HIGHLIGHTS:

- High Grade Panel

- 161.0 metres @ 4.26 grams per tonne (g/t) gold including

- 30.0 metres @ 10.1 g/t gold, and

- 15.7 metres @ 10.4 g/t gold

- Parallel Panel

- 3.0 metres @ 21.4 g/t gold

- Satellite hit (over 150m below High Grade Panel)

- 24.0 metres @ 5.10 g/t gold

Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1) ("Heliostar" or the "Company") is pleased to announce additional results from the 100% owned Ana Paula project in Guerrero, Mexico. The Company has drilled 3,210 metres in phase one of the program and will follow-up the best results with a second phase program.

Heliostar CEO, Charles Funk, commented, "Drilling at Ana Paula continues to demonstrate the deposit's most unique aspect; long intervals of consistent high-grade gold mineralization. The drill program is both expanding the boundaries of the High Grade Panel and infilling sections to upgrade resource classifications. We continue to intersect satellite zones that are open to expansion including 24 metres grading 5.10 g/t gold, over 150 metres below the base of the High Grade Panel and 3 metres grading 21.4 g/t gold in the Parallel Panel. These indicate that more infill drilling can add higher grade ounces to the Ana Paula resource model."

Drill Results

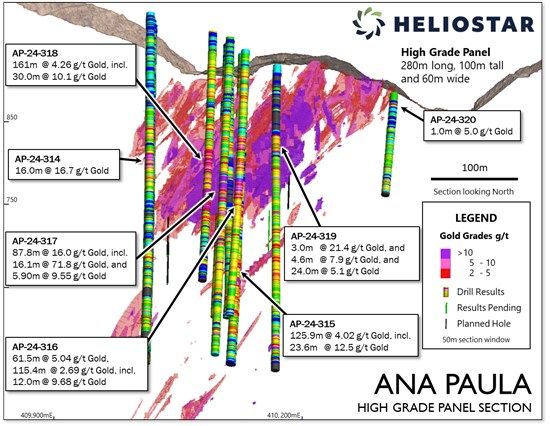

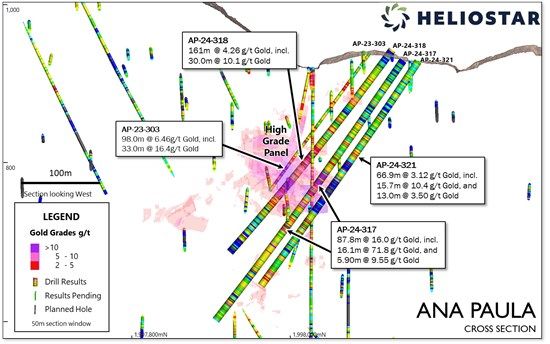

The focus of the holes reported today was to expand the High Grade Panel and test step-out targets at depth beneath this zone. Hole AP-24-321 is on the same section as AP-24-317, and AP-24-318 is a step-out to the West of this section, and these two holes are building out confidence in the northern and southern boundaries of the High Grade Panel.

Hole AP-24-318 shows a 161-metre-long interval of consistent gold mineralization grading 4.26 g/t gold from 101 metres downhole with multiple higher-grade subzones, including 30 metres grading 10.1 g/t gold.

Hole AP-24-321 intersected a zone of limestone to the north of hole AP-24-317, which intersected an interval of 87.8 metres grading 16.0 g/t gold. At the upper contact of this limestone, hole AP-24-321 encountered 15.7 metres grading 10.4 g/t gold from 167.6 metres downhole. This suggests that the very high grades in AP-24-317 are due to gold concentrating along a geological contact.

Hole AP-24-321 also intercepted a deeper interval of 13 metres grading 3.5 g/t gold from 327 metres downhole that may be a narrow depth extension beneath the High Grade Panel.

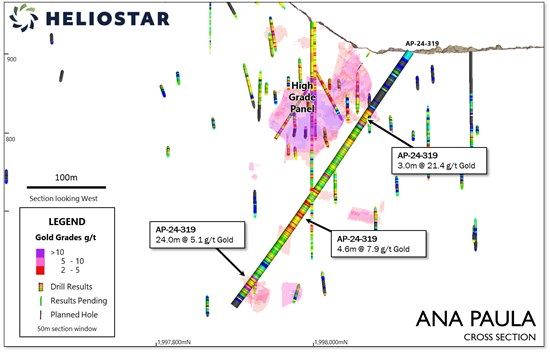

Hole AP-24-319 is, we believe, perhaps the most interesting of today's results. It was the first north to south hole on a new cross-section through the deposit and hit multiple gold zones. It intersected 3 metres grading 21.4 g/t gold from 111 metres downhole in a step down in the Parallel Panel. Beneath the High Grade Panel, it returned a best intercept of 4.6 metres grading 7.9 g/t gold from 189 metres downhole amongst multiple narrow intercepts. These zones suggest good potential to extend the High Grade Panel deeper than currently modelled on this section.

Further downhole again in AP-24-319, a broad satellite zone over 150 metres beneath the High Grade Panel with 24 metres grading 5.1 g/t gold from 349 metres downhole has room to expand above and below the drillhole.

Hole AP-24-320 was drilled to the east of the High Grade Panel and returned 1.0 metres grading 5.0 g/t gold from 102 metres downhole.

To date, the Company has completed nine holes for a total of 3,210.1 metres. The team also completed four geotechnical and water monitoring holes to the end of 2024.

