September 06, 2024

Dynasty Gold (TSXV:DYG) offers a compelling investment value proposition with its 100-percent-owned Thundercloud and Golden Repeat gold assets in Canada and the US. The company is advancing its key asset, the high-grade Thundercloud gold project, located in Northwest Ontario, Canada, a highly prospective property with significant exploration upside. The property was acquired from Teck Resources in 2021, with $10 million in previous exploration expenditure and an NI 43-101 resource estimate completed in December 2021.

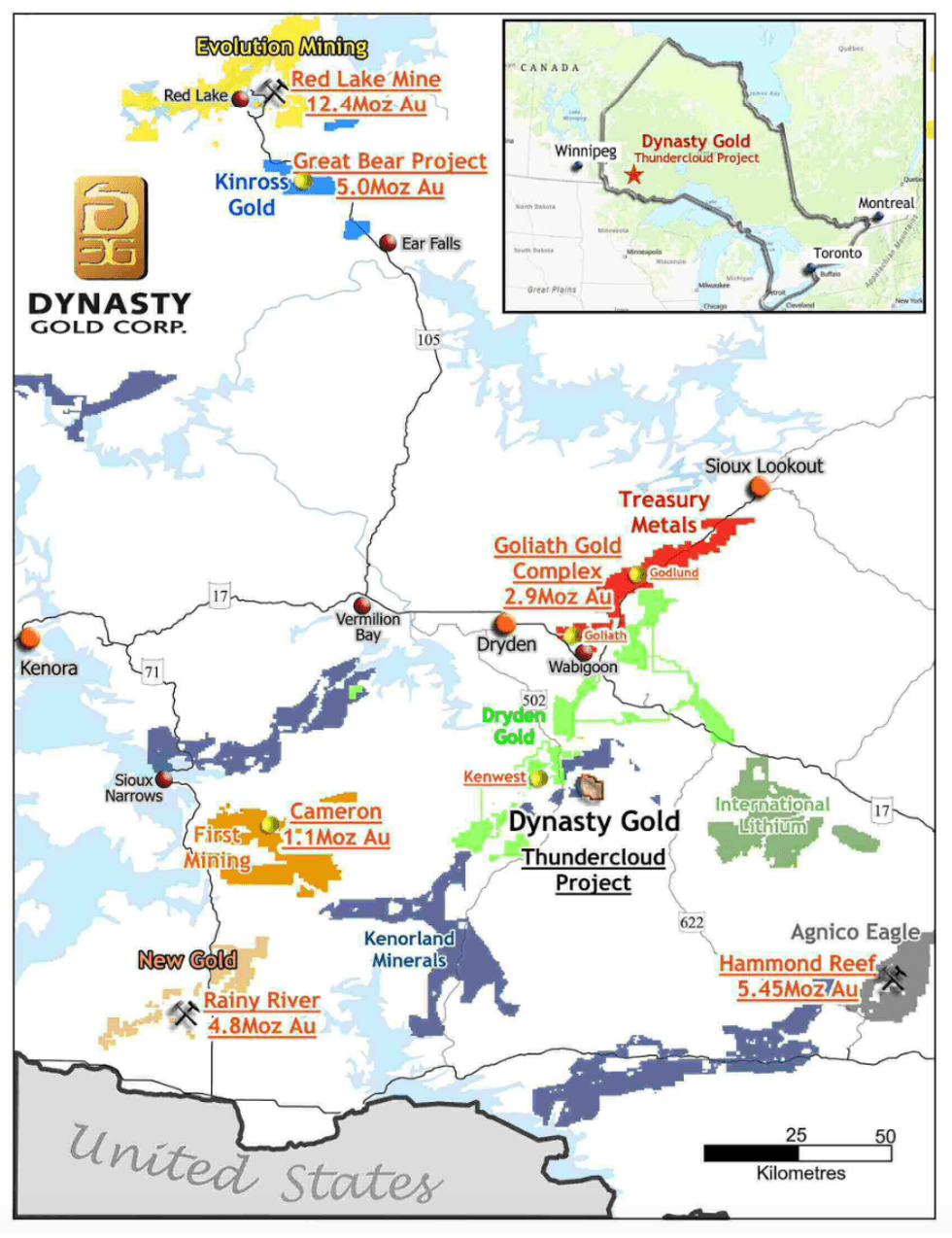

The Thundercloud gold project is located in the Archean Manitou-Stormy Lakes Greenstone Belt in Ontario, Canada. Thundercloud spans 2,250 hectares and is part of the Wabigoon Subprovince, known for hosting several significant gold deposits. The project has been de-risked by the amount of drilling by Teck Resources in the 2000s. Dynasty has benefited from Teck’s datasets and is able to expedite its exploration and advance it to the current resource within two years from its maiden drill program on the property.

Historical drilling and exploration at Thundercloud have identified several zones of gold mineralization, with high-grade intercepts suggesting the presence of an extensive gold system

Company Highlights

- Dynasty Gold has two highly prospective, high-grade gold projects in North America - Thundercloud and Golden Repeat.

- The flagship Thundercloud project, acquired from Teck Resources in 2021 and with more than $10 million in previous exploration expenditures, is the current focus of Dynasty’s exploration and drilling program.

- Drilling and exploration work done by Dynasty to date has effectively increased the resource at Thundercloud from 187,000 ounces inferred to 232,000 ounces measured and indicated at a high grade of 8.04 g/t gold at 3.03 g/t cut-off, a possible open-pit operation. At 0.5 g/t cut-off, the project hosts 439,000 oz at 2.14 g/t. To date, more than 90 percent of the drill holes are less than 250 meters and 90 percent of the property has seen little drilling.

- Thundercloud is a brownfield project with extensive historical data, making it a lower-risk investment compared to other greenfield exploration projects.

- Dynasty’s second asset, the Golden Repeat gold project, is located within the Midas Gold Camp in Elko County, Nevada. The project is drill-ready with permits in place.

This Dynasty Gold profile is part of a paid investor education campaign.*

Click here to connect with Dynasty Gold (TSXV:DYG) to receive an Investor Presentation

DYG:CC

The Conversation (0)

17 October 2024

Dynasty Gold

Gold-focused exploration with high-grade gold assets in Canada and the US

Gold-focused exploration with high-grade gold assets in Canada and the US Keep Reading...

9h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

9h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

10h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00