September 06, 2024

Dynasty Gold (TSXV:DYG) offers a compelling investment value proposition with its 100-percent-owned Thundercloud and Golden Repeat gold assets in Canada and the US. The company is advancing its key asset, the high-grade Thundercloud gold project, located in Northwest Ontario, Canada, a highly prospective property with significant exploration upside. The property was acquired from Teck Resources in 2021, with $10 million in previous exploration expenditure and an NI 43-101 resource estimate completed in December 2021.

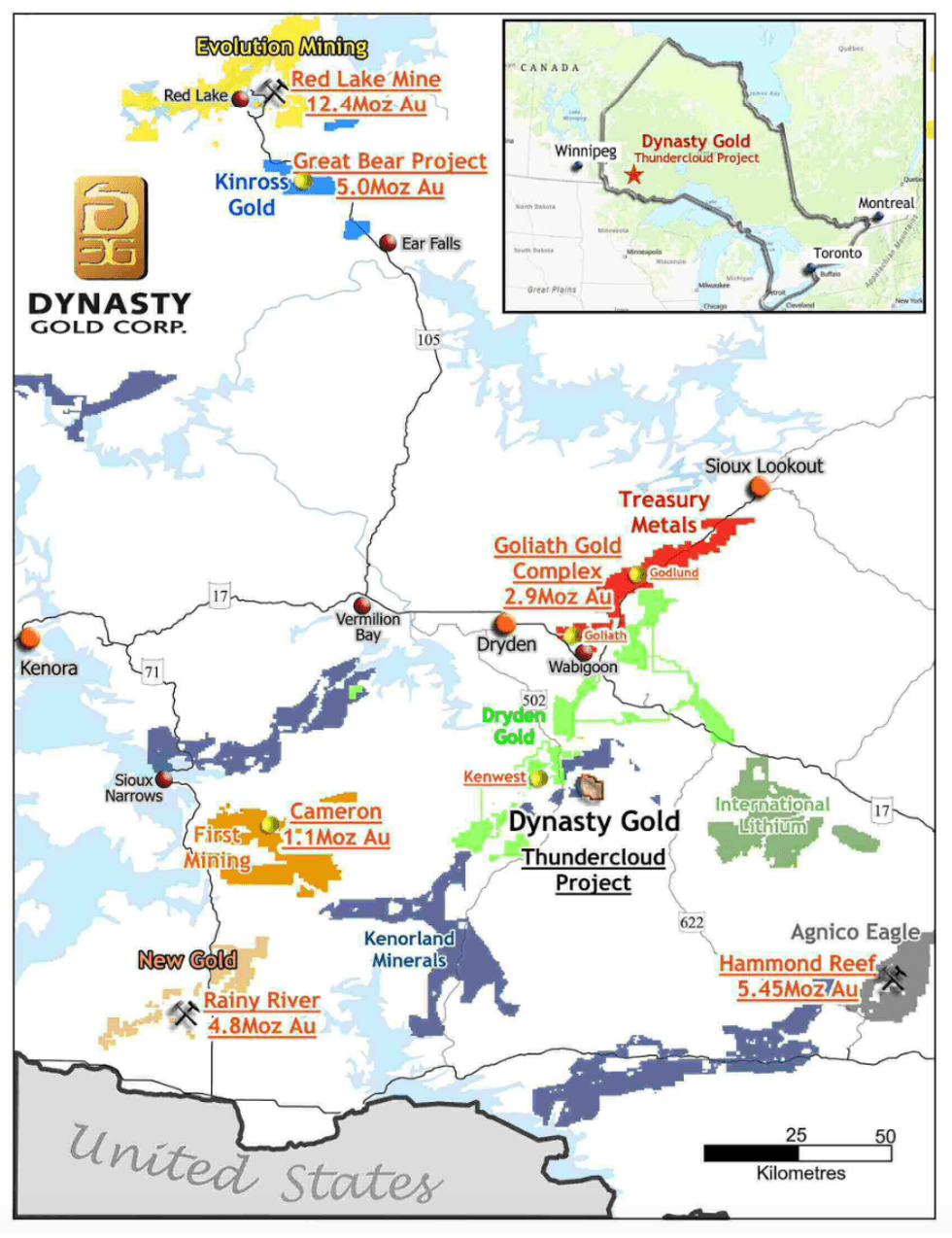

The Thundercloud gold project is located in the Archean Manitou-Stormy Lakes Greenstone Belt in Ontario, Canada. Thundercloud spans 2,250 hectares and is part of the Wabigoon Subprovince, known for hosting several significant gold deposits. The project has been de-risked by the amount of drilling by Teck Resources in the 2000s. Dynasty has benefited from Teck’s datasets and is able to expedite its exploration and advance it to the current resource within two years from its maiden drill program on the property.

Historical drilling and exploration at Thundercloud have identified several zones of gold mineralization, with high-grade intercepts suggesting the presence of an extensive gold system

Company Highlights

- Dynasty Gold has two highly prospective, high-grade gold projects in North America - Thundercloud and Golden Repeat.

- The flagship Thundercloud project, acquired from Teck Resources in 2021 and with more than $10 million in previous exploration expenditures, is the current focus of Dynasty’s exploration and drilling program.

- Drilling and exploration work done by Dynasty to date has effectively increased the resource at Thundercloud from 187,000 ounces inferred to 232,000 ounces measured and indicated at a high grade of 8.04 g/t gold at 3.03 g/t cut-off, a possible open-pit operation. At 0.5 g/t cut-off, the project hosts 439,000 oz at 2.14 g/t. To date, more than 90 percent of the drill holes are less than 250 meters and 90 percent of the property has seen little drilling.

- Thundercloud is a brownfield project with extensive historical data, making it a lower-risk investment compared to other greenfield exploration projects.

- Dynasty’s second asset, the Golden Repeat gold project, is located within the Midas Gold Camp in Elko County, Nevada. The project is drill-ready with permits in place.

This Dynasty Gold profile is part of a paid investor education campaign.*

Click here to connect with Dynasty Gold (TSXV:DYG) to receive an Investor Presentation

DYG:CC

The Conversation (0)

17 October 2024

Dynasty Gold

Gold-focused exploration with high-grade gold assets in Canada and the US

Gold-focused exploration with high-grade gold assets in Canada and the US Keep Reading...

23h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00