Executive Officer, Director

Telephone: (604) 506-6201

Email: luch@luchccorp.com

Forward Looking Statements

This news release includes statements that constitute "forward-looking information" as defined under Canadian securities laws ("forward-looking statements") including, without limitation, statements respecting the Offering and the intended use of proceeds therefrom. Statements regarding future plans and objectives of the Company are forward looking statements that involve various degrees of risk. Forward-looking statements reflect management's current views with respect to possible future events and conditions and, by their nature, are subject to known and unknown risks and uncertainties, both general and specific to the Company. Although the Company believes the expectations expressed in its forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance, and actual outcomes may differ materially from those in forward-looking statements. Additional information regarding the various risks and uncertainties facing the Company are described in greater detail in the "Risk Factors" section of the Company's annual management's discussion and analysis and other continuous disclosure documents filed with the Canadian securities regulatory authorities which are available at www.sedarplus.ca. The Company undertakes no obligation to update forward-looking information except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements.

For more information, please contact Mark Luchinski, Chief Executive Officer and Director, at luch@luchccorp.com or (604) 506-6201.

WISE:CC

Sign up to get your FREE

Earthwise Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 February

Earthwise Minerals

Data-driven exploration targeting district-scale gold discovery in British Columbia

Data-driven exploration targeting district-scale gold discovery in British Columbia Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Earthwise Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00