July 25, 2023

Heavy rare earths and niobium explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2023 quarter.

Highlights

- DY6 commenced trading on ASX on 29 June 2023, following a successful $7m IPO

- Funds raised will be allocated towards aggressive exploration of the Company’s 100% owned heavy rare earths (“HREE”) and critical metals projects in southern Malawi

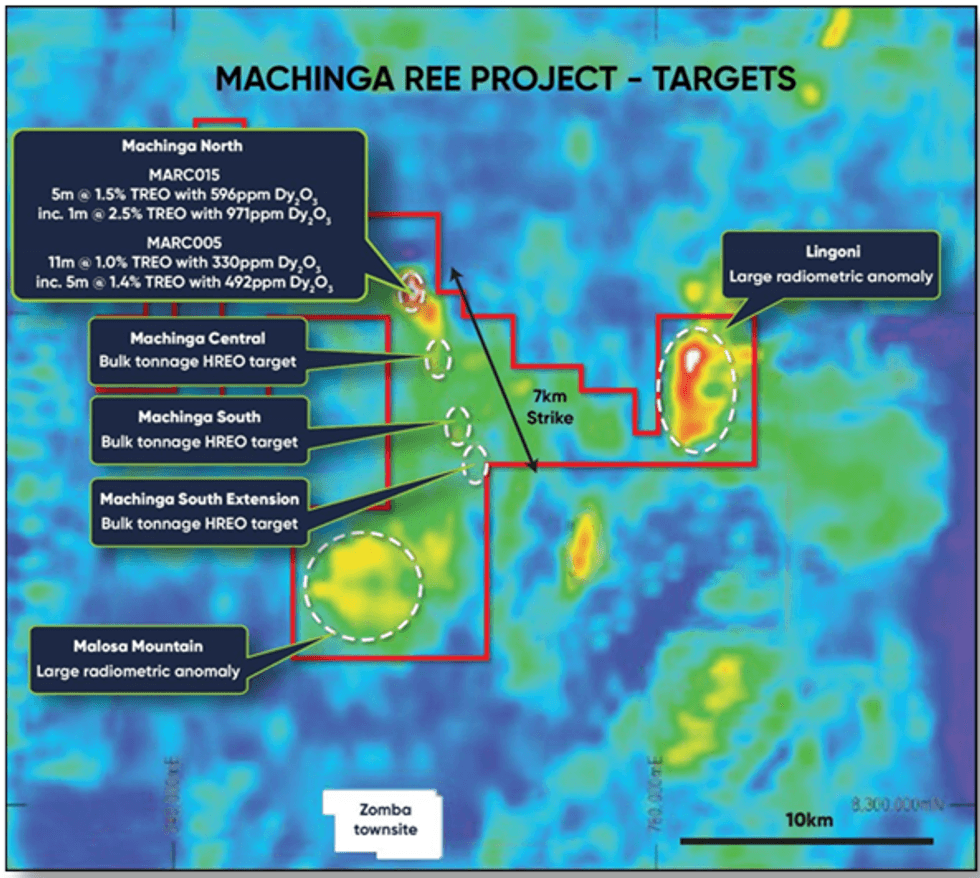

- Machinga, the Company’s flagship project, is particularly enriched with high-value heavy rare earth elements dysprosium and terbium. The project also holds significant niobium and tantalum potential as well. Machinga is only 40km east of Lindian Resources’ Kangankunde carbonatite discovery

- Six targets have been identified to date within the Machinga North concession and the Company will be following up on previous high grade intercepts from a previous 2010 campaign undertaken by Globe Metals and Mining (ASX:GBE)

- The Company’s maiden drilling program at Machinga (consisting of a combined ~5,000m of RC and DD) commenced with RC drilling in late June 2023. RC Drilling is continuing, with 19 holes for 2162 metres drilled so far. DD drilling commenced mid-July 2023 with a total of 1 hole for 110 metres having been completed to date with drilling ongoing

- The first batch of RC samples are being cleared for despatch to Intertek’s laboratory in Zambia, prior to transit to Perth for analysis. First assay results from the ongoing drilling are expected in late Q3, 2023

Corporate

The Company commenced trading on ASX on 29 June 2023, following a successful $7m IPO. As part of this, the Company attracted a combined $2.5 million from Hong Kong-based strategic investors, Zhensi Group (HK) Heshi Composite Materials Co., Limited and Zhung Nam New Material Company Limited.

The funds raised from the IPO are being used primarily for exploration at the Company’s three 100%-owned REE and critical metals projects located in southern Malawi, a stable and attractive African jurisdiction with proven potential for hosting major mineral deposits.

DY6 is currently undertaking a 5,000m program of reverse circulation and diamond drilling at its flagship Machinga project, only 40km east of Lindian Resources’ Kangankunde carbonatite discovery, which is widely regarded as the world’s best undeveloped rare earths project.

Drilling at the Machinga North target – one of six targets identified to date within the Machinga concession – in 2010/12 returned intercepts of 11m @ 1.0% TREO with 330ppm dysprosium oxide (Dy2O3) from 12m (MARC005), 5m @ 1.5% TREO with 596ppm Dy2O3 from 26m (MARC015) and 3m @ 2.2% TREO with 295ppm dysprosium oxide (Dy2O3) from 66m (MARC033) including 1m @ 5.1% TREO with 584ppm dysprosium oxide (Dy2O3) from 67m.

Previous trenching in 2010 included: MATR001: 7m @ 1.26% TREO, MATR002: 33m @ 0.71% TREO (inc: 11m @ 1.00% TREO with 0.46% Nb2O5) and MATR003: inc: 15m @ 0.45% with 0.75% Nb2O5, incl: 5m @ 0.54% TREO and 1.34% Nb2O5.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00