Figure 1: A West to East section with the resource model from 2023 Mineral Resource Estimate highlighting the High Grade Panel (clipped to greater than 2 g/t gold resource blocks). Recent drill results are highlighted.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/241611_11f28ed5a4fc78a8_003full.jpg

Figure 2: A cross section with the resource model from 2023 Mineral Resource Estimate highlighting the High Grade Panel (clipped to greater than 2 g/t gold resource blocks) and new holes AP-24-318 and AP-24-321.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/241611_11f28ed5a4fc78a8_004full.jpg

Figure 3: A cross section with the resource model from 2023 Mineral Resource Estimate highlighting the High Grade Panel (clipped to greater than 2 g/t gold resource blocks) and new hole AP-24-319.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/241611_11f28ed5a4fc78a8_005full.jpg

Drilling Results and Coordinates Tables

| HoleID | From (metres) | To (metres) | Interval (metres) | Au (g/t) | Topcut Au (to 67 g/t) |

| AP-24-318 | 108.0 | 269.0 | 161.0 | 4.26 | |

| including | 209.0 | 239.0 | 30.0 | 10.1 | |

| AP-24-319 | 91.0 | 114.0 | 23.0 | 4.15 | |

| including | 111.0 | 114.0 | 3.0 | 21.4 | |

| including | 189.0 | 193.6 | 4.6 | 7.91 | |

| and | 212.5 | 281.0 | 68.5 | 1.44 | |

| and | 349.0 | 373.0 | 24.0 | 5.10 | |

| including | 349.0 | 352.0 | 3.0 | 10.9 | |

| and including | 363.15 | 368.15 | 5.15 | 14.0 | |

| AP-24-320 | 15.15 | 18.95 | 3.80 | 2.43 | |

| and | 102.0 | 103.0 | 1.0 | 4.99 | |

| AP-24-321 | 117.15 | 184.0 | 66.85 | 3.12 | 2.20 |

| including | 136.3 | 146.0 | 9.7 | 2.22 | |

| and including | 167.6 | 183.3 | 15.7 | 10.4 | 6.53 |

| and | 327.0 | 340.0 | 13.0 | 3.50 | |

| including | 330.5 | 333.1 | 2.6 | 10.4 |

Table 1: Significant Drill Intersections

| Hole ID | Northing (WGS84 Zone 14N) | Easting (WGS84 Zone 14N) | Elevation (metres) | Azimuth (°) | Inclination (°) | Length (metres) |

| AP-24-318 | 410,106 | 1,998,128 | 943.2 | 180 | -57 | 332.0 |

| AP-24-319 | 410,181 | 1,998,124 | 903.5 | 180 | -55 | 394.5 |

| AP-24-320 | 410,321 | 1,998,047 | 887.7 | 180 | -50 | 138.8 |

| AP-24-321 | 410,124 | 1,998,161 | 928.4 | 180 | -55 | 350.0 |

Table 2: Drill Hole Details

Heliostar Metals Included In 2024 TSX Venture 50

Heliostar Metals is further pleased to announce that it has been included in the 2024 TSX Venture 50™ list. The TSX Venture 50™ is a ranking of the top fifty performing companies on the TSXV over the prior year.

TSX Venture 50 is an annual ranking of the top-performing companies over the last year on the TSX Venture Exchange, a world-leading capital formation platform for early-stage growth firms. The companies are ranked based on three equally weighted criteria of one-year share price appreciation, market capitalization increase, and Canadian consolidated trading value.

The Company takes pride in its share performance in 2024 and the benefits that it brings our shareholders. We believe the steps we took in 2024 have set the company up for strong growth again in 2025 and beyond.

Quality Assurance / Quality Control

Core samples were shipped to ALS Limited in Zacatecas, Zacatecas and Hermosillo, Sonora, Mexico for sample preparation and for analysis at the ALS laboratory in North Vancouver. The Zacatecas, Hermosillo and North Vancouver ALS facilities are ISO/IEC 17025 certified. Gold was assayed by 30-gram fire assay with atomic absorption spectroscopy finish and overlimits were analysed by 30-gram fire assay with gravimetric finish.

Control samples comprising certified reference and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

Statement of Qualified Person

Stewart Harris, P.Geo., a Qualified Person, as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Harris is employed as Exploration Manager of the Company.

About Heliostar Metals Ltd.

Heliostar aims to grow to become a mid-tier gold producer. The Company is focused on developing the 100% owned Ana Paula Project in Guerrero, Mexico and has recently entered into an agreement to acquire a portfolio of production and development assets in Mexico.

FOR ADDITIONAL INFORMATION PLEASE CONTACT:

| Charles Funk President and Chief Executive Officer Heliostar Metals Limited Email: charles.funk@heliostarmetals.com Phone: +1 844-753-0045 | Rob Grey Investor Relations Manager Heliostar Metals Limited Email: rob.grey@heliostarmetals.com Phone: +1 844-753-0045 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things, The drill program is both expanding the boundaries of the High Grade Panel and infilling sections to upgrade resource classifications and these indicate that more infill drilling can add higher grade ounces to the overall Ana Paula resource model.

Forward-looking statements and forward-looking information relating to the terms and completion of the Facility, any future mineral production, liquidity, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the receipt of necessary approvals, price of metals; no escalation in the severity of public health crises or ongoing military conflicts; costs of exploration and development; the estimated costs of development of exploration projects; and the Company's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities in foreign jurisdictions; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding exploration and mining activities; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises, ongoing military conflicts and general economic factors to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/241611